The Solidarity Research Institute (SRI) has published its Bank Charges Report for 2024, providing consumers with a comparison of the fees charged by the biggest banks based on different baskets of transactions.

The five banks that form the core of the report are Absa, Capitec, First National Bank (FNB), Standard Bank, and Nedbank. The report’s section on online banking services includes two more banks: Bank Zero and TymeBank.

This year’s report does not include Discovery Bank “because many of the transactions in our basket are not indicated on its fees page”, SRI said.

An addition to this year’s report are the costs associated with PayShap, the new immediate payment channel.

SRI singled out the progress that Nedbank has made regarding competitiveness and transparency.

“It is not just the names of its accounts that have changed. In recent years, Nedbank has often been noticeably more expensive than other banks. This year, Nedbank is the cheapest in the 30-transaction profile, with an easy-to-understand fees page on its website.”

On the other hand, FNB and Absa’s fees pages were more difficult to figure out this year than in the past because a layout that forces one to scroll around between specific fees and included fees, especially in their bundled accounts, the report said.

The report only compares the costs of transaction accounts available to any member of the public.

The analysis excludes exceptional fees, such as for the replacement of lost cards. The report also excludes accounts for children, students, older people, pensioners, or specific faith groups.

Most banks have accounts that are only available to these groups and they usually are cheaper. Younger and older people should therefore enquire with banks about products designed specifically for them. These products are often almost free of charge, SRI said.

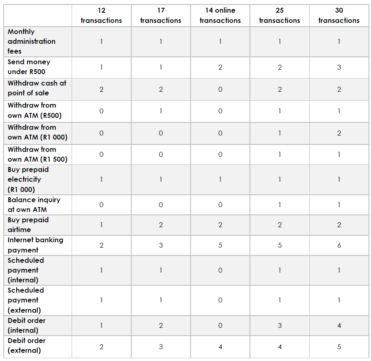

The transaction profiles are based on what the banks advise to reduce fees: few cash withdrawals, no cash deposits, cash withdrawals mainly at retailers instead of ATMs, no physical visits to branches, and purchases, such as airtime, are made via online platforms.

The transaction costs are compared across four consumer profiles:

- People with a low income and basic banking needs: 12 and 17 transactions a month.

- Accounts used for online transactions only: 14 cashless and contactless transactions.

- People with a middle-class income and sophisticated banking needs: 25 transactions a month.

- People with a higher-middle-class income and sophisticated banking needs: profiles with 30 transactions a month.

Low income and basic banking needs

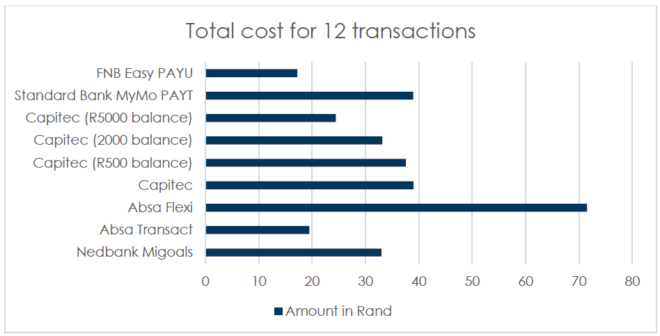

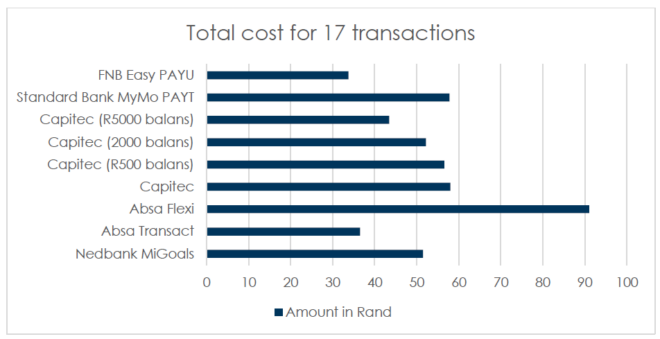

FNB’s Easy PAYU account is the clear winner in this category.

“The biggest factor that distinguishes this account from the others is the number of free transactions that are included in the monthly fee of R5.25. This is the only account in this category where airtime purchases are free. Cash withdrawals at shop counters are also free at FNB,” SRI said.

Like FNB, Absa Transact also provides one free money transfer to a cellphone number a month. Cash withdrawals from retailers are also free from both Absa accounts.

Absa Transact account is in second place for the 12- and 17-transaction profiles, but the report says this may be an unfair comparison because the account is available only to people who earn less than R3 000 a month. Once a person’s income exceeds this amount, he or she is upgraded to the more expensive Flexi account, which is significantly more expensive than the others in these two categories.

Capitec remains the only bank in this category to offer interest on the balance. But at 3,5% it is not enough to outweigh the fees charged, and Capitec is no longer competitive compared to FNB’s account.

