Although an increasing number of analysts and commentators compare the current AI hype with the Dotcom Bubble of the late 1990s, it appears that the lofty valuation of US AI stocks versus the rest of the S&P 500 and world markets can be justified.

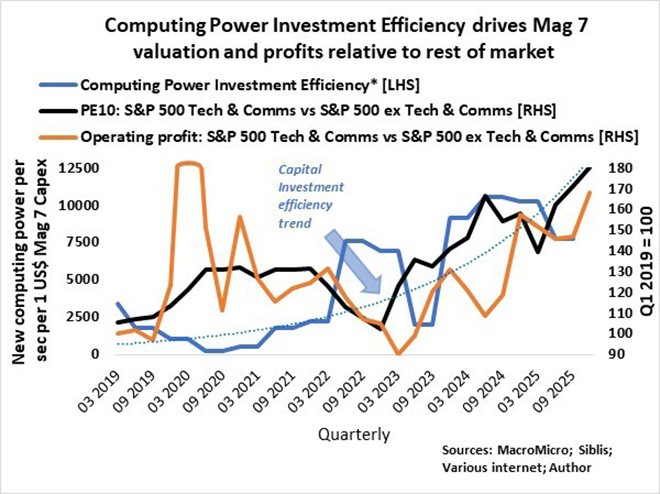

MacroMicro has constructed computing power investment efficiency whereby “the efficiency of capital investment in computing resources” of the Magnificent Seven (Mag 7) can be measured. It is calculated by dividing the incremental computing power per second added in the United States over a given period by the aggregate capital expenditure of these companies during that same period. Computing power investment efficiency has grown nearly exponentially since 2019, and, according to MacroMicro, the rapid increase in capital expenditure by the Mag 7 resulted in each dollar invested today generating 30 times more computing power per second than it did five years ago.

In addition, my analysis indicates that higher capital investment efficiency is the driving force behind the Mag 7’s superior growth in operating profits relative to the rest of the US market and underscores the rising trend in the PE10 (PE ratio based on inflation-adjusted earnings from the previous 10 years) of the combined S&P Information Technology & Communications sector relative to the rest of the market (S&P 500 ex Information Technology & Communications).

However, it raises the question whether the current and planned massive capital investment by the AI industry will continue to result in exponential growth in computing power investment efficiency, and even if it does, whether AI companies will continue to deliver superior profit growth and henceforth sustain lofty valuation metrics relative to the rest of the market.

The AI explosion, the business models, and the massive capital expenditure drive dwarf the Dotcom era, but there is no room for error, as investors will turn sour at any major wobble in the AI industry. Companies with the strongest balance sheets and business models such as Google (now Alphabet), Microsoft, Intel, and Priceline (now Booking Holdings) survived the Dotcom storm and grew even stronger, with Microsoft and Alphabet currently among the top 10 most valuable companies in the US.

At these lofty valuation levels, with the PE10 of the S&P 500 Information Technology & Communications sector at 2.2 times relative to the rest of the US market, the uncertainty regarding the evolvement of AI and its translation into operating profits, my strategy is to concentrate on who the likely survivors will be in the event of the AI bubble bursting and not the possible winners. Yes, I prefer companies with the strongest balance sheets and business models, specifically global AI-related companies trading at significant discounts to their underlying net asset values.

AI-related companies will always remain a core holding in my total equity portfolio because of their unique business models, growth prospects, and risks – upside and downside.

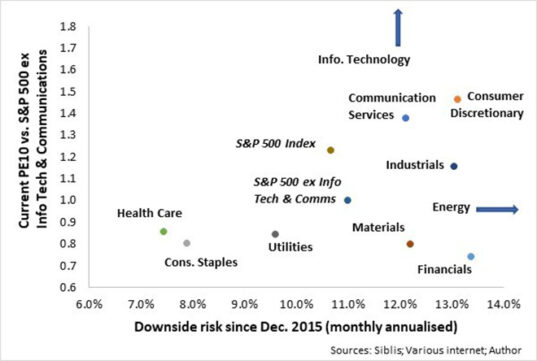

My total exposure to AI-related companies relative to my total equity exposure is, however, driven by my risk budget – the overall amount of downside risk or drawdown I can comfortably handle. The probability of revisiting the average downside risk of about 12% of the combined S&P 500 Information Technology and Communications sector over the past 10 years is increasing.

