The demanding work environment may explain the high number of corporate benefit claims related to psychiatry and neurological disorders among employees in the financial services sector, Liberty said in comments on its latest claims statistics.

The financial services group, which is owned by Standard Bank, this week released its claims statistics for 2024.

Liberty paid out a total of R12 billion in claims last year, of which R7.5bn were for retail risk claims, R2.6bn for corporate benefits, R1.33bn for funeral claims, and R662 million for credit life claims.

It paid 91.5% of all claims submitted, compared to 93.8% in 2023. Declined valid claims were a very small proportion at 0.5%. Declined claims under living benefits were slightly higher, mainly because the claim was not covered by the policy conditions or the claim criteria were not met, Liberty said.

The statistics also included an update on two-pot claims to January, which showed that Liberty claimants received R444.4m after tax.

CORPORATE BENEFITS

Surge in capital disability claims

A closer look at Liberty’s corporate claims shows that the value of claims payouts for these benefits increased by 6% from 2023. The total number of claims increased by 2% year-on-year to 11 198.

It is notable that capital disability benefit claims were the main reason for the increase in total claims paid across the entire book. Payouts surged by 70% to R142m last year.

Liberty attributed this to a 32% increase in the number of claimants, and a 29% increase in the average sum assured.

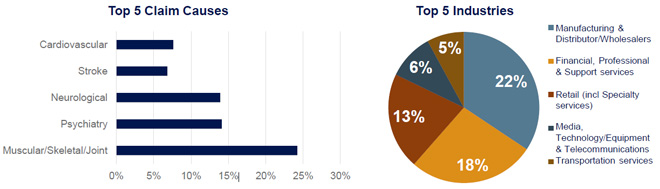

Muscular, skeletal, and joint-related claims were the leading cause of capital disability claims, with claims for these conditions increasing by 114% from 2023.

Life cover: most claimants younger than 55

The largest contributor to corporate claims was the group life assurance or life cover benefit, which accounted for R1.3bn in payouts, an increase of 2%. The number of claimants decreased by 15%, but the average sum assured increased by 17%.

Motor vehicle accidents were the leading cause of unnatural deaths, accounting for one in five death claims.

More than 50% of life cover claims were for members aged 54 or younger – those who are often the primary breadwinners for their families. This, Liberty said, underscores the importance of this benefit for younger members, ensuring their dependants are cared for in the event of an unexpected loss.

High claims for psychiatry, neurological disorders in financial services

The income protection benefit paid out R927m, with the 4% increase attributed to higher average monthly claim payments.

Muscular, skeletal, and joint-related claims were the leading cause of income protection claims, with a 31% increase from 2023.

Globally, musculoskeletal conditions, particularly low back pain, are a leading cause of disability in 160 countries. Prolonged sitting in office environments is a key risk factor, leading to absenteeism, reduced productivity, and early retirement, Liberty said.

Psychiatry and neurological disorders were among the top three claim contributors for income protection in 2024, accounting for 14% of the claim amount paid – a 25% increase from 2023. Factors contributing to mental illness include poverty, unemployment (up 16.8% from 2023 to 2024), inequality, violence (notably gender-based violence, affecting 33.1% of women aged 18 or older), and political upheaval.

Liberty said the financial services industry stood out for the relatively high number of psychiatry and neurological disorder claims (18% of the total by industry). It said high levels of stress, long working hours, and job pressure likely contribute to these health challenges.

“Employees in the financial services industry need to be mentally sound to perform their job, which further emphasises the critical nature of mental health within this sector. As a result, even small mental or neurological health challenges may significantly impact an individual’s ability to function effectively.”

In contrast, labour-intensive industries such as manufacturing, distribution, and wholesale experience a higher frequency of muscular, skeletal, and joint disorder claims, driven by repetitive motions and heavy lifting.

Critical illness: increase in female cancer claims

The value of critical illness (CI) benefits claims paid increased by 19% to R126m, driven by a 17% rise in claimants.

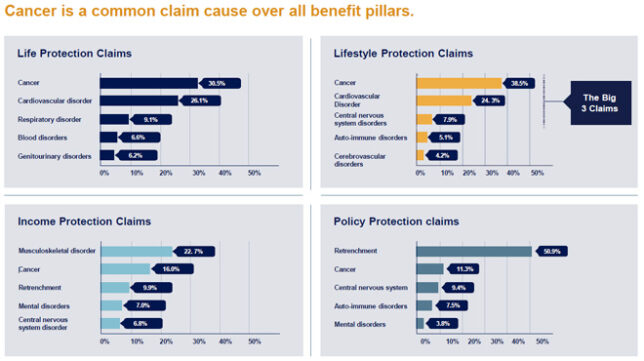

Cancer continues to be the primary contributor to CI claims, having increased by 9% (R4.7m) from 2023. This was driven by a 36% increase in female cancer claims from 2023 to 2024.

