Global investors are (again) putting their faith in President Cyril Ramaphosa, as it seems that lower sovereign risk is being priced in South African investments. This is despite the cynicism among South African citizens and businesses.

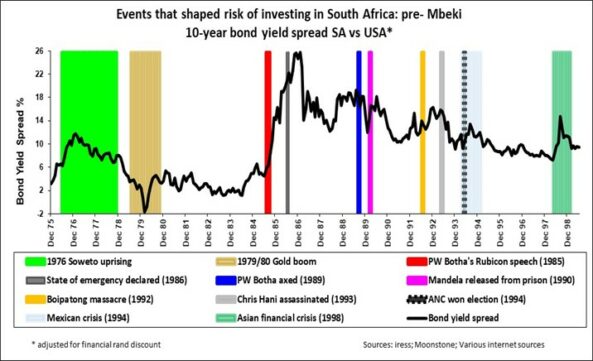

The yield spread between the 10-year government bonds of a country and those of the United States is a useful indicator of the sovereign risk of a country. The reality is that history has shown that events, global and domestic, have always shaped the perceived risk of investing in a country.

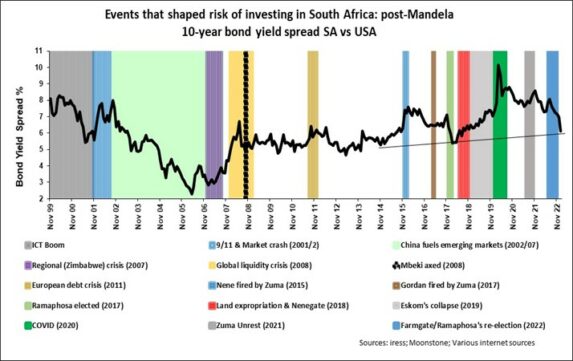

During events such as the Mexican crisis in 1994, the Asian crisis in 1998, the Dotcom bubble in 2000, 9/11, the global financial crisis in 2008/9 and the Covid pandemic, global investors hiked the risk premiums on emerging-market assets, including South Africa. Similarly, China’s resurgence after the turn of the century led to a healthy appetite for emerging-market assets.

Link between events in SA and yield spreads

South Africa’s economic history is characterised by distinct eras. During the apartheid era, the country was starved of foreign capital as foreign investors exited the country.

Global capital outflows broke apartheid after PW Botha’s arrogant and irrational, bordering on the bizarre, Rubicon speech in 1986. The yield spread required by foreign investors ranged from 15% to more than 25% until Nelson Mandela’s release from prison in 1990.

President Mandela’s disciplined rule earned trust and optimism among global investors. The yield spread of South African 10-year government bonds to US bonds narrowed to 2% after Thabo Mbeki took over from Mandela in 1999. After the global financial crisis, during which Mbeki was axed, the yield spread remained in a tight band, around 6%.

Nhlanhla Nene’s overnight firing by then President Jacob Zuma, the appointment of David van Rooyen, and the reappointment of Pravin Gordhan in a matter of a few days in December 2015 crashed global investor confidence in South Africa. The yield spread opened to nearly 8%.

Global investor confidence in South Africa was restored with Ramaphosa’s election in 2017, but it was short-lived, as confidence was shattered by Ramaphosa’s land expropriation announcement and the collapse of Eskom gaining momentum. The civil unrest in July 2021, also known as the Zuma unrest, dented confidence, as did the Farmgate scandal, which tarnished Ramaphosa’s reputation in the second half of 2022.

Ramaphosa’s re-election as president of the ANC at the end of 2022 restored investor confidence, as the yield spread fell to about 6% from 8% in July last year.

Impact of the collapse of Eskom and Transnet

The cynicism among South African businesses and citizens is understandable. The frustration is aptly summed up in a speech by Duncan Wanblad, the chief executive of Anglo American Plc, at the 2023 Mining Indaba in Cape Town.

“Corruption – and the crime that stems from it — are a cancer eating away at the entire economy on a horrific scale […] Progress made in energy provision was so late in the day that the system had already failed,” Bloomberg quoted him as saying.

