The FAIS Ombud is proposing not to increase its levy in 2024/25, while the FSCA has proposed a 6% increase in the levies and fees payable by the entities it supervises in the coming financial year.

If the Ombud’s proposal is adopted, the base levy payable by an FSP will remain at R1 100 and the levy per representative and key individual at R690. The cap on the maximum levy payable will stay at R333 275.

The Ombud’s move brings a measure of relief to FSPs with a large number of reps. Although the base levy decreased by 10.6% between 2022 (when it was R1 231) and 2023, the rep and KI levy increased by 47% over the same period.

Furthermore, the nil increase will dampen the special levy payable in 2024/25.

Entities regulated by the Prudential Authority (PA) and the FSCA must pay a special levy for the first two levy years immediately following the date of the commencement of the Financial Sector and Deposit Insurance Levies Act, which was 1 April 2023.

An FSP’s special levy is 7.5% of its FSCA levy, Financial Services Tribunal (FST) levy, Ombud Council levy, and FAIS Ombud levy.

Both the FAIS Ombud and the FSCA were entitled to increase their levies by 6.9% in 2024/25.

The Levies Act provides that the levies in the Schedules to that Act must be increased by the arithmetic mean of the Consumer Price Index (CPI) as published by Statistics South Africa in the preceding calendar year. StatsSA published a CPI of 6.9% in December 2022.

The Minister of Finance, however, may, by notice in the Government Gazette, determine that there must be no increase or a below-CPI increase.

The FAIS Ombud did not provide an explanation for the 0% increase.

The FSCA said its proposed increase was in line with its projected expenditure for 2024/25 and was below 6.9% to reduce the impact on regulated entities.

How much more will FSPs pay the FSCA?

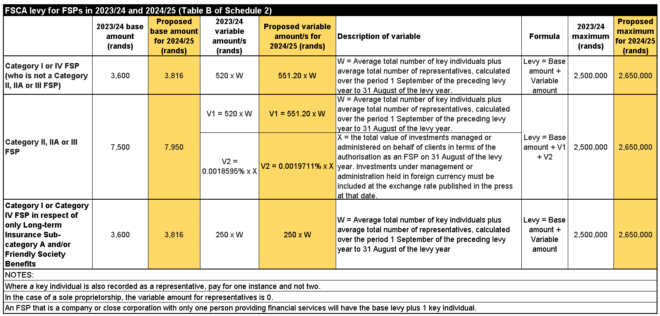

The FSCA’s 6% increase means Category I and IV FSPs and Category I and IV FSPs that provide only Long-term Insurance Sub-category A products and/or Friendly Society Benefits will pay a base levy of R3 816, up from R3 600.

The base levy for Category II, IIA, or III FSPs will rise from R7 500 to R7 950.

FSPs must add the representative and KI levy to the base levy.

The proposed 6% increase will result in the levy for each rep and KI in Category I and IV and Category II, IIA and III rising from R520 to R551.20.

There is an exception to every rule. The Authority is proposing not to increase the rep and KI levy for Category I and IV FSPs that provide only Long-term Insurance Sub-category A products and/or Friendly Society Benefits. It will remain at R250.

An FSP must calculate its total rep and KI levy by multiplying the levy by the average total number of KIs and the average total number of reps, calculated from 1 September of the preceding levy year to 31 August of the current levy year. Where a KI is also a rep, the person is counted once.

To calculate its total FSCA levy, a Category I and IV FSP must add the base amount to its total rep and KI levy.

A Category II, IIA, and III FSP must calculate its total FSCA levy by adding to the base amount its total rep and KI levy and the levy on the total value of investments under management or administration on 31 August of the levy year.

The percentage used to calculate the levy on investments under management or administration will increase by 6%, from 0.0018595% to 0.0019711%.

The cap on the maximum FSCA levy payable will also rise by 6% to R2.65 million for all categories of FSP.

An FSP that is authorised for more than one category is liable for a single levy calculated as follows:

- The highest basic amount that applies to the different categories for which the FSP is authorised.

- The average total number of KIs plus the average total number of reps, under the different categories, calculated from 1 September of the preceding levy year to 31 August of the levy year. KIs and reps who are approved or appointed under multiple categories are counted once.

- The total value of investments managed or administered on behalf of clients under the different categories on 31 August of the levy year. Investments under management or administration held in a foreign currency must be included at the exchange rate published in the press at that date.

- The highest maximum amount that applies to the different categories for which the FSP is authorised.

The table below sets out the formulae for calculating the FSCA levy for FSPs (Table B of Schedule 2 to the Act).

And then you add…

The FSCA levy is only one component of the levies payable by FSPs and other entities regulated by the Authority.

They must also pay the FST levy, which is 2.5% of the FSCA levy (per Table C of Schedule 3 of the Financial Sector and Deposit Insurance Levies Act). In the case of entities regulated by both the PA and the FSCA, the Tribunal levy is 2.5% of the sum of an entity’s PA levy and FSCA levy.

