Seven medical schemes – three of them open schemes – grew their membership by more than 5% between 2021 and 2022, with one scheme’s membership increasing by 10%, according to statistics released by the Council for Medical Schemes (CMS).

The regulator last week released a brief preliminary report highlighting demographic, benefit, and financial trends in the medical schemes industry in 2022.

The number of members and dependants grew by 1.26% and 1.01%, respectively, in 2022, bringing the total number of medical scheme beneficiaries to 9.04 million (2021: 8.94 million).

Closed schemes grew from 4.11 million to 4.18 million lives covered between 2021 and 2022, while open schemes grew from 4.83 million to 4.86 million beneficiaries.

Although the number of medical scheme members has increased, the share of the population belonging to medical schemes shrank from 16.5% in 2000 to 14.92% in 2022.

Industry consolidation continued, with the number of schemes declining from 75 to 72 in 2022.

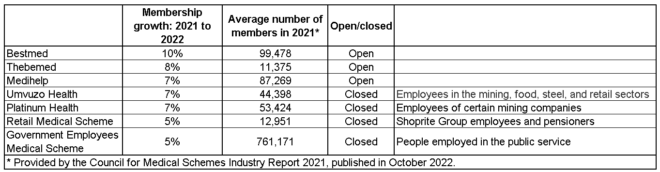

The report called attention to what it described as “a remarkable trend”: seven schemes “exhibiting significant expansion” by recording growth rates of 5% or more.

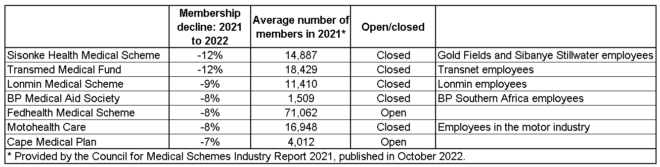

The report also lists the schemes that experienced a substantial decline in lives covered. As the table shows, most of these schemes are restricted.

Restricted scheme members enjoy better cover

There is a startling difference between the level of cover enjoyed by most beneficiaries of closed schemes and beneficiaries who belong to open schemes.

The report shows that 95% of beneficiaries of restricted schemes are on comprehensive plans (50%) or partial plans (45%). Only 3% are on hospital plans.

On the other hand, hospital plans, at 43%, are the single-biggest type of cover for most beneficiaries of open schemes. Comprehensive plans (22%) and partial plans (23%) cover 45% of beneficiaries, while the plans of 12% of beneficiaries were not classified.

Increase in value of claims

Total healthcare expenditure on benefits paid increased by 9.2% in 2022 to R224.1 billion. Risk benefits paid accounted for 90.7% of total benefits paid, at R203.3bn, while savings accounted for 9.3%, at R20.8bn.

The claims paid per average beneficiary per annum (PABPA) increased by 3.5%, from R23 060.79 in 2021 to R23 877.83 in 2022. Similarly, risk benefits paid per beneficiary increased by 3.6%, from R20 810.38 in 2021 to R21 551.26 in 2022. The average amount spent from medical savings accounts PABPA increased by 3.4%, from R2 250.41 in 2021 to R2 326.57 in 2022.

Total benefits paid increased by 17.3% between 2015 and 2022, translating into an annual average increase of 2.3%. In restricted schemes, the increase was 22.5% for the same period, or an annual average increase of 2.9%. In open schemes, the increase was 13.7%, or an annual average increase of 1.8%.

Medical schemes experienced further increases in claims compared to 2021, mainly because the release of pent-up demand resulted in increased utilisation. Risk claims PABPM increased by 5.97% to R1 842.54 from R1 738.73. The claims ratio, therefore, increased from 90.94% in 2021 to 93.96% in 2022. This resulted in a net healthcare deficit of R6.16bn compared to a surplus of R820.52 million in 2021.

Swing to a net healthcare deficit

In 2022, medical schemes used their built-up reserves to fund their operations. For every R100 received in contributions, R2.92 of reserves were used to fund the R93.96 paid in claims and the R8.96 in non-healthcare expenditure.

In 2022, schemes collected R210.76bn in risk contributions from members (2021: R204.69bn), and expenditure on relevant healthcare services was R198.04bn (2021: R186.15bn).

As was the case in 2021, schemes implemented below-inflation increases in 2022. The increase in risk contributions PABPM was 2.56%, rising from R1 911.95 in 2021 to R1 960.92 in 2022. The Consumer Price Index was 6.9%.

Schemes’ investment income positively contributed towards their net surplus of R2.57bn in 2022, lifting them out of a net healthcare deficit of R6.16bn. This was a significant swing from the net surplus of R12.19bn and net healthcare surplus of R820.52m in 2021.

The increased investment yields had a positive effect on the industry’s reserves, which increases by 3.84% to R109.76bn. The industry’s solvency ratio edged up by 0.92% to 47.21%.