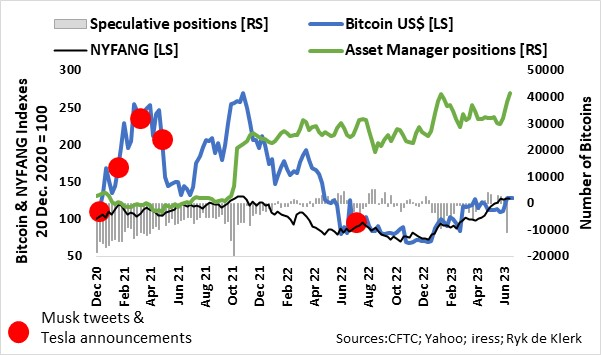

Thanks to Elon Musk, Bitcoin is evolving from a gambler’s den to an acceptable financial asset.

On 20 December 2020, Musk tweeted “Bitcoin is safe” after Bitcoin doubled in price since June 2020.

His tweet came at a time when speculators (measured by non-commercial positions) were short of nearly 19 000 Bitcoins.

Early in February 2021, Tesla announced it changed its investment policy in January, and it had bought Bitcoin worth $1.5 billion in January 2021.

Musk inflicted even more pain on the short sellers when he announced at the end of March 2021 that Tesla customers can buy their cars with Bitcoin. At that stage, Bitcoin was 2.3 times higher than it was when he tweeted in December 2020.

After Musk tweeted in mid-May 2021 that Tesla will no longer accept Bitcoin payments, Bitcoin tanked, and by July all the gains since the start of the year had been wiped out. Yes, a 50% drawdown!

Hype around cryptocurrencies and the run-up to the launch of the first US Bitcoin exchange-traded fund (ETF) based on futures contracts, positive sentiment towards technology stocks, and high inflation turned the corner for Bitcoin.

The ProShares Bitcoin Strategy ETF started trading on 19 October 2021. According to the BIS, the fund debuted as one of the most heavily traded ETFs in market history, attracting more than $1.3bn in assets in the first few days.

By mid-November, Bitcoin surpassed its previous highs.

From there, cryptocurrencies collapsed as both industry investors and retail investors reeled from slumping stock markets on quantitative tightening and inflationary concerns amid implosions across the crypto industry.

Musk added to the pain in the last leg of the massive sell-off as, according to Securities and Exchange Commission (SEC) filings in July 2022, Tesla offloaded 75% of its Bitcoin holdings in the second quarter of 2022.

The drawdown of Bitcoin from top (November 2020) to bottom in January this year was a massive 75%. At a Bloomberg Crypto Summit in July last year, Mike Novogratz, the founder of Galaxy Digital Holdings, said: “It turned into a full-fledged credit crisis, with complete liquidation and huge damage on confidence in the space. Both the industry and retail investors really had very, very little concept of risk management.”

Self-regulation

Although no US federal or state agency exercises comprehensive supervisory jurisdiction over global or domestic markets for Bitcoin, it appears that virtually most excesses, including malfeasance and possible manipulation of the Bitcoin market from December 2020 to June 2022, have been dealt with.

I laud Musk for his decisive involvement initially, while the increased involvement by large financial institutions such as BlackRock, Fidelity, and Deutsche Bank in crypto such as Bitcoin provides confidence that excessive speculation and volatility will be dealt with through self-regulation, as the industry and retail investors were taught very expensive lessons.

Fair price

It is apparent that the slump in Bitcoin to June 2022 brought its performance since December 2020 in line with that of the NYSE FANG+ Index, an equal dollar weighted index consisting of 10 of the highly traded tech giants: Meta, Apple, Amazon, Netflix, Microsoft, Google, Tesla, Nvidia, Snowflake, and Advanced Micro Devices.

Since June last year, Bitcoin’s price trended in line with the NYSE FANG+ Index. Therefore, at this stage, it seems that Bitcoin at $31 000 is priced in line with the large-cap tech stocks. Future performance relative to the NYSE FANG+ Index will be driven by the supply of and the demand for Bitcoin.

Supply and demand

Bitcoin’s supply is pre-programmed. According to the iShares Bitcoin Trust filing by BlackRock with the SEC, “the supply of new Bitcoin is mathematically controlled so that the number of Bitcoins grows at a limited rate pursuant to a pre-set schedule. The number of Bitcoins awarded for solving a new block is automatically halved after every 210 000 blocks are added to the Bitcoin blockchain, approximately every four years.

“Currently, the fixed reward for solving a new block is 6.25 Bitcoin per block, and this is expected to decrease by half to become 3.125 Bitcoin in approximately early 2024.

“This deliberately controlled rate of Bitcoin creation means that the number of Bitcoins in existence will increase at a controlled rate until the number of Bitcoins in existence reaches the pre-determined 21 million Bitcoin. As of December 31, 2022, approximately 19.3 million Bitcoins were outstanding, and the date when the 21 million Bitcoin limitation will be reached is estimated to be the year 2140.”

