The recently published Tax Statistics 2025 show that the tax burden on individuals has increased. Personal income tax (PIT) as a share of total tax revenue rose from 35.7% in 2023 to more than 37% in 2024, before increasing further to 39.5% in 2025.

An analysis by Codera Analytics shows that roughly 80 000 taxpayers earning more than R2 million a year pay about 30% of the total PIT take. PIT collections for the 2024/25 fiscal year amounted to R733 billion, compared with R458bn for value-added tax and R323bn for corporate income tax.

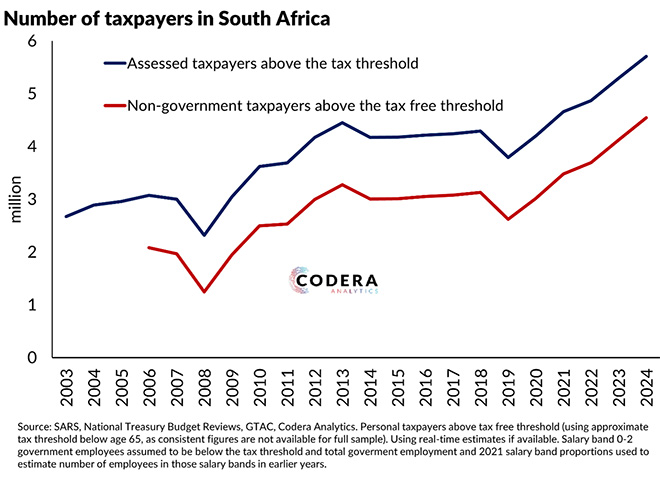

Daan Steenkamp, chief executive of Codera, says that although South Africa is estimated to have 5.5 million taxpayers above the tax-free threshold, more than one million of these are government employees.

The main reason for the heavier PIT burden is the lack of an inflation-linked adjustment in the February 2025 Budget, which raised more than R16bn without a rate hike. The government also raised almost R2bn by not adjusting medical tax credits for inflation.

The South African Revenue Service’s tax statistics team says further data extracts and analysis will be required to confirm Codera’s findings. Its data deals only with taxpayers who have been consistently assessed every year since 2015, rather than the entire PIT base.

Steenkamp notes there is a significant difference between the number of registered taxpayers, the number of active taxpayers, and the number of registered taxpayers who are above the tax threshold.

The tax register

The annual Tax Statistics report, released at the end of last year, shows that the number of taxpayers registered for PIT declined by 3.3% to just over 26 million in 2024/25.

“This reduction is primarily attributed to a register clean-up that removed active cases that had changed to estates.” In other words, people who had died were removed from the “active” register.

In 2010, SARS changed its taxpayer registration policy and stipulated that every formally employed individual, regardless of tax liability, must be registered for PIT. If employees are not registered, it is the duty of their employer to register them with SARS. If an individual is not registered and SARS detects economic activity through third-party data, that person is automatically registered.

As a result, the tax register grew from 5.9 million active cases on 31 March 2010 to 27.1 million on 31 March 2024, before declining to just over 26 million last year.

Not all registered individuals pay tax. For example, taxpayers with taxable income below the income tax threshold may not be required to submit a return. Some individuals nevertheless pay tax in the form of employees’ tax (PAYE), which is collected by employers and paid over to SARS.

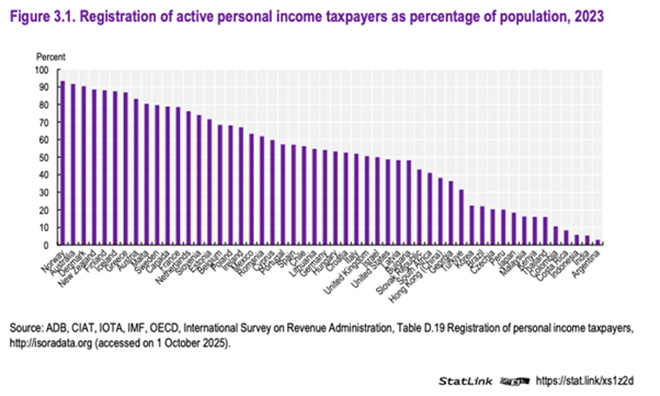

Some jurisdictions require registration at the earliest point of employment or income earning, similar to SARS’s approach, while others follow a “cradle-to-grave” registration strategy.

