After a few years of sluggish performance, hedge funds in South Africa experienced healthy inflows for the second consecutive year, indicating increasing acceptance of the investment instrument as a key tool for navigating market volatility.

The annual hedge fund statistics, recently released by the Association for Savings and Investment South Africa (ASISA), show that the hedge fund industry attracted record net inflows of R6.24 billion in 2023. Net inflows in 2022 amounted to R4.54bn (net inflows of R5.33 billion in 2022).

Assets under management (AUM) grew to R137.9bn (excluding funds of funds) last year.

Hayden Reinders, convenor of the ASISA Hedge Funds Standing Committee, welcomed the stronger uptake of hedge funds, particularly by retail investors.

“This hopefully indicates that hedge funds in South Africa are increasingly being accepted as an important investment tool in mitigating market volatility,” he says.

Reinders attributes the stronger uptake to the increasing accessibility of retail hedge funds for investors, with investment platforms now more open to offering them.

He highlights that larger hedge fund managers’ boosted marketing efforts, along with their strong performance, as key factors driving greater interest from retail investors.

He adds the investment tool’s growing popularity also comes on the back of the amendments to Regulation 28 of the Pension Funds Act, which came into effect at the beginning of 2023.

Previously, the asset class “hedge funds, private equity, and any other assets not listed in this schedule” was bundled. The amendments split hedge funds and private equity investments into stand-alone asset classes, allowing local pension funds to invest 10% of assets into hedge funds and 15% into private equity investments.

Reinders says that although categorising hedge funds did not alter their technical status, it significantly improved investor understanding. He says that by clarifying and labelling hedge funds, investors can now easily comprehend and explore this investment option, thereby encouraging greater investment interest.

The comeback kid

In South Africa, hedge funds are deemed regulated collective investment schemes, just like unit trust portfolios. In 2015, South Africa became the first country in the world to implement comprehensive regulation for hedge fund products.

The roll-out of the regulation led to the consolidation and closure of several hedge funds, which translated into a few lean years for the industry.

Reinders explains that as of that date, all hedge funds were mandated to be classified as regulated hedge funds. Consequently, any fund recognised as a hedge fund was required either to establish a new scheme within the hedge category or affiliate with a management company platform authorised to oversee schemes within the hedge sector. In the first few years, the industry saw a steady decline in portfolios.

“Many of the smaller funds fell off or consolidated in the initial two-to-three-year period while the industry was finding its feet,” he says.

The wheel began to turn about two years ago when the industry again began to attract healthy net inflows (R5.33bn in 2022). The year prior, hedge funds attracted muted net inflows of R0.59bn, and in 2020 the industry suffered net outflows of R2.45bn.

The number of hedge funds has also stabilised over the past three years. Currently, there are 213 hedge funds in South Africa under the management of 11 hedge fund management companies.

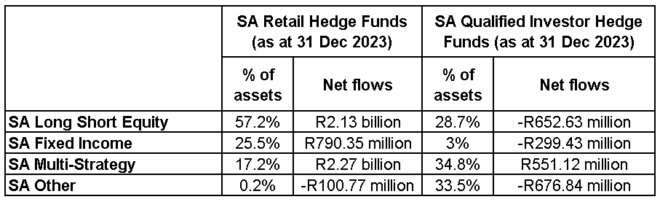

According to ASISA’s annual hedge fund statistics, 32% of AUM were held by retail hedge funds (RIHFs) at the end of December 2023, while qualified investor hedge funds (QIHFs) held 68% of assets.

The stats show that net inflows in 2023 were driven predominantly by RIHFs, which attracted net inflows of R5.1bn.

QIHFs, on the other hand, recorded net outflows of R1.1bn.

Reinders says the continued upward trajectory of net inflows in 2023 reflects a growing awareness among retail investors that hedge funds are not high-risk alternatives to unit trust funds but a building block of a well-diversified investment portfolio.

“While the markets have been interesting in 2023, hedge funds continue to be consistent and regulated investment products,” he says.

Most popular with investors

Hedge funds in South Africa are classified according to their investment strategies: Long Short Equity, Multi-Strategy, Fixed Income, and Other.

Reinders says judging from the net inflows, Multi-Strategy hedge funds were most popular with retail and qualified investors in 2023.

Multi-Strategy hedge funds do not rely on a single asset class to generate investment opportunities but blend various strategies and asset classes, with no single asset class dominating over time.

He comments that this is the first time in at least five years that retail Multi-Strategy hedge funds outdid retail Long Short Equity funds in popularity.

Retail Multi-Strategy funds attracted R2.27bn in net inflows in 2023, while retail Long Short Equity funds recorded R2.13bn.

Long Short Equity funds predominantly generate their returns by pairing long positions on equities with short-selling to benefit from both falls and drops in market prices.

Reinders notes that in the qualified investor space, only Multi-Strategy funds attracted net inflows (R551.12 million). All other categories reported net outflows for the year.

Retail Fixed Income funds attracted net inflows of R790.35m. These portfolios invest in instruments and derivatives sensitive to movements in the interest rate market.

Hedge funds in the “SA Other” category reported net outflows of R100.77m. These portfolios apply strategies that do not fit into the other classification groupings.

Looking ahead

According to Reinders, continued focus on retail investor hedge funds is anticipated, with ASISA projecting further growth in this category. He notes that several listed platforms are embracing this trend, with their efforts including the incorporation of daily pricing on hedge fund systems, making hedge funds more marketable.

Previously, most hedge funds were monthly priced but with Linked Investment Service Provider (LISP) requirements making them daily, many retail hedge funds updated their supplemental deeds to change to daily liquidity and daily pricing.

Reinders explains that, for regulatory purposes, both compliance and risk monitoring must happen daily.

“So, it was an easy enough switch to make the retail hedge funds more competitive by adding them to a LISP,” he says.

However, he says a growth-limiting factor is how hard it is to launch new portfolios in the sector.

He says, off the back, a new hedge fund is at a disadvantage because of the huge start-up costs involved.

With hedge funds being a regulated product, the cost of having a regulated portfolio includes FSCA fees, platform fees, and other expenses tied in with trustees, prime brokers, auditing, risk providers, and administrators.

Reinders explains the cost can be higher unless there is a break-even size of the fund.

“R50m launch sizes help, but to break even on a lot of the fixed costs, you probably want to be at around R120m, which might be difficult for a launch portfolio. If is too small, it can struggle to get to scale.”

He says while ASISA doesn’t have an answer to this challenge yet, the non-profit organisation is looking at how it can help going forward.

“What we are doing at ASISA is looking at Board Notice 52 and what amendments should come first,” Reinders says.