The FSCA is proposing to make it easier for retirement funds to get an exemption from the full liquidation process when the participating employer withdraws from the fund.

The Authority wants to use the power conferred on it by section 281(1) of the Financial Sector Regulation Act (FSRA) to exempt retirement funds from two provisions of paragraph 9 of Board Notice 75 of 2009. This board notice provides retirement funds and liquidators with guidance on the information the FSCA requires when a fund is liquidated or partially liquidated.

Section 28(17) of the Pension Funds Act (PFA) empowers the Authority to prescribe the circumstances under which a fund may be exempted from the provisions of section 28, which set out the procedures for the voluntary winding up of a fund. Paragraph 9 of Board Notice 75 contains the conditions for a retirement fund to apply for a such an exemption.

Currently, in terms of paragraph 9.2 of the board notice, the FSCA will only consider applications for an exemption from the provisions of section 28 where, on the date on which the fund takes a resolution to liquidate or partially liquidate the fund because of the withdrawal of a participating employer:

- The average benefit per member is less than R50 000 (paragraph 9.2(a)); and

- The fund or the withdrawing participating employer does not have more than 50 members (paragraph 9.2(b)).

The exemption is subject to…

The FSCA’s draft exemption, published on 2 November, proposes to exempt funds from paragraphs 9.2(a) and (b), subject to the following conditions:

- On the date on which a fund takes a resolution to liquidate or partially liquidate the fund because of the withdrawal of a participating employer, the fund or the relevant participating employer does not have more than 100 members;

- All the other requirements and conditions in Board Notice 75 – specifically paragraphs 9.2(c), 9.2(d) and 9.3 – are complied with; and

- The fund submits an application in the format set out in Form D to the board notice, together with a specific request to be exempted from paragraph 9.2(a) or 9.2(b). The request must confirm that the fund is in compliance with paragraphs 9.2(c), 9.2(d) and 9.3.

Essentially, the proposal does away with the average-benefit-per-member threshold and caps the membership threshold at 100.

In a communication accompanying the draft exemption, the FSCA said it will consider each exemption application on a case-by-case basis, depending on the circumstances of each fund or participating employer – for example, whether there are arrear contributions or unclaimed benefits, or whether a full section 28 liquidation is in the best interest of members.

This indicates that meeting the conditions will not automatically result in a fund being exempted from section 28; the FSCA can still require the fund to go through the full liquidation process if the Authority deems it necessary.

If the proposal is adopted, the exemption will apply to funds that lodge a request for an exemption with the FSCA from 1 January next year.

Rationale for the exemption

The FSCA said it receives applications for an exemption from section 28 of the PFA from funds that are unable to comply with some of the conditions in paragraph 9 of Board Notice 75. These funds consequently apply for the same exemption in terms of section 281(1) of the FSRA.

The challenge with the conditions in paragraph 9 is that, in certain instances, large income and therefore benefit disparities among members can result in the average benefit being skewed and overstated, the Authority said.

In addition, it said many small participating employers facing financial distress during economic downturns cannot afford to continue paying their contributions, resulting in the termination of their participation. Under such circumstances, members may be better served by applying for an exemption from the full liquidation process.

It seems the proposed exemption will be a temporary measure. The FSCA’s communication says the process to amend section 28 of the PFA and Board Notice 75 is under way, “to ensure members are treated fairly by reducing the red tape in the current liquidation process”.

Earlier this year, the Financial Services Tribunal dealt with a case in which a member of an umbrella fund took issue with the FSCA’s decision to exempt the fund from the requirements of section 28. The participating employer experienced financial difficulties because of the lockdown and decided to liquidate its sub-fund.

The sub-fund had 54 members and the average benefit per member was R104 191, which meant it did not meet the requirements of paragraphs 9(a) and (b) of the board notice. Despite this, the FSCA granted the sub-fund an exemption from section 28 of the PFA.

The tribunal dismissed the member’s application, saying revoking the exemption would adversely affect the members’ rights. It said the cost of a full liquidation would reduce the members’ benefit.

Read: Why FSCA’s liquidation exemption stands despite conflicting with Board Notice

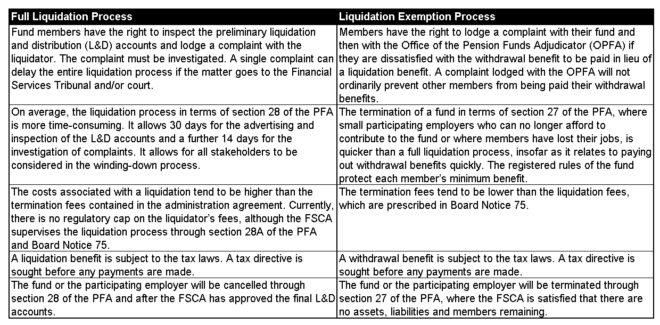

The FSCA’s communication set out the advantages and disadvantages of a full liquidation process and a liquidation exemption process.

Comment and further information

Comments on the draft exemption must be submitted on the comments template (Word document) and emailed to FSCA.RFDstandards@fsca.co.za by 14 December.

For more information, contact the FSCA’s Regulatory Framework Department by emailing Roslynne van Wyk at roslynne.vanwyk@fsca.co.za.

Click here to download the draft exemption notice.