Market research company Consulta has published its latest South African Customer Satisfaction Index (SAcsi) for the medical schemes industry, showing which of the country’s largest schemes has the most satisfied members.

A key word in the previous paragraph is “largest”. The survey’s insights are based on feedback from the members of the four biggest (by membership) open schemes – Bestmed, Bonitas, Discovery and Medihelp – and the largest closed scheme, the Government Employees Medical Scheme (GEMS).

Moonstone asked Consulta why, if inclusion in the survey was based on membership size, Momentum was excluded. According to the Council for Medical Schemes’ Industry Report, released in October 2022, Momentum had 153 064 (principal) members (and 293 884 beneficiaries) at the end of 2021, whereas Medihelp had 90 442 members (197 621 beneficiaries). The reason is that an administrator must pay a subscription fee for a scheme to be included in the survey. Momentum did not subscribe in 2022.

The researchers polled 3 950 scheme members in the third and fourth quarters of 2022.

According to Consulta, the latest survey shows that, for first time since 2019, medical schemes are starting to bounce back when it comes to measuring the gap between what members expect and what they perceive they are receiving in return for their contributions and loyalty. However, Consulta said the industry still has some ground to recover after customer satisfaction dropped to a six-year low in 2021.

Commenting on the results, Abigail Boikhutso, Consulta’s group chief executive, said: “Essentially, the industry has levelled back to ground zero. During the pandemic, medical schemes were caught in the eye of the storm in a difficult and unsettled period where household incomes were impacted, and job and financial security were in the balance. In line with this, consumer price tolerance was low, and requirements may not have been perceived to have been met by members. It follows that a high rate of complaints would have a marked negative impact on customer satisfaction scores.

“Now that we’ve come through the worst of Covid, the industry has experienced a slight increase in perceived value by members. However, the benchmark is low, and this positive bounce is, in reality, taking medical schemes back to where they were in 2019.”

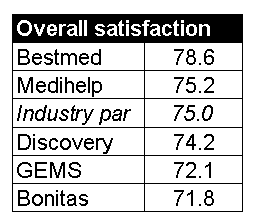

Overall satisfaction

For the third year in a row, Bestmed emerged as the leader on overall customer satisfaction, with the other schemes performing at or below the industry par. All the schemes, except for Bonitas, improved their customer satisfaction scores compared with 2021.

Fair treatment

Bestmed, with a score of 80.6, also has the highest number of members who feel they are being treated fairly by their scheme.

Medihelp scored at the industry average of 78 for Treating Customers Fairly (TCF). Bonitas (77.7) and Discovery (77.6) also came in on par.

GEMS (76.6) was slightly lower than the rest of the industry, but it improved from its 2021 TCF score of 74.

Gap between expectations and quality

According to Consulta, the strongest gauge in the Customer Satisfaction Index model is Customer Expectations because it measures customer anticipation of the quality of a company’s service.

The 2022 study shows that the industry is normalising back to a range of between 80.1 and 82.2. This range contrasts with the notably high industry expectation of 85 in 2020, which could be linked to the pandemic, because customers expected their schemes to do more to assist them during that period, Boikhutso said.

The gap between Customer Expectations and Perceived Quality indicates the degree to which the industry (and each respective brand) exceeds or falls short of customer expectations on each of the three components that constitute the Customer Expectations and Perceived Quality indices: overall quality, meeting needs, and reliability.

The Customer Expectations par score of 82.2 in 2022 was the same in 2021, while the Perceived Quality par score of 80.4 has not decreased since 2021. The industry score for the expectation-quality gap was -1.8.

Medihelp’s Perceived Quality score of 80.6 fractionally (0.1) exceeded its Customer Expectations score of 80.5, which implies that quality essentially matched expectations.

Bestmed has the smallest gap (-0.6) between expectations and quality, followed by Bonitas (-1.1), and Discovery and GEMS follow, both with a gap of -1.7.

Value for money

The Perceived Value index is a measure of quality relative to the price paid. Consulta says the perception of value for money is a robust predictor of future usage and company growth.

Over the past 12 months, the industry has shown an increase in perceived value (1.9), a rebound from last year’s drop.

Bestmed is the solo leader in terms of the Perceived Value delivered to members. All the other schemes performed on par.

Complaint incidence and handling

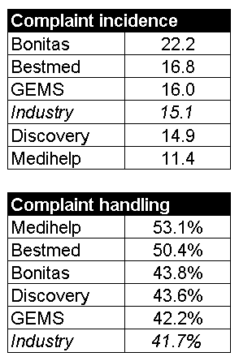

The score that measures complaints about schemes fell to 15.1 from the highest score in four years, 20.9 in 2021. The most prevalent complaints relate to the non-payment of claims and co-payments.

Although the industry showed the first decrease in complaints in five years, the incidence of complaints is high compared to the international best practice score, which is below 10.

When it comes to measuring how well schemes address complaints, all the five schemes surveyed scored above the industry average of 41.7%.

Bonitas had the highest complaint incidence rate, with a relatively low rating for complaint handling.

GEMS reduced its complaint incidence significantly by 9.1, with a score of 16 in 2022 from 25.1 the year before. It scored 42.2% for complaint handling.

Except for Bestmed, the schemes recorded a decrease in complaints since 2021.

Although Bestmed had the lowest complaint incidence score of 11.6 in 2021, it is now slightly above the industry average (15.1) with a score of 16.8 in 2022.

Discovery improved its complaint incidence score from 21 in 2021 to 14.9 in 2022.

Which scheme has the most loyal members?

Bestmed has the most loyal customers at 72.7%, up from its 2021 score of 65.7% and above the industry par score of 67.1%.

GEMS follows at 70%, well up from its 2021 score of 61.1%, and Medihelp also improved to 68.1%.

The other schemes were below par.

Discovery, at 66.8%, remains fairly static from 66.4% in 2021. Bonitas, at 63.2%, fell slightly from its 2021 score of 64.3%.

Which members are most likely to recommend their scheme?

The Net Promoter Score (NPS) measures the likelihood of a person recommending a brand. The industry par of 20.1% improved significantly in 2022, up by 8.3% from a low of 11.8% in 2021.

GEMS has the highest NPS, at 29.2%, a dramatic turnaround from its crash to -9.2% in 2021. GEMS members actively promote the brand to others, with 51% of members recommending the brand. GEMS also has the lowest number of detractors at 22%.

Bestmed follows with a score of 23.7%, which was well ahead of the other open schemes, while 48% of members willingly endorse the brand to others.

Medihelp has an NPS of 17%, an improvement on its 2021 score of 10.9%, with 44.7% of members promoting the brand and 27% detractors.

Discovery’s NPS improved to 14.3% after experiencing its lowest score of 9.7% in 2021. Forty-three percent of members actively promote the brand, while 29% are detractors.

Bonitas has an NPS of 8.6%, a significant decline from its score in 2021 of 20.2%. Only 40% of customers actively promote the brand, and 32% are detractors.