Most South Africans wish they had made better financial decisions when they were younger, by growing their money instead of spending it, according to survey commissioned by Sanlam.

The results also show that only 32.7% of the 5 205 people surveyed have a financial adviser, and 41.1% of those who have an adviser see him or her once a year.

Receiving help from a financial adviser is notably lacking among South Africans aged from 18 to 49. Their main “go-to” for “financial advice” is “online” – although the survey did not disclose whether this could be, say, the websites of reputable financial institutions or “influencers” on TikTok.

The second-biggest source of advice is “family”. “Friends” and “other” are the third- and fourth-biggest sources respectively.

Financial advisers only become a more important source of advice (28.2%) than family among South Africans aged 40 to 44. They are the primary source of advice (32.9%) for those aged 45 to 49.

The role of financial advisers continues to increase as people get older: 43.7% among those aged 50 to 54; 54.3% among those aged 55 to 59; 55.2% among those aged 60 to 64; and 60% for those who are 65-plus.

As Sanlam points out, the problem is that South Africans are not receiving proper financial advice when it would most boost their wealth: when they are young adults who have time on their side to harness the power of compounding. This is also when they should buy risk insurance products to provide for themselves and their dependants in the event of disability or critical illness.

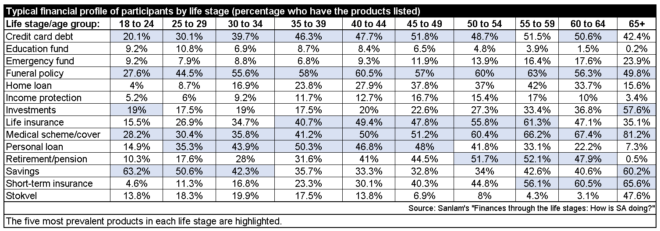

The survey found that only 10.4% of 18-to-24-year-olds and 17.6% of 25-to-29-year-olds have a retirement product. Overall, 36.1% of respondents have a retirement fund.

It found that 41.4% of respondents have savings (defined as “money in a low-interest bank account”) and 24.6% have investments (“money in higher-interest, longer-term products”).

Sanlam commented that the greater use of savings is not surprising, because it means the funds are available more readily, suggesting people take a shorter-term view of their money.

Less than half of all the respondents, 41.4%, have life insurance.

Treat money as an asset

When asked what advice they would give their younger selves for the decade preceding their current age, most respondents in every life stage (54.8%) said, “Think of money as an asset to grow, not a luxury to spend.” Interestingly, considering how this question was worded, this was also the top response (59.2%) among those aged 18 to 25.

Respondents’ second most popular piece of advice (21.3%) for their younger selves was, “Get professional financial advice.” This was followed by, “Stop thinking of your income as infinite; start making plans” (19.1%).

“Enjoy your money, you only live once,” came in as the lowest recommendation (2.3%) for younger selves across the board.

Biggest financial concerns

Despite respondents’ believing the best choice for their younger selves is growing their money, the top two financial concerns across all life stages are “making ends meet” (28.4%) and “paying off debt” (21.9%).

“Being able to retire comfortably” only becomes the third-biggest financial concern among those aged 45 to 49 (10.4% of respondents in this age group) and the second-biggest concern among those aged 50 to 54 (19.5%). It is the biggest concern among those aged 50 to 64.

“Being able to build my wealth” features among the five biggest financial concerns of South Africans aged 18 to 24 (fourth place; 9.2% of respondents in this age group), 25 to 29 (fifth place; 6.5%), 30 to 34 (fifth; 5.5%), 35 to 39 (fifth; 5.4%), and 65-plus (fifth; 6.1%).

Apart from “making ends meet” and “paying off debt”, financial concerns that crowd out wealth-building among respondents aged 18 to 39 are paying for their education, buying a property, and paying for their children’s education.

Read: Consumers relying on loans as inflation and interest rate increases bite

Very interesting article, however this is only the clients side of the story. I have been an advisor since 1988 and very few clients actually take the good advice we give them and run with it and stick to the plan. It has all got to do with a lack of discipline. The clients that did what I told them became very wealthy.

What is overlooked are factors such as (i) Expectation: Financial advice does not come free of charge, get used to a quid pro quo. People do not expect advice from other professionals and not be billed: medical, legal, accounting, business admin; nor a plumber and electrician. Too often many an inquirer sees nothing wrong with picking our brains for advice and know how, to walk away when the matter of a cost arises. (ii) Education and mind set: Authorities, in particular the FSCA, FICA and the SARS, do not refer enough those in need to an IFA, with a flyer of good example questions and fees. I feel, too, the IFA and FPI, amongst others, do not apply enough direct marketing resources to marketing the valuer of the IFA. The FPI places emphasis on marketing its’ own qualifications and not the functions per se of the IFA.

This is left to our own web pages and ability to network; no doubt too narrow a focus in itself.