Institutional demand for Bitcoin futures and options, as measured by the net asset management position published by the Commodity Futures Trading Commission, increased to nearly 42 000 coins from 22 500 coins since November last year, equal to net inflows of $385 million.

Bitcoin’s price is driven by rising mining costs

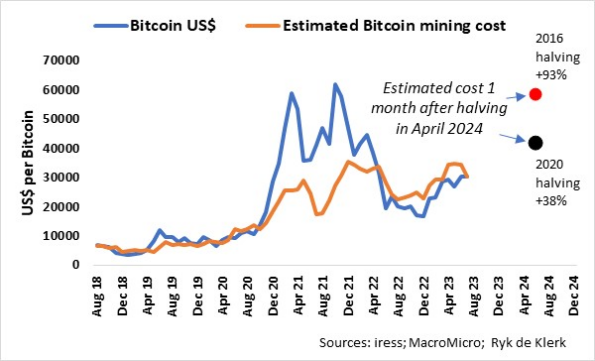

Bitcoin’s price is underscored by the cost of mining new coins.

The cost of mining Bitcoin depends on several factors, including the cost of electricity, the cost of equipment, and the difficulty of the mining process, and therefore computer capacity to perform mathematical calculations.

The estimated mining cost varies from source to source. I use MacroMicro’s Bitcoin’s average mining costs based on observing the consumption of electricity and the daily issuance of Bitcoin, provided by Cambridge University.

When Bitcoin’s price is higher than the average mining cost, it draws in more miners, and vice versa when the price is lower, the number of miners will decrease.

From the data, it is evident that since June last year Bitcoin miners have been squeezed financially, as the cost of mining one Bitcoin exceeded Bitcoin’s spot price.

Looking back at the previous halvings in 2016 and 2020, the halvings had an immediate impact on the cost of mining a Bitcoin. In 2016 and 2020, mining costs jumped by 93% and 38% respectively from a week prior to halving to a month after the event.

Demand to exceed supply

At this stage, Bitcoin ETFs don’t own Bitcoin because the SEC is of the view that Bitcoin is traded on non-regulated cryptocurrency exchanges.

BlackRock’s filing to establish a spot Bitcoin type ETF through a trust and other financial institutions’ filings for crypto ETFs are an indication of possible huge pent-up investment demand for crypto, specifically for Bitcoin. Successful filings of Bitcoin and other crypto ETFs are likely to see investment demand for Bitcoin easily exceeding new mining supply after the halving of Bitcoin in April next year.

With the Bitcoin market and network coming of age, the use of Bitcoin to pay for services and goods through direct transactions is likely to gain further traction.

The current market cap of Bitcoin is nearly $590bn, more than double the value of gold ETFs and gold-related funds. But Bitcoin lacks liquidity.

Liquidity will be enhanced, though

The increase in demand is likely to broaden the market for and interest in Bitcoin and other crypto as the trade in derivatives such as futures and options on crypto is likely to flourish. Furthermore, Bitcoin’s new-found correlation with the highly traded tech giants opens the way for arbitrage between Bitcoin and the tech stocks.

I concur with what Mathew McDermott, the global head of digital assets at Goldman Sachs, said last year: “Bitcoin is now considered an investable asset. It has its own idiosyncratic risk, partly because it’s still relatively new and going through an adoption phase.”

The listing of BlackRock’s ETF trust will certainly be a validation of Bitcoin as an asset.

That’s why I (want to) own Bitcoin.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

Bitcoin has absolutely no intrinsic value. Since it produces no cash flow (interest or dividends or rental etc) and has no underlying useful product, the only reason to buy bitcoin is the expectation that if you buy a useless asset, then you might be able to con someone else to buy it from you at an even higher price. Bill Gates what spot on when he said that trading in Crypto Currencies like Bitcoin is entirely driven by the “Greater Fool” theory. This doesn’t mean you can’t make money on bitcoin. If you are lucky, you can make money on Bitcoin and you might even have a very slightly better chance on Bitcoin that the roulette table at the casino.

Hype driven assets are notoriously erratic so if one enters into bitcoin ownership one must always keep in mind one needs a buyer of bitcoin at the moment of sale but hypis never that sympathetic

Yes and no. With that logic our currency is more of a useless asset comparatively since there is no value in it, and there is no end to how much can be printed by the reserve.

However there are more and more digital currencies that has more rules that govern them, rather than just print as much as the reserve wants, and since the currency is limited and has functionality attached, it acts in a similar way to when money was backed by gold reserves, only now the ‘gold reserves’ is the limited crypto reserves.

So Yes -> you can see as no intrinsic value, but then no currency you have has intrinsic value, so then stock up on physical assets, but if you want to have digital assets like with a bank you have to realize that those digital rands or dollars is worse investment than other crypto digital assets.

Thanks @ Ryk for this nice article, stay safe. One day you will be a VERY RYK Ryk….. VIVA btc maximalists VIVA……. 🙂