Reports developed by the Financial Intelligence Centre (FIC) contributed to the recovery of close to R144 million in proceeds from crime in 2024/25, which was 46% more than in the preceding financial year.

The Centre’s financial intelligence reports resulted in the recovery of R143 964 500, compared with R98 502 230 in 2023/24, according to the FIC’s annual latest report, which was released yesterday. These recoveries are lower than the R5.824 billion recovered in 2022/23 and the R5.108bn in 2021/22.

The FIC produces financial intelligence reports following its analysis of regulatory reports and the information it receives from accountable institutions.

Where necessary, the financial intelligence reports are submitted to law enforcement, the South African Revenue Service, and other competent authorities for use in their investigations, prosecutions, and applications for asset forfeiture. The FIC does not conduct investigations.

During the year under review, there was a 17% increase in the demand for financial intelligence products from competent authorities.

Reports that are compiled upon request from local law enforcement and other competent authorities are called reactive reports. During 2024/25, the FIC produced 3 104 reactive reports, compared with 2 654 in the previous year. Of these, 60 were responses to requests for financial intelligence from foreign financial intelligence units.

The FIC said the reasons for the rising demand for financial intelligence include the Financial Action Task Force’s requirement that South African law enforcement proactively increases requests for financial intelligence from the FIC for their money laundering and terrorist financing investigations.

The reports that the FIC produces at its own initiative, based on its analysis, are called proactive reports or spontaneous disclosures. The FIC produces such reports where it detects potential illicit activities. In 2024/25, the FIC compiled 1 092 proactive reports, compared with 1 159 in 2023/24, of which 991 were medium to low priority and 101 were high priority.

Included in the total number of proactive reports produced were 23 spontaneous disclosures sent by the FIC to foreign financial intelligence units. A further 51 were reports focused on illicit financial flows. These reports were submitted to law enforcement and other competent authorities in the criminal justice system for investigation.

In addition, the FIC sent 69 requests for information to foreign financial intelligence units.

The FIC has the power to block or freeze funds that are suspected to be the proceeds of crime. It can use a direction issued under section 34 of FICA to instruct an institution not to proceed with a transaction for 10 working days. This allows the FIC to make the necessary enquiries concerning the transactions and, where necessary, to inform and advise an investigating authority or the National Director of Public Prosecutions. The FIC also shares this information with the Asset Forfeiture Unit (AFU) within the National Prosecuting Authority, which can seize and take control of the funds if necessary.

During 2024/25, the FIC blocked more than R157.5 million as suspected proceeds of crime and issued 164 section 34 directives.

Key initiatives and collaborations

The FIC continued to play a leading role in the timeous sharing of financial and other information between partners in government, civil society, and the private sector to expedite the prevention, detection, investigation and resolution of criminal matters. This flow of information was facilitated through national initiatives such as the Reformed Fusion Centre (RFC) and the Asset Recovery Hub.

The Asset Recovery Hub is a multi-agency initiative led by the FIC, working in close collaboration with the AFU and the Directorate for Priority Crime Investigation (Hawks), and other law enforcement agencies. The Asset Recovery Hub is aimed at fast-tracking matters towards asset recovery where there is a high risk of assets being dissipated. The Hub initiated 11 investigations, which resulted in the recovery of more than R33m in proceeds of crime.

The RFC is a multi-disciplinary, public-public collaboration under the stewardship of the FIC. It is designed to strengthen South Africa’s ability to detect, investigate, and disrupt serious financial crime, particularly money laundering and corruption. In the past financial year, the RFC co-ordinated 562 investigations, including three large-scale project investigations into serious and complex money laundering. It played a pivotal role in recovering about R93m in proceeds of crime in one of these project cases.

In its first full year of operation, the Shared Forensic Capability division contributed to asset recoveries to the value of R14.37m and to the enrolment of 14 cases for prosecution. The division provides forensic service support to law enforcement, revenue authorities, intelligence services, and other authorities in terms of section 40 of FICA.

Strategic focus

The FIC’s acting director, Pieter Smit, said a FICA-compliant business community is the bedrock of the country’s successful regime for combating money laundering and terrorism financing. “Their diligent filing of regulatory reports, which contains transaction and other crucial data, is central to the FIC’s creation of high-quality financial intelligence products for the use of law enforcement and other competent authorities for their investigations, prosecutions and applications for asset forfeiture.”

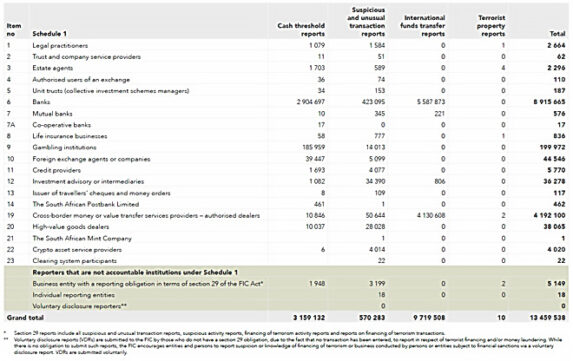

To that end, the 55 262 institutions registered with the FIC submitted more than 13.4 million regulatory reports during the 2024/25 financial year. These include more than 3.1 million cash threshold reports and more than 570 000 suspicious and unusual transaction reports.

The FIC said in statement its activities over the past year demonstrated targeted activity that helped to protect the economy from financial crime and contributed towards bringing South Africa towards being removed from the Financial Action Task Force’s grey list.

A review team of the FATF concluded an on-site assessment in July to verify whether critical anti-money laundering and combating the financing of terrorism reforms have been implemented. A decision on South Africa’s potential exit from the grey list is expected at the FATF plenary this month.