Investors often underestimate the length of time their investments will be held. Paul Hutchinson, sales manager at Ninety One, explores the importance of recognising and embracing longer time horizons for optimal investment outcomes.

If you consider someone entering the workforce today, it is reasonable to assume they have an investment time horizon of 70 to 75 years, consisting of 40-plus years of investing for retirement and 30 years of living off their accumulated investments in retirement. This may be an extreme example, but even someone who is mid-way through their working career realistically has an investment time horizon of 40 to 50 years.

Underestimating your investment time horizon often results in your being too risk averse with what should be viewed as long-term investments.

Time horizons are longer than you think

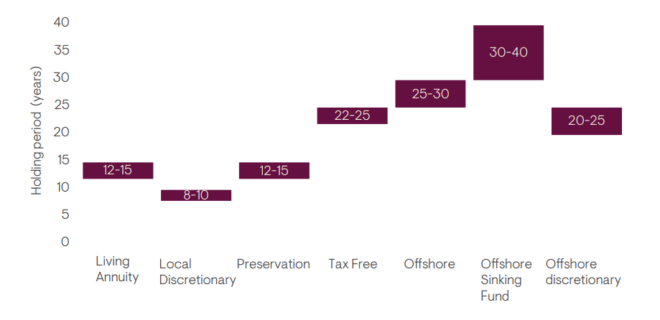

To better understand and illustrate investor holding periods, we analysed the average holding period of clients invested in various products on the Ninety One Investment Platform. The results are shown in the chart below. To determine the average holding period, we divided the average assets over the year in each product by any outflows from that product over the same year.

Consider that the average holding period of an offshore investment is about 30 years, while even that of a local discretionary investment is at least eight years. The key take-out is that once an investor has decided to invest, they tend to stay invested.

Unfortunately, the challenging market conditions of the past few years have resulted in investors being far more conservative in how they invest. An analysis of net flows into collective investment schemes shows that most inflows have been into income funds at the expense of equity and multi-asset funds. The reality is that investors are not letting their money work hard enough for them.

With the above insight into the average holding period, we can now, with a greater degree of confidence, recommend a more aggressive, growth-oriented investment solution. This is important because it is mostly through investing in growth assets that you can confidently generate attractive real returns over the long term after tax and inflation.

“Risky” assets, on average, earn a risk premium (higher return) over the longer term but at higher risk (volatility) in the shorter term. By way of illustration, the long-term real return (after taking inflation into account) for South African equities has been about 7% a year over the past 100 or so years. This is materially higher than the real return offered by more conservative asset classes (cash and bonds), which has been about 1% to 2% a year.

Time is on your side

A key concern for many investors is the downside risk associated with local and offshore equity and growth-focused multi-asset investments. But with time, comes a greater degree of certainty.

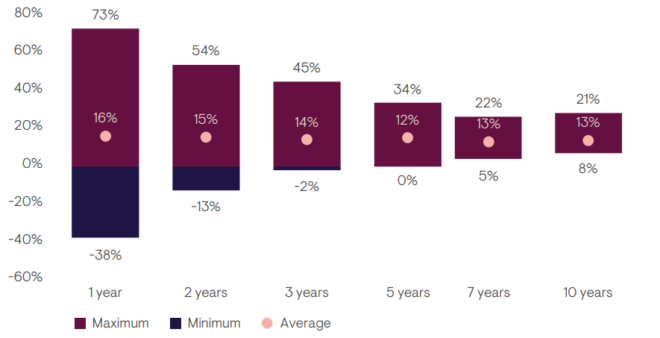

The following chart illustrates that over shorter periods, equity investors do run the risk of a negative return, but as the investment time horizon lengthens, so the risk of a negative return is ameliorated. What is also noteworthy is the fact that there has not been a rolling five-year negative return, a clear demonstration that time helps to reduce risk and improve investment outcomes.

Source: Morningstar, 20 years to 31 May 2023

Acknowledging that you are likely to have a longer holding period than you realise, and that you need higher exposure to growth assets, is important, especially if you are risk averse by nature. This is particularly true when considering that the key output of most financial planning exercises is the estimated investment return required to maintain your standard of living in retirement, and that in most instances, you will need to be more aggressive in your investments than you may be comfortable with. However, the reward is real.

You pay your money, and you take your chance

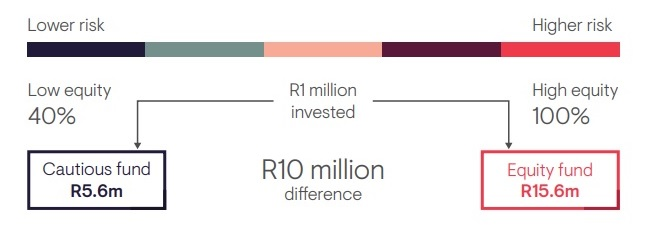

Consider the outcome for a long-term investor who, unmoved by the above argument, invested in a cautious fund, as opposed to being correctly invested in an equity fund. A R1 million investment in the average multi-asset low-equity fund (a proxy for a cautious investment) over 20 years would have returned R5.6m at the end of March 2023, whereas the same R1m invested in the average South African equity fund would have returned R15.6m.

Source: Morningstar, 20 years to 31 March 2023

Given the very real consequences of this decision, it strongly recommended that investors seek professional financial planning and investment advice, tailored to their individual circumstances.

Disclaimer: The information and opinions expressed in this article are those of the writer and do not necessarily represent those of Moonstone Information Refinery or its sister companies. All the information provided is for general purposes only. It does not constitute financial planning or investment advice that is appropriate for every individual’s needs and circumstances.

Two additional considerations. Firstly, the amount after the 20 years in the equity fund is almost triple that in the cautious fund in nominal terms, but after adjusting for inflation, the relative difference will be even greater, making the equity fund even more attractive for someone requiring no income and no access to the funds for emergencies. Secondly, the situation changes drastically for someone drawing an income from their investment (eg post-retirement), where the volatility of the equity fund would have a very negative effect due to the need to sell more units when the price has dipped to get the required income.