A proposed amendment Bill aims to address legislative gaps pertaining to funeral policies, but will it really solve the problems associated with over-insurance?

Last week, United Democratic Movement MP Nqabayomzi Kwankwa announced in the Government Gazette that he intends to bring to Parliament the Long-term Insurance Amendment Bill, 2024. It aims to make changes to the Long-term Insurance Act.

According to the explanatory memorandum, the principal Act does not provide for a due diligence exercise to be conducted by a long-term insurer offering a funeral policy product, to determine whether the policyholder or prospective policyholder already holds a funeral policy for the same life event.

As the memorandum explains it, policyholders face prejudice when they discover only at claims stage the consequences of having multiple funeral policies from the same long-term insurer. This lack of awareness, the memorandum says, leads to some policies not paying out. In other words, policyholders may end up paying substantial premiums for funeral policies that ultimately provide no value.

The draft Bill intends to amend the principal Act to:

- Require the Prudential Authority (PA) to prescribe rules related to protecting a policyholder of multiple funeral policies for the beneficiaries, and to require a long-term insurer to offer advice within a certain period to existing policyholders related to the consequences of holding multiple funeral policies for the same beneficiaries.

- Provide that non-disclosure of a funeral policy for the beneficiary does not affect the validity of an affected funeral policy, and a policyholder of a funeral policy is entitled to cancel any of the multiple funeral policies held for the same life event after being advised of the benefits implications thereof.

- Provide for a sanction in the event of a failure of a long-term insurer to comply with certain rules and disclosure obligations.

According to Paull Lawrence, general manager and compliance officer at Moonstone Compliance and Risk Management, the proposed amendments, if passed, would only serve as a Band Aid, not a proper fix. He says the whole structure of the funeral class needs to be reviewed to prevent over-selling.

“What typically happens is that a client takes out multiple funeral policies for multiple family members, including wider family. As they (mostly) have to include themselves when they take out the policy, they end up being overinsured, but the other lives assured are all under the statutory limit.”

He adds that restricting consumers across different insurers is not viable.

“The rule would only be able to regulate the individual insurer and their own book of business. You cannot regulate across insurers. For example, you can’t expect a Ford dealership to go and check Audi, VW, Toyota, Nissan, and so on, to establish if I already have a car and, if so, they cannot sell me a Ford.

“But, certainly, within an insurer, the limit should be checked at new business stage and not at claim stage,” says Lawrence.

When is a consumer overinsured?

According to the FAIS Ombud, although there may not be a set maximum number of funeral policies you can have, there is a maximum payout limit of R100 000 for each life insured.

Effective from 1 July 2018, the PA prescribes a maximum amount of R100 000 (per life insured), escalating annually, from the commencement date of Prudential Standard GOI 7, by the Consumer Price Index (CPI) annual inflation rate published by Statistics South Africa, as defined in section 1 of the Statistics Act.

As of 1 July 2023, the maximum for funeral class of business (based on CPI growth) is R126 773.46.

According to the FAIS Ombud, this limit is specific to the insurance policy held by a particular policyholder.

“Once this limit is reached, further payments will not be made, as stipulated by the Insurance Act,” the FAIS Ombud explains.

The Ombud adds that sections 8(1)(a) to (c) of the General Code of Conduct (GCOC) require a financial adviser to obtain appropriate information from the client regarding his or her financial position.

“The financial adviser is required to conduct an analysis based on the information provided, provide the client with adequate advice, and identify financial products that are appropriate for the client’s risk profile and financial needs,” the FAIS Ombud says.

What is important to note is that the maximum payout limit comes into play only if the consumer has purchased multiple funeral policies from one and the same insurer.

Lawrence says there is no regulation to prevent a consumer from taking a funeral policy (Funeral Class) with a maximum of R100 000 from, for example, five different insurers: A, B, C, D and E. Insurer A cannot say that it will not pay because B, C, D and E also have provided the cover.

“And the claims would pay out R500 000. They are all required to pay, but individually may not pay more than R100 000,” he says.

What is Funeral Class?

Seems easy, doesn’t it? Well, it’s not that simple. It turns out that whether the maximum payout limit is applicable can vary depending on the insurer from which the product is purchased and the Class of Business (COB) for which it is licensed.

Lawrence says it is a rather difficult concept to come to grips with because it includes aspects from the Insurance Act, the Long-term Insurance Act (regulations on commission payable, Policyholder Protection Rules), Prudential Standards (Prudential Standard GOI 7, Prudential Standard GOM) and the FAIS Act (Determination of Fit and Proper Requirements, General Code of Conduct).

In the insurance industry, COB refers to the specific type or category of activities or risks that an insurance policy is designed to cover.

Under the Insurance Act, an insurer can be licensed for different COBs, such as Risk and Funeral.

Some insurers may be licensed for Funeral Class only.

The Funeral Class encompasses coverage specifically designed for funeral expenses. This type of insurance does not typically require underwriting, meaning that applicants don’t have to undergo a detailed assessment of their health or medical history to obtain cover. This type of insurance is designed to help ease the financial burden on families when a loved one passes away.

