The Ombudsman for Short-term Insurance (Osti) recorded a 17.8% increase in the number of registered complaints in 2022 compared to 2021, due in part to an increase in disputes over motor vehicle, flood, and power surge claims.

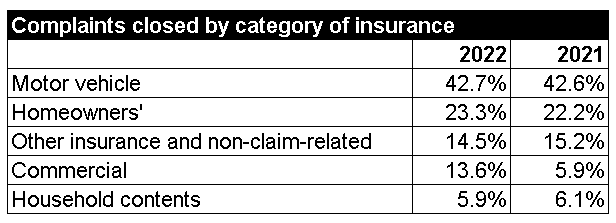

The ombud scheme registered 11 542 complaints in 2022, compared to 9 797 in the previous year. The office closed 10 411 complaints compared to 10 879 in 2021, a decrease of 4.3%, according to the Osti’s annual report, which was released this week.

Of the 11 542 registered complaints, 647 (6% of complaints) related to the KwaZulu-Natal floods of April and May 2022, 202 (2%) related to power surges, 57 were Sasria-related complaints arising from the unrest in July 2021, and 39 were Covid-19-related complaints. In 2020, Covid-related complaints comprised 7% of all the registered complaints.

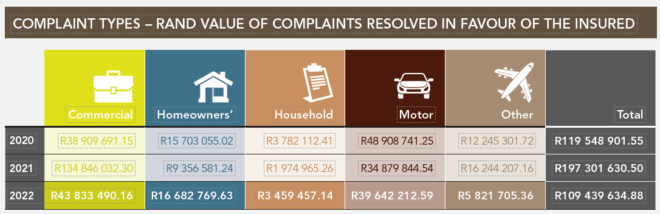

The Osti recorded R109 439 635 (2021: R197 301 630) as the “monetary benefit and value” for consumers who approached the office for assistance.

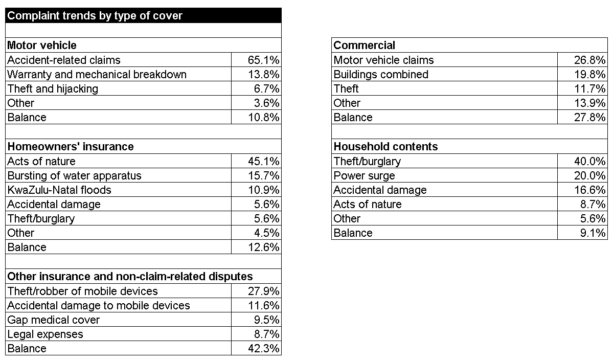

Complaint trends in relation to types of cover

The Osti highlighted the following complaint trends by type of insurance cover:

Motor vehicle insurance

At 65.1%, accident-related claims were the highest number of complaints in this category, which was unchanged from 2021.

Homeowners’ insurance

The highest number of complaints came from acts of nature, at 45.1%, which was a slight decrease from 2021, when it was 48.6%.

In 2022, there were no complaints where subsidence and landslip were the main type of cover claimed under, unlike in 2021, when subsidence and landslip was the third main type of cover claimed under.

Other insurance and non-claim-related disputes

This category relates to complaints in respect of various other types of insurance, including personal accident, water loss, travel, all risks, mobile devices, legal expenses, hospital, and medical gap cover.

The highest number of complaints under this category related to claims for theft/robbery of mobile devices, at 27.9%, which was a decrease from 36% in 2021.

Commercial

The highest number of complaints related to motor vehicle claims at 26.8%. This is a significant increase from 2021, when it was at 19%.

In 2021, the highest number of complaints related to Covid-19 business interruption, at 26.5%, which declined significantly to 5.1% this year.

Household contents

At 40%, complaints relating to theft/burglary were the highest number of complaints closed under this category.

In 2021, theft and burglary complaints comprised 44% of the complaints under this category, followed by power surge at 16%. There has been a steady increase in power surge-related complaints under this category, from 3% in 2018, to 6% in 2019, to 11% in 2020, and to 16% in 2021.

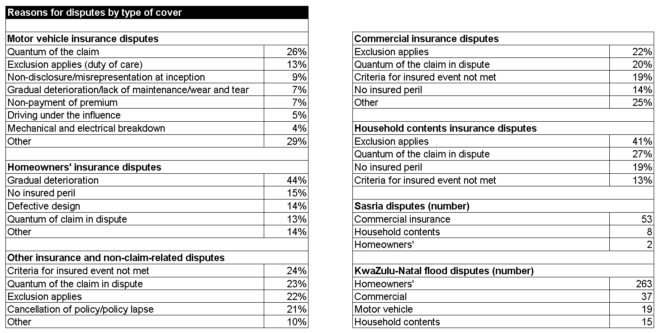

Reasons for disputes by type of cover

The report provided the following insights into the reasons for disputes between the insured and the insurer by type of insurance cover:

Motor vehicle insurance

The main reason for complaints was the rejection of the claim because of an exclusion in the policy.

