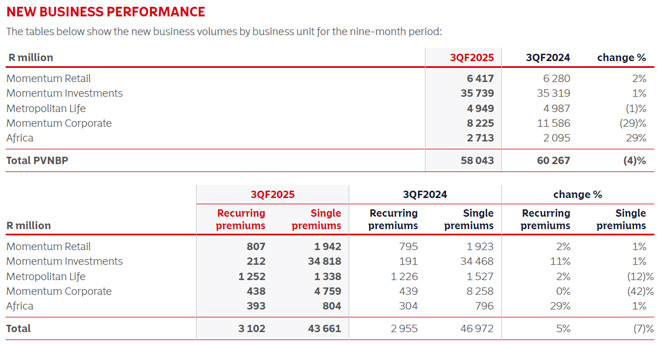

The Momentum Group reported a decline in new business written in the nine months to the end of March compared with the previous period, as sales of lump-sum products fell in Momentum Corporate and Metropolitan Life.

Sales, as measured by the present value of new business premiums (PVNBP), dropped by 4%, from R60.267 billion to R58.043bn, the group said in an operating update published on Monday. The decrease follows a similar pattern in the first two quarters of the group’s financial year.

The update said the value of new business (VNB) continued to grow in the third quarter, albeit at a slower pace than in the first half of the financial year. (VNB measures the profit expected from new business written during the period.) VNB was supported by a shift in the new business mix towards more profitable lines and an improved performance from Metropolitan Life.

Other highlights from the group’s third quarter update are:

- Normalised headline earnings (NHE) for the nine months were R4.8bn. NHE for the six months to the end of December were R3.44bn.

- The group believes it is on track to achieve NHE of R7bn, a return on equity of 20%, and a VNB margin of 1% to 2% by the time it reports its 2027 annual results.

- Momentum received approval from the Prudential Authority for its R1bn share-buyback programme, which started on 14 May.

Performance by segment

Momentum Retail, which offers insurance and savings and investment products to the middle-income and affluent markets, saw new business sales increase by 2% compared to the third quarter of last year.

Protection new business (policies that pay benefits in the event of death, disability, or other insured events) improved by 4%, while long-term savings business saw a marginal increase.

VNB was positive in the year-to-date, reflecting the lower cost of capital and reduced sales-related expenses versus the prior period. However, the quarterly VNB was modest because of ongoing investments in advice capabilities (expanding and training the financial adviser force) and changs to the operating model.

Momentum Investments’ sales rose by 1%, aided by an increase in new business volumes on the Momentum Wealth investment platform.

Sales of life annuities continued to grow, although at lower absolute levels than in the prior period, as client preferences shifted from life annuities to living annuities. The shift from higher-margin life annuities towards living annuities impacted VNB, although it was positive for the quarter and the year-to-date.

Assets under administration increased by 9%, driven by positive net inflows into Momentum Wealth and favourable market movements, while similar factors resulted in assets under management rising by 7%.

Metropolitan Life, which sells long-term insurance products to the lower- and middle-income markets, saw sales fall by 1%.

Single-premium annuity business declined by 12%, partly because of fewer large one-off inflows and a reduced distribution force.

Recurring-premium long-term savings sales grew by 2%, helped by new products launched in response to the two-pot retirement system.

VNB was positive for the quarter but remained negative in the year-to-date. The positive quarterly result stemmed from lower distribution costs and adjustments to poorly performing products.

Momentum Corporate experienced a challenging nine months, with sales down nearly a third.

The decline reflects lower single- and recurring-premium new business at FundsAtWork (employer-sponsored group risk and retirement solutions), as well as the absence of sizeable one-off single-premium inflows that bolstered the prior period.

VNB remained negative both quarter-on-quarter and in the year-to-date, largely because of lower overall sales volumes and shifts away from higher-margin products.

Momentum Insure’s gross written premiums (GWP) increased by 1% compared to the third quarter of 2024. (GWP represents the total premiums written before reinsurance and other deductions.)

The combined ratio improved to below 92% (the long-term target range is 92% to 97%). The combined ratio measures underwriting profitability: it is the sum of the claims ratio and the expense ratio.

The claims ratio (claims incurred divided by earned premiums) improved to 51.2%, aided by successful renewal strategies and no major weather-related losses. The expense ratio (operating expenses divided by net premiums earned) rose slightly, driven by ongoing investments in digital platforms and risk modelling.

New business volumes grew by 20%, although this increase did not fully offset declines in the in-force book.

Persistency (the proportion of policies that remain in force) deteriorated marginally but stayed slightly above industry norms.

Subsidiary Guardrisk’s diversified insurance offerings benefited from a broad appetite in niche markets.

According to the update, new business volumes expanded “significantly”, with particularly strong growth in mining rehabilitation solutions, corporate risk solutions, and Guardrisk Life.