In addition, all entities that are required to pay levies to the FSCA must also pay levies to the Ombud Council. The amount of the levy payable to the Council is equal to a fixed percentage (2.5%) of the levy amounts payable to the FSCA (per Table D of Schedule 4).

And FSPs must pay the FAIS Ombud levy (per Table E of Schedule 5). The base levy is R1 100, and the levy per rep and KI is R690.

Finally, in the 2023/24 and 2024/25 financial years, entities supervised by the FSCA must pay a special levy of 7.5% of the levies payable in terms of Schedules 2 to 5.

Fee increases

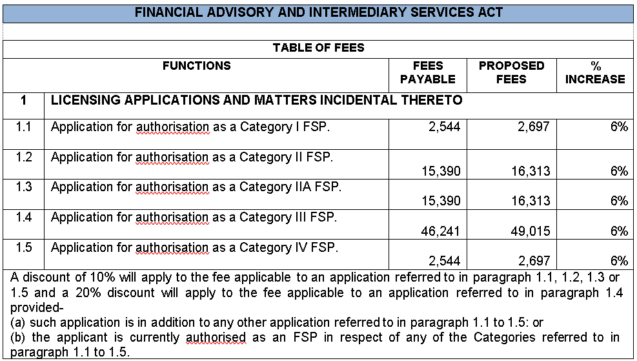

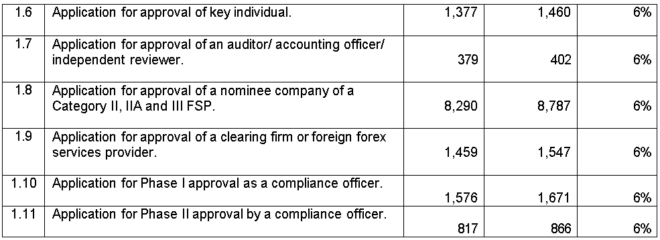

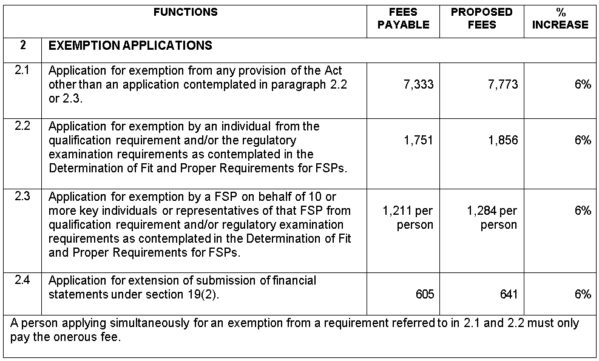

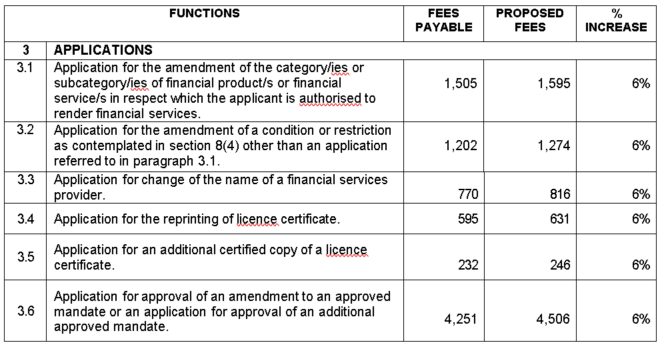

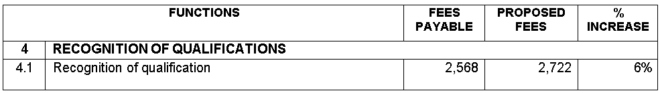

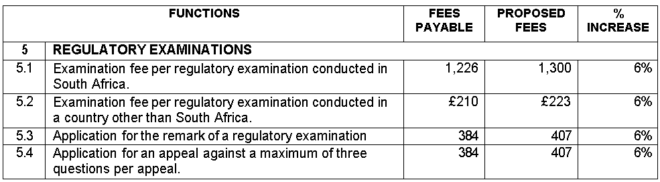

The Authority is proposing to increase all the fees it charges for performing regulated functions by 6%. The table below sets out what this means in rands and cents.

Proposed levy and fee increases for all FSCA-regulated entities

The FSCA’s proposed levy and fee increases for 2024/25 all the entities it regulates can be found in annexures C and D on pages 15 to 41 of this document.

Comments on the FSCA’s proposals must be submitted on the comments template and emailed to FSCA.RFDStandards@fsca.co.za by 2 November 2023.

Afternoon

Where can I find our Levy Invoice ?

Our FSP Nr : 12604

Thank you

Good afternoon. Are you a client of Moonstone Compliance?