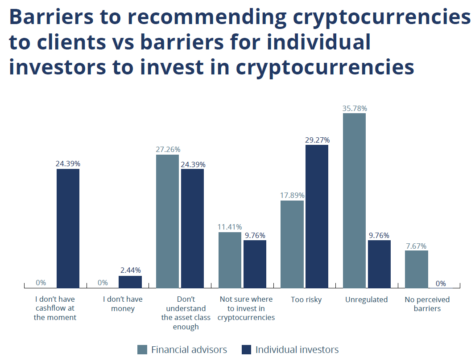

The unregulated nature of crypto assets was the biggest obstacle to financial advisers recommending cryptocurrencies to investors, whereas the perception that crypto is “too risky” was the main barrier for investors, according to a survey by Jaltech Fund Management.

However, it should be noted that the survey was conducted during the first half of 2022, before the FSCA declared crypto assets to be a financial product in terms of the FAIS Act in October 2022 and announced that crypto providers would have to apply for a licence from June 2023.

Read: What crypto asset providers need to know about licensing, regulation

Jaltech’s findings are based on an online survey, which was completed by 624 participants, of which 63% (392) were financial advisers and 37% (232) were individual investors. None of the respondents was paid for their participation. However, they were all entered into a draw to win a retail voucher.

Among advisers and investors, the second-biggest barrier to investing in cryptocurrencies was insufficient understanding of the asset class. Among investors, this reason tied with “don’t have cash flow at the moment”.

Most respondents reported having a “very basic level of knowledge” of cryptocurrencies: 79% of advisers and 65% of investors. And 13% of advisers and 20% of investors said they had “no knowledge”.

However, 15% of individual investors rated themselves as “very knowledgeable”, compared with only 8% of advisers placing themselves in this category.

“The data suggests that individual investors may be overly confident in their cryptocurrency knowledge, while financial advisers are grounded by their knowledge of the complexity of investing. Another view is that this outcome may be driven by the unregulated nature of cryptocurrencies, where financial advisers don’t have much of an incentive to develop a deeper understanding on cryptocurrencies, as they are not yet licensed to advise on the asset class,” Jaltech said.

Of the participating advisers, 87% reported that their clients were asking about investing in cryptocurrencies.

However, advisers reported that the actual uptake of cryptocurrencies by their clients was fairly low. Most advisers (47%) said that fewer than 5% of their clients were invested in crypto, and 29% were unsure of the percentage. Only 2% of advisers said more than 40% of their clients had crypto investments, while 18% put it at between 5% and 20%, and 4% between 20% and 40%.

Actual and optimal allocations

At the time the survey was conducted, 51% of respondents (advisers and investors) were not invested in cryptocurrencies.

Of the advisers who were personally invested, 63% had invested less than R50 000, 15% had invested between R50 000 and R100 000, 22% had invested more than R100 000. The investment amounts among individual investors were higher: 17% had invested between R50 000 and R100 000, and 25% had put in more than R100 000.

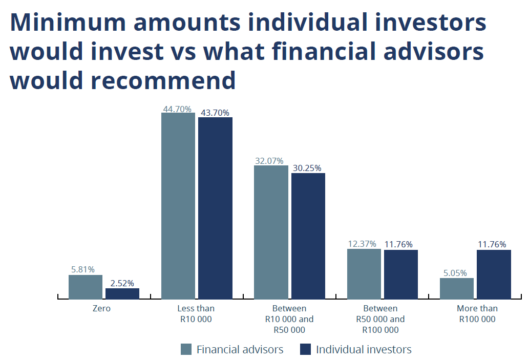

When it comes to the optimal allocation to cryptocurrencies, most individual investors (43.7%) and financial advisers (44.7%) believe the correct allocation was R10 000 or less.

Only 5.81% of advisers and 2.52% of individual investors said they would recommend an allocation of zero, which, according to Jaltech, suggests that most respondents in both groups feel cryptocurrencies have a role to play in a portfolio.