Assets managed by the local collective investment scheme (CIS) industry reached almost R3.5 trillion at the end of last year – a historic high – despite the turbulent economic conditions.

Assets under management (AUM) grew by 11.34%, from R3.141 trillion at the end of December 2022 to R3.498 trillion at the end of December 2023.

Sunette Mulder, senior policy adviser at the Association for Savings and Investment South Africa (ASISA), says the growth can be attributed to market performance and net inflows of R110 billion over the 12 months to the end of December 2023.

South African investors had a choice of 1 832 local CIS portfolios at the end of December 2023, an increase of 63 portfolios over the 12 months.

Worldwide, there were 139 160 CIS portfolios with total AUM of $63.4 trillion at the end of September 2023, according to statistics from the International Investment Funds Association (IIFA). The figures provided by the IIFA, of which ASISA is a member, lag by one quarter because of the magnitude of statistics that must be collated.

Net inflows/outflows are calculated by deducting the rand value of repurchases (units sold by investors) from the total value of units bought by investors. The net inflow figure consists of new money invested and dividends reinvested.

The CIS industry statistics for the quarter and year to the end of December 2023, released by ASISA this week, show that participating CIS management companies recorded net outflows of R2bn in 2023. Existing investors reinvested income declarations (dividends and interest) worth R112bn. The industry, therefore, ended 2023 with net inflows of R110bn – a R2bn increase on 2022’s net inflows (R108bn).

Highs and lows of 2023

Mulder says investor appetite ebbed in the fourth quarter of 2023, resulting in net outflows of R3bn over the three months to the end of December. But existing investors reinvested income declarations of R23bn, bringing total net inflows for the fourth quarter of 2023 to R20bn.

Single-digit net new inflows were recorded in quarters one and three of 2023, but investor confidence also dipped in the second quarter,when the CIS industry recorded net outflows of R12bn. Reinvestments in the second quarter exceeded the net outflows, leaving the industry with an effective net inflow of R14bn.

Mulder says the second quarter of 2023 saw the repo rate increase by 0.5% to a 14-year high of 8.25%, which placed an additional burden on consumers servicing debt.

In May 2023, another petrol price increase meant that South Africans were paying on average R1.50 a litre more than in the previous year.

Investor trends in 2023

Mulder notes that while 45% of all international CIS assets are invested in equity portfolios, South African investors prefer the diversification offered by portfolios in the South African multi-asset category. Just under half of local CIS assets (49%) are held in these portfolios, and only 19% of assets are invested in South African equity portfolios.

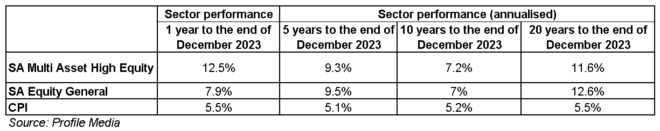

A look at the average performance of domestic multi-asset high-equity portfolios and equity portfolio shows a small difference over the medium and long term. Mulder says this means that investors in multi-asset high-equity portfolios benefit from the performance of the equity markets with less of the volatility associated with equity portfolios because of asset class diversification.

Mulder says South African interest-bearing portfolios hold 31% of assets, and South African real estate portfolios hold only 1% of assets.

Interest-bearing portfolios attracted R70bn in net inflows (including reinvestments) in 2023, of which R22bn was channelled to money market portfolios. She notes that the net inflows into money market portfolios fluctuated wildly from quarter to quarter last year, depending on investor risk appetite and opportunities available in the market.

“While the first quarter of last year saw R15bn of net inflow for money market portfolios, net outflows of R2bn were recorded in the fourth quarter. This seems to indicate that investors saw opportunities elsewhere in the market.”

South African multi-asset portfolios attracted R51bn in net inflows in 2023. Multi-asset income portfolios were most popular with investors in 2023, attracting R26.6bn, followed by high-equity portfolios, which saw R18bn in net inflows.

The highest net outflows in 2023 were recorded by global multi-asset high-equity portfolios (-R3.5bn), followed by worldwide multi-asset flexible portfolios (-R3.4bn), and South African real estate general portfolios (-R3.1bn).

Locally registered foreign portfolios held AUM of R855bn at the end of December 2023, compared to R694bn at the end of December 2022.

These portfolios recorded net outflows of R23.38bn for the year.

There are 684 foreign currency-denominated portfolios available in South Africa.