Lawrence explains that the Prudential Standard restricts such insurers to having a maximum cover per life insured of R100 000.

“This means that the Funeral Class insurers may only pay out a maximum of R100 000 on the death of a life insured,” he says.

For example, if a person has multiple policies – say four with cover of R30 000 each (totalling R120 000) with the same Funeral Class insurer – the insurer is prohibited from paying more than R100 000. The remaining R20 000 will be forfeited.

“The Funeral Class insurer also needs to meet the specific Rule 2A: Microinsurance and Funeral Policy Product Standards under the Policyholder Protection Rules,” he says.

Microinsurers are restricted in the same way as insurers licensed for Funeral.

What is Risk Class?

If an insurer is licensed in the Risk Class, it has the authority and the ability to assess and classify individuals or businesses into various risk categories based on factors such as health, lifestyle, and occupation. This classification helps the insurer to determine appropriate premium rates and coverage terms for policyholders in different risk groups.

An insurer that is licensed for risk can offer a policy for any cover amount.

“These risk policies could be fully underwritten, or have limited underwriting or even not underwritten, depending on the insurer and their risk appetite. As such they could offer multiple policies to a client and can pay out in excess of R100 000 on a death claim,” says Lawrence.

A risk insurer can offer their risk policies as funeral so long as they meet the marketing requirements in the PPR:

PPR 10.4.13: An advertisement may not use the term “funeral” or any derivative thereof in relation to a policy, or suggest or create the impression that a policy is intended to cover funeral costs or any costs associated therewith unless the benefit under the policy is a lump sum, or specified or determinable equal or unequal sums of money payable at specified intervals to cover the cost associated with a funeral or the rendering of a service on the happening of a death event.

Risk policies that are underwritten are generally always cheaper than non-underwritten policies because they also ensure that insurers are protected against anti-selection (where impaired lives deliberately take policies out with an insurer who doesn’t underwrite).

“I have seen clients with multiple funeral policies on their payslips. If they were able to get underwritten life cover, they would be in a substantially better place financially, paying lower premiums overall and getting a decent payout on death,” says Lawrence.

He adds that it would be in a consumer’s best interest to have underwritten life cover.

“This would pay out substantially more on a claim which would cover any funeral costs, as well as leaving some legacy for the beneficiaries,” he says.

Risk and Funeral

Making things even more complex, an insurance company might have licences for both Risk and Funeral.

Lawrence says that in such an instance, it becomes difficult for a client to understand under which class of business the policy resides.

“In essence, a client could be offered a ‘funeral policy’ from the same insurer, one for a maximum of R100 000 and one for R250 000.”

He says consumers should also be allowed to make their own choice. However, he adds, financial literacy is crucial.

“In a lot of cases, no advice is provided. The clients want the cover without a proper understanding of the implications of their decisions.”

Regulatory framework – when is ‘advice’ required?

Funeral parlours and representatives of financial services providers drive the sale of funeral policies.

Sections 8(1)(a) to (c), referred to earlier, also come with a major loophole. Lawrence explains it is only relevant where “advice” is provided.

“If a representative provides information on a policy and asks the client if they want it and says that they are not providing advice and the client accepts the policy, then advice is not given and section 8 is not relevant,” Lawrence says.

Competence requirements for representatives

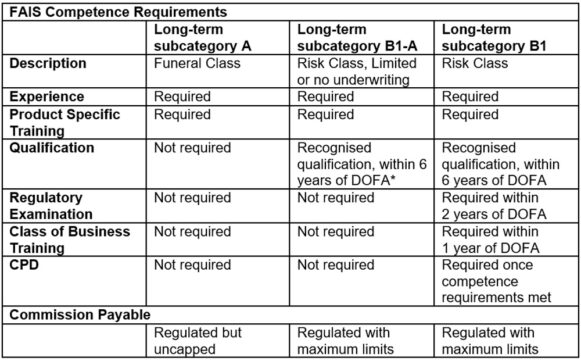

In addition, there are differences in the competence requirements for representatives selling Funeral and/or Risk class of business.

Lawrence says, as can be seen in the table, the competence requirements to sell Funeral Class of business are very low.

“The person just has to have some experience (six months for advice and two months for intermediary service) and have received some form of product training. Whilst they still have to meet the General Code of Conduct (GCOC) requirements, there is no requirement to be trained on the GCOC.”

He says that commission for Funeral can be substantially more on an “as and when” basis than for a Risk Policy, so it can also be a driver for sales.

A better option than the rules proposed would be for the industry to review clients who have multiple policies and look at restructuring their insurance policies to replace some of the more expensive funeral policies with more cost-effective risk policies and demonstrate the monetary savings which could be had. This would also provide for higher claims payouts, providing needed financial support to the family after the funeral has happened. This, together with improved financial education and financial literacy, is likely to have a much bigger impact on clients who are over-indebted.

Deadline to comment

Comments on the Long-term Insurance Amendment Bill can be emailed to the Speaker of the National Assembly at speaker@parliament.gov.za and to Nqabayomzi Kwankwa at nkwankwa@parliament.gov.za by Friday, 23 February 2024.