The following graph from the Tax Administration 2025: Comparative Information on OECD and Other Advanced and Emerging Economies report illustrates how South Africa compares with other jurisdictions in terms of active taxpayer registrations.

Actual payers

The number of individuals expected to submit income tax returns was 7.3 million for the 2021 tax year. This increased to 7.6 million in 2022, 8.3 million in 2023, and 9.2 million in 2024. These increases can be attributed to growth in the taxpayer register, partly driven by the expansion of auto-assessments.

Taxpayers who were auto-assessed and not previously assessed contributed to the increase in expected submissions. The population of taxpayers identified for auto-assessment in the 2020 filing season expanded to just over 3.4 million. In the 2024 filing season, a notable increase of 30.05% was recorded, with 5.02 million standard taxpayers auto-assessed, compared with 3.86 million in the previous year.

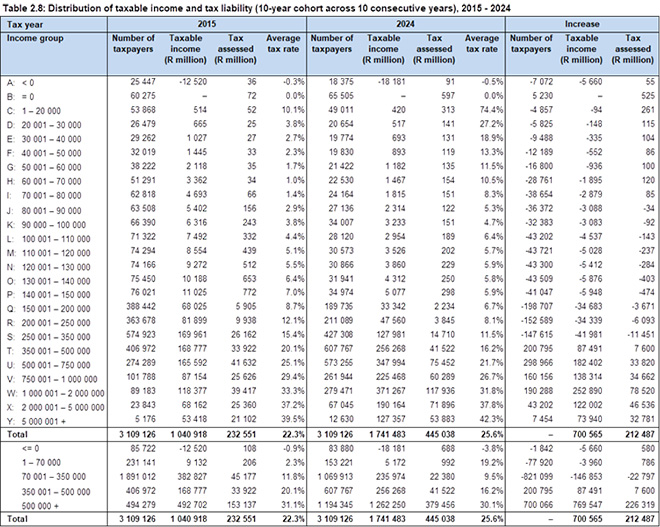

For the 2024 tax year, 80.4% of assessed individual taxpayers had taxable income of less than R500 000. While they earned just over 44% of total taxable income, they contributed only 23% of the tax assessed.

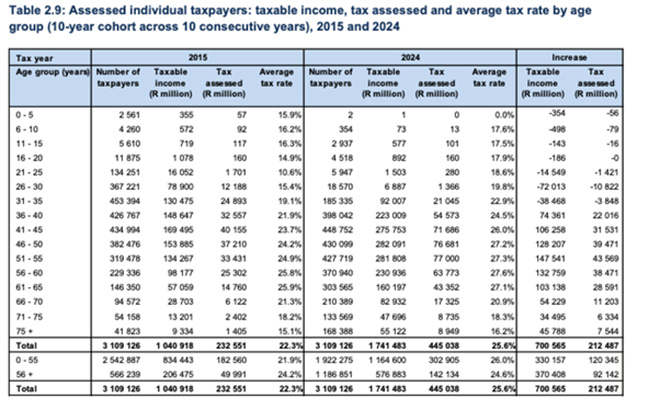

By contrast, fewer than 20% of registered taxpayers earned more than R500 000, yet they were liable for 77% of total tax assessed. Taxpayers aged between 41 and 65 contributed almost 75% of the total tax assessed.

Commentators have warned about the implications of a tax base that is increasingly sustained by individuals who are close to retirement or already approaching retirement age.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.