The big question is where I can find growth at significantly lower downside risk to mitigate and neutralise the impact of possible deep drawdowns in AI-related investments.

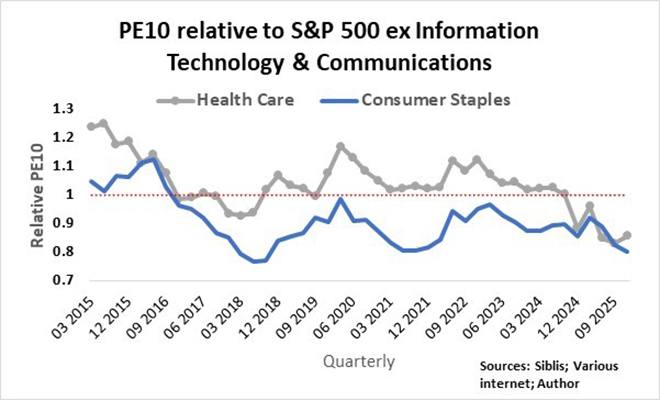

With the AI sector’s unique growth prospects and risks, I separated the Information Technology and Communication sector from the S&P 500 index to analyse the rest of the market and expressed the PE10 valuations relative to a calculated PE10 of the S&P 500 ex the Information Technology & Communications sector. The Health Care and Consumer Staples sectors, in particular, stand out by trading at PE10 valuation discounts of 15% and 20% respectively, and a downside risk of about a third lower than the calculated S&P 500 ex Information Technology & Communication universe.

Consumer Staples have been under pressure because investors are favouring growth and specifically AI-related stocks ahead of value stocks (high dividend, slow profit growth). Health Care stocks, which include pharmaceutical companies, biotechnology companies, health insurers, and medical equipment makers, are also under pressure because of the Trump’s administration policies and regulatory obstacles.

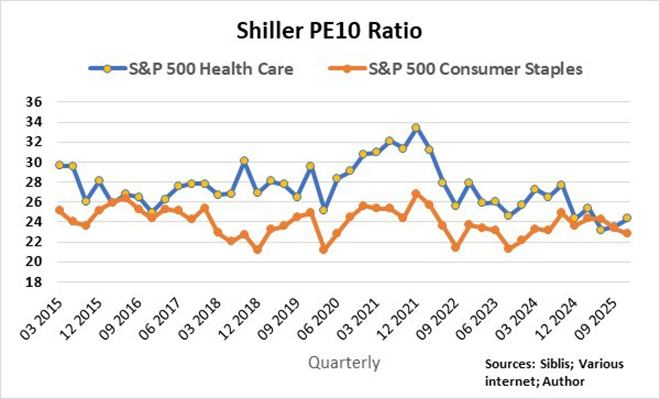

Health Care and Consumer Staples are at inexpensive PE10 valuation levels relative to the calculated S&P 500 ex Information Technology & Communications universe, while the relative valuation of Consumer Staples is testing cycle lows.

Furthermore, both sectors are inexpensive on an absolute basis, while the PE10 valuation of Consumer Staples is approaching the lows of December 2018, March 2020, September 2022, and September 2023.

I have therefore turned bullish on US and global consumer staples and healthcare stocks despite the negative perceptions regarding the latter, as it appears that most of the negative environment is already priced in. Furthermore, I can think of a few holding companies or conglomerates that hold significant assets in the said two sectors, trading at huge discounts to their underlying or intrinsic net asset value.

Yes, I am bearish on stock markets in general but invest bullish by seizing value opportunities in my quest to achieve positive returns at significantly lower risk than global stock markets in general.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.