Medical schemes spent less on broker costs last year than they did in 2020, according to the Council for Medical Schemes’ latest Industry Report.

“Broker costs” include all broker service fees (or commissions) and other distribution costs.

Broker costs represented 14.23% of medical schemes’ total non-healthcare expenditure in 2021, slightly less than 14.81% in 2020.

Non-healthcare expenditure consists of commercial reinsurance agreements, administration expenditure, broker costs and impaired receivables.

Broker costs decreased by 0.7%, from R2.54 billion in 2020 to R2.52bn in 2021, after increasing by 3.63% in 2020.

Broker service fees as a percentage of schemes’ gross contribution income decreased from 1.16% in 2020 to 1.12% in 2021.

For schemes that pay broker commissions, the amount paid per average member per month (PAMPM) decreased by 1.1%, from R82.75 in 2020 to R81.84 in 2021.

The statutory limit on broker fees in 2021 was R101.91 plus value-added tax (VAT). The 2020 limit was R98.85 plus VAT.

The overall decrease in broker commissions was the result of open schemes paying lower commissions; restricted schemes’ commissions increased last year.

Among open schemes that pay commissions, the amount paid PAMPM declined by 1.11%, from R85.36 in 2020 to R84.41 last year.

Among restricted schemes, the amount paid PAMPM increased by 0.93%, from R55.63 in 2020 to R56.15 last year.

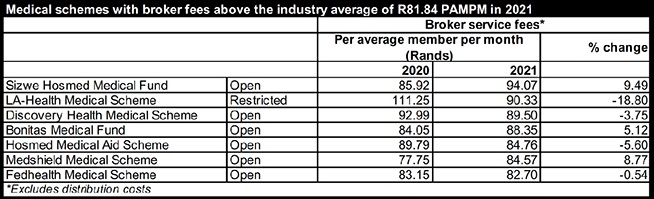

The table below shows the schemes whose commissions were higher than the industry average of R81.84 PAMPM last year. These seven schemes, up from five in 2020, represented 77.42% (2020: 77.39%) of total membership that paid broker service fees and 84.18% (2020: 84.47%) of total broker service fees paid.