Discovery Health has announced a partnership with Clicks as part of a move to make its Flexicare health insurance product available to the consumer market from 16 February.

Flexicare is underwritten by Auto & General Insurance and administered by Discovery Health, which will use Clicks’s network of about 800 stores for distribution.

Clicks Clubcard members who join Flexicare will get back 10% on their premiums each month.

Flexicare is not a medical scheme and does not include cover for in-hospital care, except for certain emergency treatments.

Flexicare has been available since 2018 to employees in the retail and corporate sectors who cannot afford to join a medical scheme. Almost 100 000 employees across 450 employer groups now have this cover, according to Discovery.

The decision by Discovery to offer day-to-day healthcare benefits to the mass market follows Dis-Chem and TymeBank entering this market in 2022.

Discovery Health said five to eight million South African residents in formal employment do not have medical scheme cover. But they use the private healthcare sector for their primary healthcare needs and are paying out-of-pocket for each consultation and for prescribed medication.

Flexicare cover is typically limited to providers across Discovery’s doctor, dentist, optometry, pathology, and pharmacy networks. Consultations outside these networks are not covered.

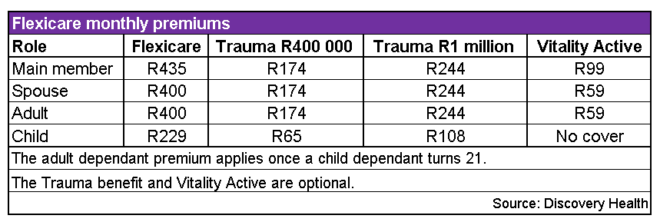

Members have the option of adding a trauma benefit that provides emergency treatment at private hospitals. There are two cover levels for this benefit: R400 000 or R1 million for each hospital admission.

They can also join Vitality Active, a slimmed-down version of Discovery’s Vitality programme, at a cost of R99 a month for the main member.

What benefits are provided?

Prospective members should pay careful attention to the conditions attached to each benefit. Not adhering to the conditions may result in a treatment not being covered at all, or in the member facing a co-payment. Here is an overview of Flexicare’s benefits:

Consultations with a general practitioner (GP)

- Unlimited consultations with a GP at 100% of the agreed rate (the rate at which Discovery pays providers for their services). These include in-person or online consultations.

- The benefit includes medical procedures that can be done in a GP’s rooms – such as biopsies, wound care and stitching – if they are on the Discovery list of defined procedures.

- Members can change their allocated network doctor twice a year.

Dentistry

- One consultation for a full-mouth examination per member a year.

- One preventive treatment per member a year (includes cleaning, scaling, polishing, and fluoride treatments).

- Restorations (repairs) and composite fillings. Members must obtain pre-authorisation if their family needs four or more restorations, or five or more composite fillings, in a year.

- Extractions: for a single tooth extraction, a maximum of one per quadrant per 365 days; extraction of each extra tooth in the same quadrant: one per member per 365 days. (The mouth is divided into four parts called quadrants, and there are eight teeth in each quadrant.)

- Treatment of pain and sepsis, infection control, oral hygiene advice, and local anaesthetic.

Optometry

- One eye test per member a year at a network provider.

- One pair of glasses (no contact lenses) per member every 24 months. The benefit includes standard, high-quality, clear plastic lenses (single-vision and bi-focal).

- Frames are limited to a single frame for each member for 24 months.

Pathology

Unlimited pathology tests at 100% of the agreed rate and limited to approved pathology codes. A test must be requested by a network doctor.

Radiology

Unlimited radiology at 100% of the agreed rate for black-and-white X-rays and soft-tissue ultrasounds. A test must be requested by a network doctor.

Medication

- Over-the-counter medicine: cover for medicine on a defined list (formulary) and on the advice of a pharmacist. Cover is limited to R105 per quarter and a maximum of R420 per member a year.

- Prescribed (acute or short-term) medicine: 100% of the agreed rate if it is on a formulary and it is prescribed by a network doctor.

- Chronic medicine: 100% of the agreed rate if the medicine is on the formulary for 27 chronic conditions (including HIV).

- All medicine must be dispensed by a network pharmacy to be covered.

- One free flu vaccination a year.

Maternity

The maternity benefit includes:

- Unlimited network GP consultations throughout the pregnancy.

- Unlimited acute medicine in line with a defined medicine list, prescribed by a network GP and collected from a network pharmacy, or prescribed and given to you by a network GP.

- Essential blood and screening tests through a network pathologist when referred by a network GP.

- Two ultrasound scans for each pregnancy at a network provider (first ultrasound between week 10 and 14, and the second between week 20 and 24).

Optional trauma benefit

The accidents and emergencies that are covered by the optional trauma benefit include:

- Burns;

- Head injuries;

- Chest injuries or severe fractures caused by a fall;

- The loss of an arm, hand, leg or foot;

- Near-drowning;

- Poisoning or a serious allergic reaction that may cause death; and

- Injuries resulting from a crime, sexual assault or a car accident, or an injury at work.

All Flexicare members have access to ambulance services in the event of a medical emergency, but only those with the trauma benefit have the option of being transported to a private facility.

Waiting periods

Members will not be able to access their benefits immediately on joining Flexicare. All benefits, unless otherwise approved, are subject to a waiting period during which members and their dependants cannot claim for the associated healthcare services.

There is a general waiting period of one month on all benefits, including trauma benefits. The waiting period for dentistry and optometry is three months.

There is a 12-month waiting period for chronic medication and for maternity benefits.

A 12-month, condition-specific waiting period may be applied for any condition (including chronic illnesses and HIV) that existed before the date on which someone joins Flexicare.

seeking a clarity about your scheme and its how much

We are not Discovery Health.