The FSCA has issued a crop of warnings about entities and individuals who are purporting to conduct financial services business without authorisation. Some of them are impersonating legitimate businesses, fraudulently using their FSP numbers and branding.

The Authority pointed out that “financial services business” refers to persons advising members of the public on investing their funds, often in the form of offering investment opportunities. It also refers to persons who deal with investments in any manner. This includes receiving funds from the public, making investments on behalf of the public, and trading in any financial product for or on behalf of the public, or enabling the public to trade in financial products.

It once again advised the public to be on the look-out for the tell-tale signs that an “investment opportunity” is a scam. The red flags include unrealistic returns, claims that the entity or person does not require an FSCA licence, vague information about the investment product or the company that provides the product, claims that the investor must act urgently, and requiring the investor to pay over more money to have the investment returned.

In a separate communication last week, the FSCA said impersonation scams are rife, and it provided a list of recent cases (see below).

Odyssey Investment Group

The Authority advises the public not to conduct any financial services-related business with Odyssey Investment Group.

The FSCA said it has come to its attention that Odyssey Investment Group is using social media platforms to solicit investments from members of the public. People are invited to join Elon Musk in launching his new currency.

“The FSCA suspects that the Odyssey Investment Group used Mr Elon Musk’s name without his consent,” the Authority said in a statement on 28 March.

Odyssey Investment Group is not licensed under any financial sector law to provide financial products or financial services in South Africa. Odyssey Investment Group did not respond to communication from the FSCA.

Swiftkryprtotrade

The Authority has also warned the public against doing financial services business with an entity called Swiftkryprtotrade, which it believes is providing advisory and intermediary services without authorisation.

The FSCA said it has come to its attention that Swiftkryprtotrade and individuals allegedly linked to it are using Telegram to target members of the public by falsely claiming to be agents or representatives of the JSE Limited.

The impersonators use images of senior executives of the JSE and its employees to lure members of the public, to solicit investments from those seeking trading opportunities and high profits.

The JSE is not associated with the impersonators, who are using its brand name, logos, trademark, and pictures of its employees without its permission. The JSE does not conduct business using Telegram.

The individuals in question were not available for comment, the FSCA said in its statement on 28 March.

Glowfx, Bennefx, Xprestrade

The Authority has urged the public to be cautious when conducting financial services-related business with Glowfx, Bennefx, and Xprestrade, none of which are authorised to render financial services or provide financial products in South Africa.

It has come to the FSCA’s attention that Xprestrade provided a client with a document purporting to be an FSCA “guarantorship” agreement. The document purports to guarantee the conversion of Bitcoins to cash.

The FSCA said these claims are false: it does not issue “guarantorship” agreements.

The document claims that “David Carter” is the FSCA’s legal authority, but no one with the name of “David Carter” employed by the FSCA, the Authority said in a statement on 28 March.

‘Exercise caution’

In another statement last week, the FSCA provided a list of persons and entities that it said might be rendering financial services to the public without authorisation.

“Without commenting on the business of these entities or persons, the FSCA points out that offering financial products or services in South Africa requires authorisation by the FSCA. None of the entities or persons referred to below are licensed or authorised under any financial sector law to provide financial products or financial services in South Africa,” the statement said.

The persons and entities are:

- Forex Royals

- Forex Trading Investment Company

- Mr Marshall Ndou and EmpireFX_Nasdaq

- Forex Trading Investment Platform

- SkyMt, conducting business via its website skymt.com

- Dr Nomalizo Tefu and Reannex Investments

- UniqueMarket24

- Mr Sisipho Buthelezi, also operating under the alias Sisipho Investment

- News24 trading investment

- Mr Ruan Erasmus

- RL Consortium (Pty) Ltd

- Mr Yoel Spector, purporting to be an authorised FSP with number 34185

- Power Guarantees (Pty) Ltd

- Mr Chad Broadbent and Phoenix Forex

Recent impersonation scams

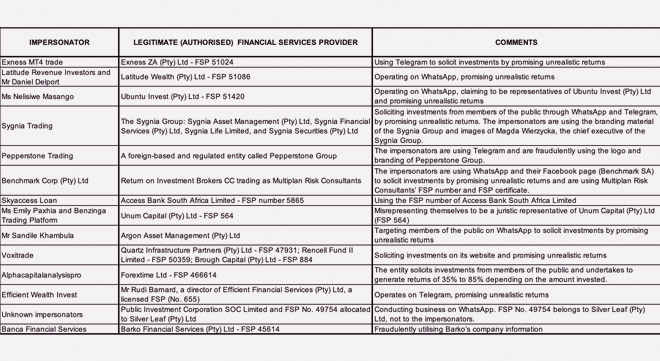

The Authority pointed out that it is against the law to impersonate other businesses or to make false claims to be associated with an authorised financial services provider.

It also noted that those engaged in impersonation scams often use social media platforms to make investment- or trading offers to the public. Therefore, the public should take extreme care when dealing with investment or trading offers on social media platforms, particularly if they are unsolicited.

The FSCA provided the following list of recent instances of impersonation.

Check before you invest

Members of the public should always check the following:

- That an entity or individual is authorised by the FSCA to provide financial products and services, including for providing recommendations about how to invest.

- The category of advice the person is registered to provide, as there are instances where companies or people are registered to provide basic advice for a low-risk product but advice on far more complex and risky products.

- That the FSP number used by the entity or individual offering financial services matches the name of the FSP on the FSCA’s database.

You can check whether an entity or person is authorised to provide financial products and services by:

- Phoning 0800 110 443 (toll-free)

- Conducting an online search for an authorised financial institution by licence category: https://www.fsca.co.za/Regulated%20Entities/Pages/List-Regulated-Entities-Persons.aspx

- Conducting an online search for a financial institution that is an authorised FSP: https://www.fsca.co.za/Fais/Search_FSP.htm