The Association for Savings and Investment South Africa (Asisa) has red-flagged the high number of policy surrenders and lapses in 2022, saying this points to the “unprecedented” financial hardship facing consumers.

Asisa released its statistics for the long-term insurance industry this week.

The statistics show that 689 888 recurring- and single-premium savings policies were surrendered in 2022. Although this is lower than in 2021, when 938 148 savings policies were surrendered, this is still too high and therefore concerning, said Hennie de Villiers, the deputy chairperson of Asisa’s Life and Risk Board Committee.

The statistics also show that 8.4 million recurring-premium policies lapsed last year – a million more than in 2021.

“On the other hand, almost 1.2 million fewer recurring-premium policies were sold in 2022 than in 2021, further demonstrating the financial pressure experienced by consumers,” De Villiers said.

Claims and benefits paid

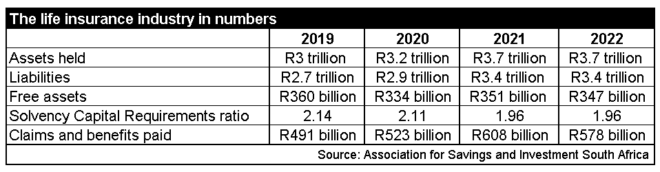

Policyholders and beneficiaries received claims and benefits payments worth R578 billion in 2022, the second-highest paid in a year. The payments included claims against life, disability, critical illness and income protection policies, and retirement annuity and endowment policy benefits.

De Villiers said although the value of claims and benefits paid had decreased from the R608bn paid in 2021, when death claims as a result of the Covid pandemic were at their highest, the statistics show that the impact of Covid is likely still a threat and is still costing lives.

“Last year, life insurers paid 501 785 death claims, 26% lower than in 2021, but still 24% higher than in 2019,” he said.

Industry remains well capitalised

Asisa said the country’s life insurers navigated volatile investment markets and a tough operating environment in 2022, emerging well capitalised and in a strong position to continue honouring their contractual promises to policyholders and their beneficiaries.

Asisa’s statistics show that life insurers held assets of R3.7 trillion at the end of 2022, while liabilities amounted to R3.4 trillion, both the same as at the end of 2021. This left the industry with free assets of R347bn at the end of December 2022, almost double the capital required by the solvency capital requirements (SCR).

De Villiers said the assets held by the country’s life insurers at the end of 2022 were significantly higher than at the end of 2019 before the Covid-19 pandemic.

“While liabilities also increased substantially, there was only a slight downward adjustment in the average SCR ratio over the same period, from 2.14 in 2019 to 1.96 in 2022, demonstrating the industry’s resilience during the Covid pandemic.”

He said the experience of the long-term insurance industry in 2022 was similar to that of the local collective investment schemes (CIS) industry, which ended 2022 where it finished 2021 with R3.14 trillion in assets under management. This means the South African life and CIS industries mirrored the FTSE/JSE All Share Index, which also ended 2022 almost exactly where it finished in December 2021, closing at 73 709 on 30 December 2021 and at 73 048 on 30 December 2022.

Would like to know if u guys can be able to help me ,my husband died 2012 November 12 working as truck driver ,even today I never get a cent of his money

I suggest you take your complaint to the Pension Funds Adjudicator: https://www.pfa.org.za/