US copper futures soared after an investigation into how imports of the metal were affecting the US’s national security was initiated by President Donald Trump in February this year, thereby raising the prospect of 25% tariffs on copper imports in the US. In anticipation of the higher tariffs, traders moved massive quantities of copper from exchanges such as the Shanghai Futures Exchange and the London Metals Exchange (LME) to US-based COMEX warehouses to stock up in the US before tariffs set in.

This strategic shift and the re-routing of supplies from all over the world saw the import of more than 800 000 metric tons of copper into the US in the first six months of the year – more than double the volume over the same period last year. The situation became even tighter when Trump in July decided to increase the tariff on copper imports to 50%, effective 1 August.

At the close of the markets last Friday, the copper future price on COMEX traded at a 32% premium to the spot copper price on the LME and could perhaps reach 50% when the new tariff sets in on 1 August.

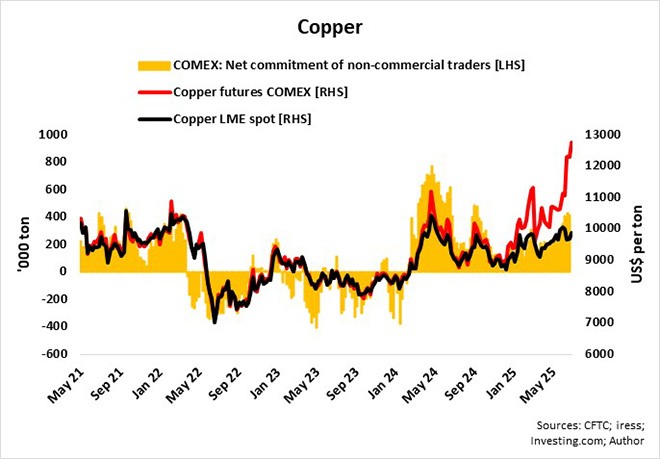

From the accompanying graph, it is evident that non-commercial traders (that is, speculators and financial institutions) are unmistakably in charge of the global copper market and currently hold a net long position of more than 400 000 tons of copper via futures and options on COMEX.

With the surge in imports and the COMEX copper stockpile now at the highest level since 2004, a significant oversupply of copper in the US is emerging. The big question is where to from here for copper.

As Reuters aptly summarised this month: “For now, traders who rushed to front-run the tariff are sitting on some of the most expensive copper in the world – metal that could be tough to offload unless the (US) premium holds.”

In my opinion, the fundamentals of the global copper market are likely to change considerably after 1 August, when the 50% tariff becomes effective. US copper imports are likely to drop significantly due to tepid demand, while copper exporters from other countries will have to try to find other markets for their products. Copper stockpiles in LME and Shanghai Futures Exchange warehouses are likely to expand again, which normally results in downside pressure on copper prices, exacerbated by the possible liquidation of non-commercial long positions on COMEX.

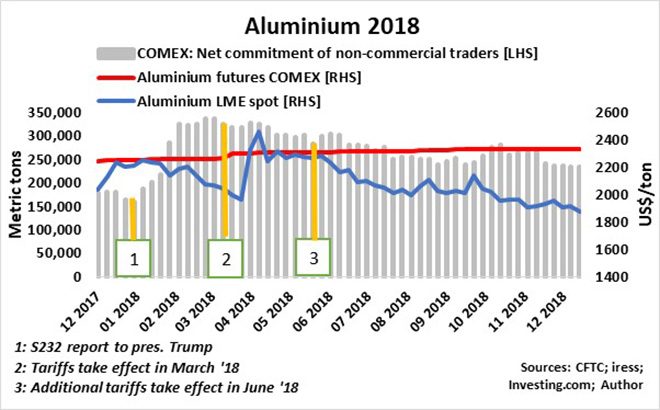

The copper market could be a repeat of the aluminium market in 2018.

In January 2018, Trump received a Section 232 report on aluminium and steel imports, citing national security concerns. In March, Trump imposed tariffs on steel and aluminium and imposed additional tariffs in June that year. After the additional tariffs took effect in June, the COMEX aluminium futures price remained steady through to the end of 2018. The spot aluminium price on the LME immediately after the tariff hike in June commenced a gradual decline through end-2018, resulting in the COMEX premium increasing to about 25%, while non-commercial traders (speculators and financial institutions) cut their net long positions by more than 20% over the same period.

The fundamental factors influencing individual commodities can differ vastly, but it does seem that although the premium of US copper prices to may hold at 50%, declining LME and Shanghai prices may drag COMEX copper futures prices down with them. Yes, the “most expensive copper in the world” may find its way back into the market.

I am shy of the copper market and base metals in general because of the possible ripple effect of a sell-off in copper. Furthermore, it casts a shadow on commodity-based economies.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.