Technically speaking, the bear market in developed-market equities that began in January last year – as measured by the MSCI World Index in US dollar terms – has ended, with the index surging by more than 23% since the lows in October 2022. The surge was predominantly led by growth stocks, specifically tech stocks, and the MSCI World Growth Index was up by more than a third.

In contrast, value stocks, as measured by the MSCI World Value Index, managed a gain of only 13%, falling short of the definition of a 20% gain from recent lows, and therefore still in a bear market.

Will the growth-led market recovery make way for value in this seemingly “risk-on” environment?

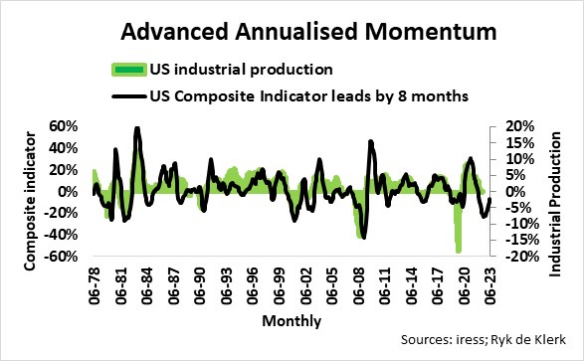

Over the past 45 years, the advanced momentum of my composite leading indicator led the momentum of the US economy, as measured by industrial production, by about six to eight months. With the US stock market, a major component, market behaviour, points to a contraction in US industrial production, and therefore to weak or even negative economic growth over the next two quarters.

The credit crunch, as well as exposure to commercial property debt, could lead to further bank failures and keep US banks’ lending standards tight, particularly those of regional and smaller banks. According to some commentators, the impact of the credit squeeze on the US economy could be like another 0.25% to 0.5% hike by the Fed.

The credit crunch is not limited to the US, though. The net tightening of credit standards by euro area banks surged to near level highs during the euro area sovereign debt crisis in 2011.

Although consumer price inflation is still elevated, price inflation at the factory doors in the major economies is cooling rapidly as price pressures on commodities have eased significantly. In the US, producer prices for final demand rose 2.3% in April, year on year, down from 11.2% a year earlier, while the producer price index for all commodities fell by 3%. The eurozone producer price index slowed to 1%, year on year, down from more than 43% in October last year. China’s producer price index fell by nearly 5% in May compared to a year ago. Yes, disinflation is here, while deflation risks are mounting.

It is therefore no wonder that the Fed decided to skip a rate hike at last week’s meeting. They will undoubtedly want to see how the US economy develops over the next two quarters.

I deem it probable that, all other things being equal, the major central banks have finished or are about to finish their respective quantitative tightening cycles.

China, the world’s second-biggest economy, is already leading the way. China’s required reserve ratio, the portion of liabilities that commercial banks must hold, was cut aggressively to 7.6% from 8.1% in November last year to boost domestic demand amid falling global demand for its exports. In addition, last week China lowered the rate on seven-day repurchase operations, while the country’s largest commercial banks cut their deposit rates recently.

Is the Federal Reserve about to play politics?

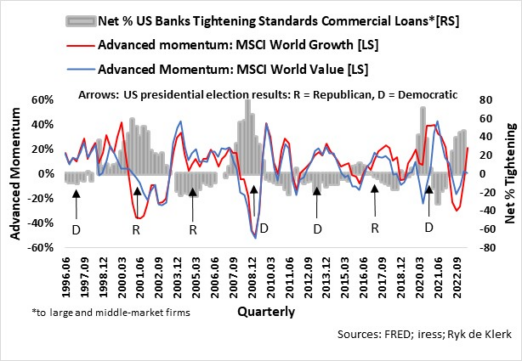

US elections in 2024 are likely to come into play soon in US monetary policies. There have been six elections since 2000, and it is no coincidence that power shifted in 2000, 2008 and 2020 when the banks were aggressively tightening their lending standards. The Democrats will be acutely aware of the fact that, except in 2016, the party in control remained in office in the next election when the banks were easing their lending standards.

Do Democrats want to go into an election year with high real interest rates and high unemployment amid a weak economy? The market does not think so. The advanced momentum of my composite leading indicator is likely to turn positive soon, indicating that the US economy will gain traction again in the first quarter next year.

In the past, momentum in world stock markets, whether growth stocks or value stocks, as measured by the MSCI World Growth and MSCI World Value indices in US dollar terms, tended to bottom when the net percentage of US banks tightening their lending standards reached extreme levels on the up. Price momentum in markets turned positive when the net percentage of banks tightening their lending standards turned negative. Vice versa, momentum in stock markets peaked when lowering credit standards reached extreme levels and turned negative when the net percentage of US banks tightening their lending standards turned positive.

The advanced momentum of world growth and value stocks (MSCI World Growth and Value indices) bottomed in the third quarter last year. Growth stocks’ momentum turned decisively positive in the June quarter, while the momentum of world value stocks (MSCI World Value Index) is on the brink of turning positive.

Will there be a follow-through on value stocks? Risk-on?

No full throttle on risk-on yet. Global equities are still facing strong headwinds. The next Senior Loan Officer Opinion Survey on Bank Lending Practices in the US will be done in July and published in August. However, considering the pressures facing banks, it is likely that the net percentage of US banks tightening their lending standards may overshoot on the upside. Recessionary conditions will undoubtedly weigh on the profits of value stocks, such as economically cyclical stocks, and could sour investor sentiment somewhat. Even growth stocks, although seemingly in the clear, may experience a slowdown in momentum.

But the groundwork for risk-on strategies, such as investing in value stocks, is being laid as the easing of banks’ lending standards in most major economies is probable in the not-too-distant future. Risk-on strategies include investments in emerging-market equities, commodities, economically cyclical stocks in mature markets, emerging-market currencies, and emerging-market bonds.

I think the growth-led market recovery will continue, but I am tilting towards value stocks, but balanced by defensive strategies, such as high-quality government bonds.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate to every individual’s needs and circumstances.