A ‘new’ world order that looks a lot like the old one

For investors, geopolitics is no longer background noise. It is a core driver of supply chains, inflation, and sovereign risk premia, says Momentum’s Sanisha Packirisamy.

For investors, geopolitics is no longer background noise. It is a core driver of supply chains, inflation, and sovereign risk premia, says Momentum’s Sanisha Packirisamy.

The Diversified Markets portfolios introduce a measured allocation to private equity, credit, infrastructure, and real assets alongside listed investments.

Behind the viral humour lies a deeper story about geopolitics, energy risk and why disciplined, diversified investing could define returns as markets head into a potentially “Goldilocks” 2026.

Singles’ Day, which takes place on 11 November in China, has grown from a student celebration of self-care into the world’s largest retail event.

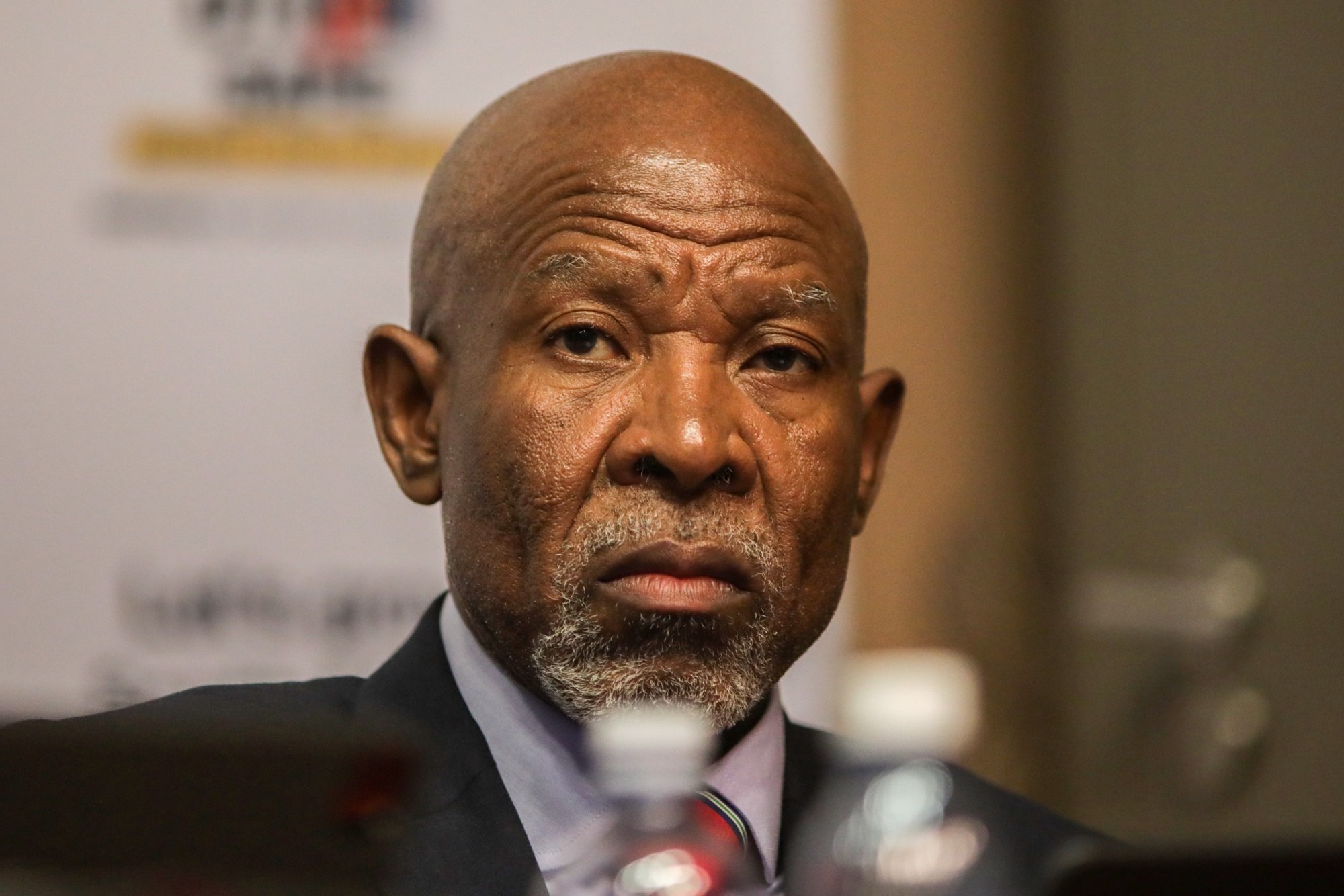

Governor Kganyago signals target reform ‘as soon as is practical’ while policymakers pause cuts.

The Reserve Bank’s repo rate cut by 25bps to 7% signals the start of a more accommodative cycle as inflation remains firmly under control.

Investors are shifting away from US-heavy passive strategies towards active, globally diversified portfolios, according to Schroders’ Global Investor Insights Survey.

Economic experts warn that the uncertainty surrounding Trump’s escalating tariffs is driving significant market fluctuations.

With the risk premium of bonds relative to equities at a 20-year low, US bonds – particularly medium-term ones – are regaining their relevance in diversified investment portfolios.

The US economy continues to surge ahead, driven by AI investments, resilient corporate growth, and strategic monetary policy.

PSG Asset Management warns that market complacency, overconcentration in US equities, challenging starting valuations, and potential policy risks could make the next decade challenging for investors.

Donald Trump’s tariff threats shook global markets in 2018 and 2019, leaving investors grappling with volatility and uncertainty. Here are the lessons for investors as an unpredictable economic climate looms.

Interest rate cuts, infrastructure bonds, and a revitalised stock market – China’s new stimulus package is poised to impact global investment strategies.