Rejection based on the “prevention of loss/due care” clause gave rise to 364 complaints, in line with the 369 cases in 2021. This trend is also consistent with 2019 and 2020 where insurers rejected claims on the basis that the driver failed to exercise due care and precaution to avoid or minimise the loss/damage. Many of these claims continue to be rejected because it was alleged that the driver was speeding.

An insurer cannot reject a claim if, at best, it is established that the driver was negligent, for which the policy provides cover. The onus to prove recklessness rests with the insurer, and the insurer must show that the driver was reckless in the legal sense, the Osti said.

There was a notable decrease in complaints were claims were rejected because the insured was driving under the influence and because of non-disclosure or misrepresentation at inception. But there was in increase in complaints arising out from the non-payment of premiums and gradual deterioration, lack of maintenance, or wear and tear.

Homeowners’ insurance

The primary cause for complaints was the rejection of claims because of gradual deterioration, a lack of maintenance, or wear and tear. This trend remains consistent with the preceding years.

This is an exclusion in most, if not all, homeowners’ insurance policies. Even though an insured event may have occurred, an insurer may be entitled to reject a claim on this ground if it is found that the primary cause of the damage is gradual deterioration, a lack of maintenance, or wear and tear. The consideration is the “but for” test: if had it not been for this, would the damage have occurred despite the insured event – for example, heavy rain.

Other insurance and non-claim-related disputes

The primary cause for disputes was the rejection of claims based on an exclusion in the policy, and most were based on the “prevention of loss/due care” exclusion.

Commercial insurance disputes

The main cause of the disputes was the application of a policy exclusion, mainly the exclusion of gradual deterioration, a lack of maintenance, or wear and tear. In 2021, the main cause for the disputes was no insured peril.

Household contents insurance

The primary cause for complaints was claims rejected based on an exclusion in the policy, and most of the exclusions were gradual deterioration, a lack of maintenance, or wear and tear. This was consistent with 2021.

However, there was a noted decrease in the number of complaints relating to the quantum and an increase in complaints relating to the criteria for the insured event not being met.

Faster complaint turnaround time

Complaints took an average turnaround time (TAT) of 122 days to resolve. The Osti aims for a maximum TAT of 120 days, which meant the office missed its target by two days. In 2021, the average TAT was 138 days.

Several initiatives were implemented during the year to improve the average TAT, which resulted in a reduction of 16 days in the TAT from 2021 despite the almost 18% increase in the volume of new complaints and no increase in the staff complement, the Osti said.

The Osti aims not to have more 10% of open complaints on its “six-month list”, which is a list of complaints outstanding for six months and longer. The office ended the year with 441 complaints on the list, which represents 10.7% of the open complaints at the time. At the end of December, there were 4 131 open cases compared to 3 052 open cases in December 2021.

More complaints result in higher revenue

The Osti’s revenue increased by 14% in 2022 compared to 2021, from R44.5 million to R50.8m, mainly because of the increase in the number of registered complaints.

The fee charged per complaint remained at R4 500 in 2022. A penalty fee of double the current fee is charged to insurers for delays in resolving complaints.

Fee income is recognised over time based on when a complaint is closed or based on a three-year average time that it takes to close complaints.

The Osti’s operating expenditure was R45.7m against the budgeted R48.6m in 2022. The office said the favourable variance was a result of the implementation of cost management measures and a hybrid working model as staff members work at the office on a rotational basis. The Osti ended the year with a surplus of R7.3m.

Most problems come from clients not understanding their covers, which is the job of the broker and/or Insurer to explain in simple terms. example: Houseowners cover- the gradual wear and tear and maintenance, which is the duty of the Insured must be explained. Motor: once again maintenance, roadworthyness, valid licenses and staying within the constraints of the Law, must be explained. House contents: it must be explained ( Especially in the light of the new Grid Clauses) to clients that Insurance covers either Acts of God or acts of individuals, NOT the acts ( or lack thereof) of a Govt, example loadshedding damage and potholes- those claims should go against the ANC Govt.

During the last 18 months or so I have complained to the ombud for bad service by Sanlam, Standard bank and Santam. On each occasion I got the impression that the ombud was protecting the insurer rather than looking at my complaints. I always thought that the reason for establishing the offices of the ombud was to protect the small man against abuse by the big corporate companies, It appears not to be the case

Les, you not the only one…would not be surprised if their funding is coming from the insurers they seem to each time side with