Cardiovascular claims were the second-highest contributor to CI claims, with a 175% increase in claims for women from 2023. Neurological disorders were the third-highest contributor to CI claims, increasing by 398% for men from 2023.

RETAIL BENEFITS

In terms of retail risk claims, most came from Liberty’s flagship Lifestyle Protector cover, which paid out R7.35bn, an increase of 11.8% from 2023.

Payouts were made to 28 889 individuals and their beneficiaries, and the average payment was R260 000.

There were increases in claims across all four key pillars of the Lifestyle Protector suite. Life Protection (life cover) payouts increased by 9.5% to R5.5bn, Lifestyle Protection (critical illness cover) increased by 20.4% to R1.2bn, lump-sum income protection payouts rose by 18.5% to R507m, and monthly income protection payouts were up by 11.6% to R267.3m.

Liberty said the significant increase in Lifestyle Protection benefit claims demonstrates that people are living longer with critical illnesses. One reason for this is that they are receiving treatment more promptly based on earlier detection. This highlights the increased need for living benefits and for regular preventative medical screenings.

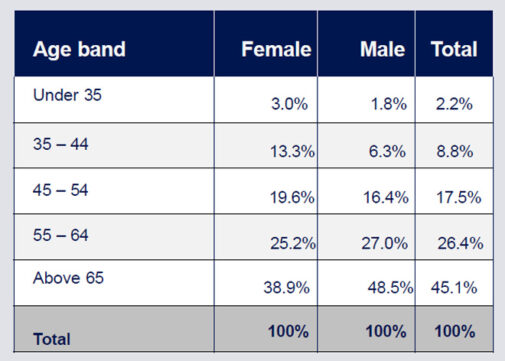

Most retail claims were from older clients, with the average age at claim being 60 for women and 64 for men. However, 25% of claims were from male clients under 55 and were 35% from female clients under 55.

“With 2.2% of claims coming from individuals under the age of 35, it is evident that death, disability, and critical illness can affect anyone, regardless of age and happen unexpectedly. It is important to encourage younger people to take out cover while they are still young and also in better health, potentially making their risk cover cheaper,” said Andrew Methmann, Liberty’s chief specialist for risk pricing.

A higher proportion of overall claims came from men (64.8%) than from women (35.2%). Although Liberty’s client base is split almost equally between men and women, one of the reasons for this gap could be that a larger proportion of these men are older and more likely to claim.

Top reasons for claims

Cancer (31.2%), cardiovascular disorders (22.3%), respiratory disorders (5.8%), musculoskeletal disorders (5.5%), and nervous system disorders (5.3%) were the top five claim causes, accounting for 70.2% of all claims among all benefits.

Although cancer was the leading cause for claims among men and women, 37.2% of women claimants claimed for cancer, compared to 27.9% for men.

“The higher prevalence of cancer among women can possibly be attributed to the high incidence of breast cancer among South African women. Notably, 46.9% of cancer-related claims submitted by women were for this specific form of the disease. For men, the most common cancer was prostate cancer, accounting for 31.9% of male cancer claims,” said Dr Reinhardt Erasmus, Liberty’s chief medical officer.

Early detection was a positive trend that emerged among cancer claims.

“Many of our cancer claims were in the early stages of the condition, and this suggests that South Africans are going for regular check-ups. Cancer can be addressed more easily if detected earlier,” said Erasmus.

Claims for serious mental disorders made up 2.8% of all retail claims in 2024. Of this percentage, 51.1% of claims were for life protection benefits, with the remainder for living benefits. Suicide accounted for most of these life protection claims.

Most retrenchment claimants were women

The main reason for income protection claims was musculoskeletal disorders at 22.7%, followed by cancer at 16%, and retrenchment at 9.9%.

Kresantha Pillay, the chief specialist for Liberty’s Lifestyle Protector cover, said most retrenchment claims in 2024 came from those aged 35 to 44, with 38.6% of claimants being women and 16.8% men.

Significantly, 64.4% of all retrenchment claimants were women.

“This reveals a stark contrast in retrenchment claim trends and shows that in 2024 women filed nearly twice as many retrenchment claims as men. This signals a troubling imbalance in job security and underscores the critical need for income protection among women, highlighting the urgency for them to explore tailored financial solutions and safeguards,” Pillay said.

TWO-POT CLAIMS

As of 29 January, Liberty had processed 62 000 applications for withdrawals from the savings component of the two-pot retirement system. Of these, 48 600 claims were approved, resulting in total payouts of R600m.

However, net payouts were R444.4m once R155.6m had been deducted by the South African Revenue Service, reflecting the application of marginal tax rates and/or the collection of outstanding tax.

Liberty said 6% of processed claims were affected by IT88 notices, which are deduction orders issued by SARS to third parties. IT88 notices resulted in 2% of claimants receiving nothing after tax.

The largest single after-tax payout was R34 500.

About 75% of claimants were aged between 30 and 50 years old, indicating that middle-aged individuals, likely facing financial pressures such as debt or family expenses, are the primary users of the savings component.