South Africa’s short-term insurance sector experienced a 28% fall in profit after tax (PAT) last year, from R8.3 billion in 2019 to R6bn, largely because of defaults on credit, an increase in net claims and a higher claims ratio, according to KPMG’s 2021 Insurance Industry Survey.

The findings are based on a survey of 40 short-term insurers.

The graph below shows PAT compared to gross written premiums (GWP) for the 10 largest non-life insurance companies in 2019 and 2020.

Santam’s PAT declined from R1.87bn to R239 million, impacted by business interruption claims. Santam took a R3bn knock from Covid-19-related claims on its net underwriting result, including R1bn already settled in August 2020.

Old Mutual Insure recorded a loss after tax of R483m after muted year-on-year growth in GWP. The top line performance was exacerbated by premium relief measures and the discontinuance of its agricultural crop business during 2020. Old Mutual Insure also experienced adverse claims due to business interruption claims and lower investment income compared to prior years. The insurer provided R460m (net of reinsurance) for business interruption losses.

Increase in claims

Net claims incurred increased by R1.9bn (4.1%) versus a R2.5bn (3.2%) increase in net earned premiums. This resulted in the claims incurred ratio increasing from 59% in 2019 to 59.5% in 2020 (55.3% in 2018).

KPMG said the loss ratio was adversely impacted by provisions for business interruption claims, but partly offset by fewer weather-related catastrophes and lower claims frequencies over several insurance classes (particularly motor insurance) following the impact of the lockdown.

The pandemic had a severe impact on trade and consumer credit class of business. Defaults on credit caused significant insurance losses.

Directors and officers liability insurance claims have increased in frequency and severity. The reasons for this include exceptionally difficult trading conditions, a highly regulated environment that often comes with personal liability, an increase in stakeholder activism, new risks such as Covid-19 and cyber liability, and a shrinking pool of experienced non-executive directors.

Liabilities on the rise

Gross insurance liabilities increased by 27.2% (increase net of reinsurance by 18%). The increase was partly driven by higher claim provisions for business interruption.

Solvency levels improved in 2020 for non-life insurers. The median minimum capital requirement for the industry was 4.6 times versus 4.0 times in 2019. The median solvency capital requirement for the industry was 1.8 times versus 1.7 times in 2019.

But investment income falls

Total investment income was down 31.9% from 2019. The lower interest rate environment and fair value losses on financial assets were the key contributors to the weaker investment performance.

Investments and securities (including cash and cash equivalents) amounted to R119.4bn, an increase of 10.3% from R108.2bn in 2019.

Increase in GWP

GWP in the non-life sector increased by 4.93% compared with 2019, to R128bn in 2020. This was lower than 7.6% in 2019 and 8.1% in 2018.

KPMG said this result was commendable considering that (a) the insurance sector was dealing with an economic recession before the pandemic struck and (b) the premium relief measures many non-life insurers provided to their customers.

“It appears the impact of the pandemic had not been as severe on the industry as expected.”

However, net written premiums increased by 3.2%, and reinsurance premium costs increased by 8.5% in 2020. Profits before tax, net of reinsurance commissions, decreased by R2.3bn.

KPMG said reinsurance rates will continue to harden this year, which will have a knock-on effect on policyholders as insurers seek higher premiums to recover this cost.

“Covid-19 claims, high global natural and man-made catastrophe losses (for example, US hurricanes and wildfires) and poor returns on investments have led to widespread rate increases. Global reinsurer Munich Re recently reported that the combination of a hardening insurance market, ‘lower for longer’ interest rates and larger-than-forecasted pandemic and non-pandemic losses would make insurance covers more expensive, particularly for long-term risks in third-party liability and other lines.”

King Price, Discovery Insure and Guardrisk were the top three contributors to the growth in GWP in the short-term insurance industry last year. Each of them achieved double-digit growth compared with 2019.

- King Price, which grew its GWP by 30.4%, from R1.6bn to R2.1bn. KPMG said King Price was able to grow its revenue while managing favourable loss and management expenses ratios. Its profit after tax increased 250% to R190.9m, KPMG said.

- Discovery Insure, with GWP growth of 14.8%, from R3.2bn to R3.7bn. Its gross new business annual premium income grew by 5% to R1.1bn, which Discovery attributed to its “shared-value insurance” products where policyholders are rewarded for better driving. “The loss ratio for good drivers was up to 45% lower than that of poor drivers and the lapse rate 9% lower than the prior year. In June 2020, the insurer recorded the highest gross new business annual premium income for any month since the inception of the business. This reflected a strong recovery through the easing of lockdown measures. It also appears that customers are seeking products where they are rewarded for good driving behaviour and travelling reduced distances following the initial hard lockdown. Discovery also reported increased new business and positive lapse trends on their commercial insurance book.”

- Guardrisk’s GWP increased by 11.3%, from R9.9bn to R11.1bn. KPMG said Guardrisk continued to expand its sources of revenue from cell captive fees into underwriting income and continued to increase its non-life risk-taking activities into specialist lines. Guardrisk General Insurance, the mid-tier corporate commercial offering in niche markets launched in 2019, grew its GWP by 32% to R2.35bn in 2020 from R1.78bn in 2019.

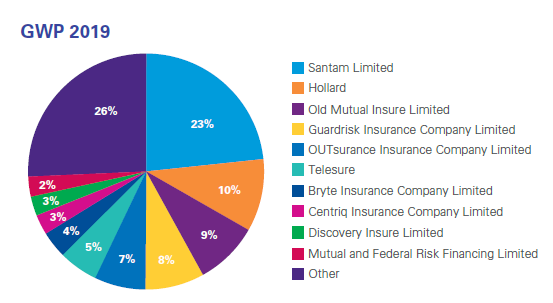

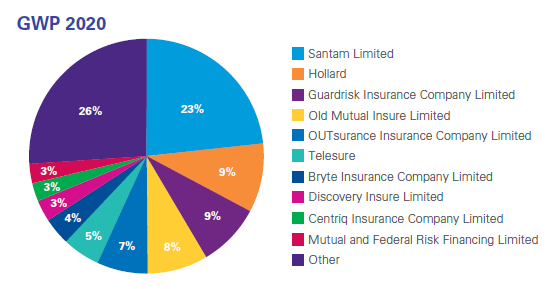

Market share of the top 10 insurers

In 2020, the 10 largest insurers by GWP had a market share of 73.8%, which was relatively consistent with 74.4% in 2019.

Comparing the market share positions of 2020 to those of 2019, Guardrisk and Old Mutual Insure traded places in third and fourth position, because of Guardrisk’s 11.3% increase in GWP. Discovery replaced Centriq in eighth position, also because of the increase in its GWP.

2020 in a nutshell

KPMG said the impact of Covid-19 and the lockdown certainly tested the short-term insurance industry in almost all respects.

Although the industry experienced lower GWP growth compared to the average of prior years, increases in reinsurance costs, low interest rates, volatile financial markets and significant business interruption claims, some lines of business loss ratios improved during the lockdown. “But perhaps more importantly, the industry survived what could be considered a 1-in-100-year event and insurers and reinsurers protected their customers.”