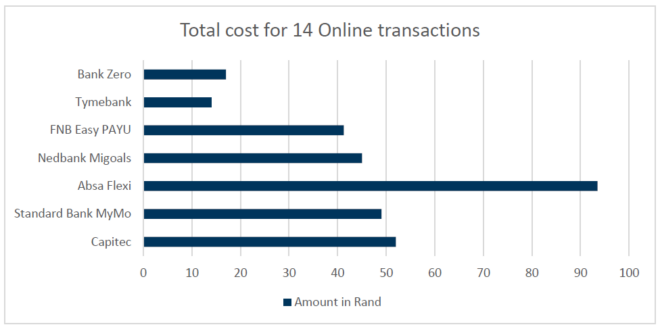

Purely online banking

This category includes only digital transactions and the monthly administration fees, while all debit orders and internet banking payments are external, to put the online banks on an equal footing with traditional banks.

SRI said the main factor determining the winner is the number of free transactions. In this case, TymeBank is slightly ahead of Bank Zero.

In the case of both banks, the only transaction on SRI’s list that has a cost is sending cash to a cellphone number.

As with other banks, there also are differences in the costs charged for immediate banking transactions at other banks, as well as the costs for immediate payment to accounts at other banks.

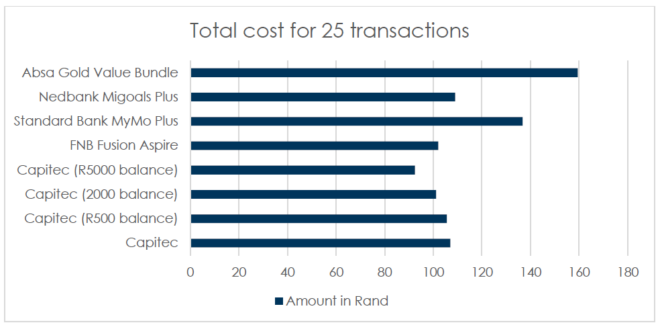

Middle-class income and sophisticated banking needs

This category contains banks’ flagship accounts – the accounts marketed to the core customer base. The accounts in this category qualify for the banks’ respective loyalty programmes. It also includes other forms of added value, such as linked credit cards, insurance at a discount, access to airport lounges, and other packages that vary widely from bank to bank.

Although Capitec does not have an extensive loyalty programme, the bank is included because it has many customers in this consumer segment.

When looking purely at costs, Capitec is the clear winner in this category, particularly if it is assumed that consumers in this category have a balance that earns interest in their transaction accounts for at least part of the month, SRI said.

But when looking at banks with a proper value proposition, FNB is once again the cheapest. This is again because of the comprehensive list of costs that are included in the monthly fee of R99. Only the purchase of electricity has an extra cost of R3.

In second place is Nedbank, which was in last place in 2023. At Nedbank, all transactions on the report’s list, apart from sending cash to a cellphone number, are included in the monthly fee of R99.

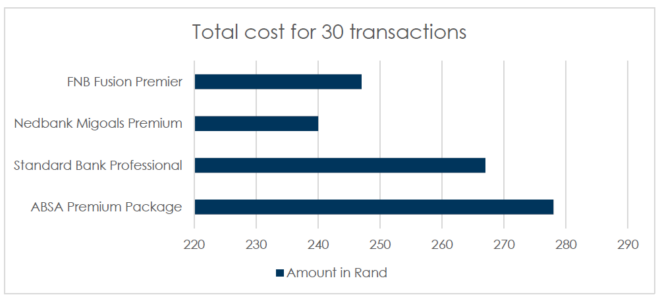

Higher-middle-class income and sophisticated banking needs

The accounts in this category are more focused on added value and rewards programmes than purely on cost. However, the aim of our report is to compare costs, and consumers are therefore encouraged to check whether the added value justifies the extra cost.

While cost is probably not the main factor for consumers in this category, it is still useful to look at it before considering other factors. Other factors are things such as how busy the bank is if one must visit a branch regularly, services such as 24-hour access to bankers and the rewards programme, as well as access to airport lounges, linked credit cards and home loans, and discounts for married couples.

In this section, the most competitive accounts are determined by the number of free transactions included in the monthly fees.

“Although Nedbank’s Migoals Premium account therefore appears to be the most expensive, with a monthly amount of R240 compared to R230 per month for the other three banks, it easily wins this category, as all transactions on our list are included in that amount.

FNB’s Fusion Premier account is second-cheapest in this category. Sending money to a cellphone number and buying electricity are the only services that incur extra costs apart from the monthly fees.

In this category it is also strange to note that at Absa and Standard Bank there are still fees when proof of payment is sent to the beneficiary, whereas they are included in all the other banks’ packages and, in Standard Bank’s case, in its MyMo Plus account.

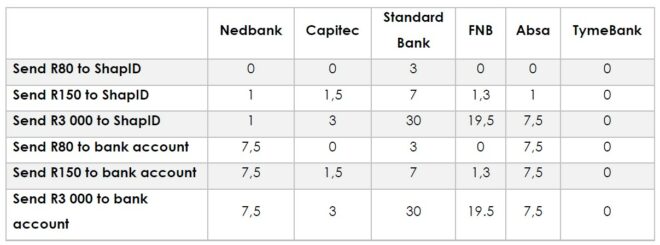

PayShap

PayShap is generally significantly cheaper than the usual immediate payment channels. It also promises always to be immediate, even when consumers are doing business with each other for the first time. In such cases, the usual channel often has a delay of about an hour. The disadvantage of PayShap is that the transaction limit is R3 000.