The country’s infrastructure has collapsed, with Eskom and Transnet against the wall. South Africa’s history and what has happened at Eskom, in particular, over the past 10 years tick the box of a kleptocracy that, according to Chatham House, is “grand corruption whereby high-level political power is abused to enable a network of ruling elites to steal public funds for their own private gain using public institutions”.

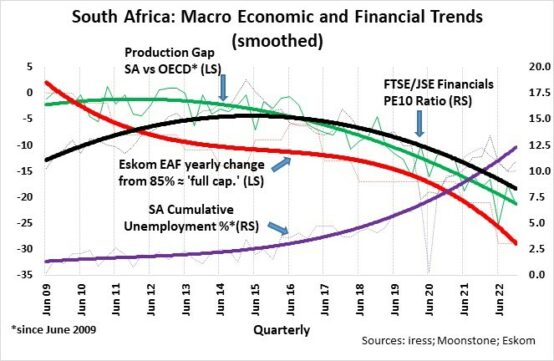

Eskom’s demise and Transnet’s collapse have forced the economy into a downward spiral. The down-trend started in earnest at the end of 2014 and has gained traction since 2018. Manufacturing production has underperformed OECD industrial production by more than 20% over the past nine years on the back of Eskom’s Energy Availability Factor contracting by a third to about 50% from 75%.

South Africa was always regarded as one of the most unequal societies in the world, with an unemployment rate of more than 25%. The implosion of Eskom and Transnet caused severe pain throughout the economy and contributed significantly to inequality as unemployment increased by more than a third to more than 33% from about 25% nine years ago.

The surge in inequality has invariably contributed to a significant increase in political instability. According to the World Bank, the country’s Political Stability and Absence of Violence/Terrorism: Percentile Rank among all countries fell to about 22 in 2021 from 40 in 2014.

The implosion has had a massive impact on savers, as the ratings of domestic economic cyclical sectors, such as financial and retail, have been in a down-trend since 2014. The opportunity cost – calculated if the Shiller PE 10 (price-earnings ratio based on average inflation-adjusted earnings from the previous 10 years) of these two JSE sectors remained unchanged from 2014 – is more than R900 billion – more than twice Eskom’s debt.

Although some investors have angst about the real possibility of South Africa being grey-listed, the reality is that the country’s credit rating has been in a down-trend since 2012. It was cut to speculative or junk grade in 2017 by ratings agencies Fitch and S&P, which take into account all factors, including corruption, political stability and the economy.

Past the tipping point

South Africa has the sword of Damocles hanging over its head. South Africa is past the tipping point and finds itself in a position similar to the one it was in before the old apartheid system collapsed.

“Business investment in South Africa is on strike until things improve,” Neal Froneman, the chief executive of Sibanye Stillwater, said in an interview in February with Bloomberg.

SA Incorporated is in a precarious situation, and if the country were a company, the creditors and shareholders would force a change in the executive.

Yes, the creditors, particularly those offshore, and the country’s citizens are in control, as they were when they broke apartheid.

Therefore, although global investors seem to have put their faith in Ramaphosa, the next few weeks will determine the country’s fate. Any mistake or irrational utterance could prove fatal, as the country’s credit rating will be punished, and the cost of capital will soar. Conversely, the markets will richly award a sea change in policies that enables the country to escape from the legacies of the past decade.

South Africa is at high risk, not only on the downside.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.

Dear Ryk, this is a great article which provides a good understand and historic perspective for all stakehokders of SA Inc.

Kindest Regards,

Frank

Dear Ryk, this is a great article which provides a good understanding and perspective for all stakeholders of SA Inc.

Kindest Regards,

Frank Agliotti

Dear Frank, I appreciate your comment and delighted that you found it insightful.

Kind Regards,

Ryk de Klerk

Ryk, ‘n baie insiggewende artikel wat ons adviseurs nuttig kan gebruik.

Dankie.

Rene

Rene, baie dankie vir die terugvoer.

Groete

Ryk

[…] Read: South Africa is at high risk, but not only on the downside […]