PSG Financial Services announces board leadership change

Founder Willem Theron will step down as non-executive chairperson.

Founder Willem Theron will step down as non-executive chairperson.

Regulatory initiatives across payments, digital assets, open finance and embedded finance are expected to progress this year.

The 2025 CE Index places short-term insurers mid-table within financial services, with clear differences emerging between brands and channels.

While local risk rankings align with global patterns, infrastructure fragility, business interruption, and cybercrime leave SA firms particularly exposed to cascading disruptions.

The initial payout returns roughly 6 cents on the rand to creditors, with legal costs taking a large slice – but further recoveries may change the final dividend.

The Bill largely clarifies and strengthens existing AML/CFT expectations rather than introducing a new regulatory philosophy.

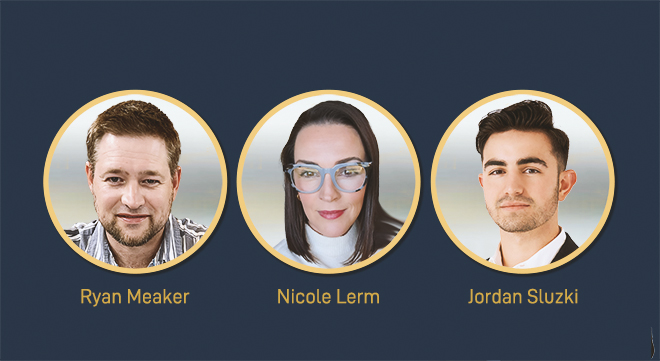

Top achievers share how MBSE’s Higher Certificate in Wealth Management translates knowledge into real-world confidence.

FNB has disbursed over R1 billion to Ithala customers and is sending about 5 000 SMS notifications per day to schedule branch visits.

The National Debt Counselling Association is pushing for a regulated mechanism to remove consumers from incomplete debt counselling caused by life-changing events.

South Africans should verify anyone offering financial services or investment opportunities.

The Bill proposes that arrangements yielding outcomes similar to traditional financial products be treated as financial services.

A Northern Cape High Court ruling shows how easily advisers can be left personally exposed.

From a shipbuilding director to a career-changer at 40 and a junior adviser navigating cross-border portfolios, MBSE’s Advanced Certificate in Financial Planning equips diverse professionals with confidence.

Campaign-driven engagement boosted positivity across the industry, yet customer complaints around service, digital reliability, and trust highlight ongoing challenges for banks.

Prospective students can jump-start their 2026 studies with early course access and benefit from a 50% discount on MBSE’s full suite of COB modules until 31 December.

Comprehensive industry input now will influence what data the FSCA collects and how it prioritises future enforcement and benchmarking.

The FSCA has fined two individuals R2.1 million and debarred them for 20 years after uncovering an unauthorised forex-trading scheme that drew in hundreds of investors.