Precious metals had a jaw-dropping streak from the end of September last year until late January, with silver topping the charts rising by more than 150%, platinum by 82%, and gold by 42%. Precious metal prices have retreated since then, but the big question is where to from now? Many arguments are put forward why precious metal prices reacted the way they did and why the near parabolic price trends should continue, citing a shortage of metal to fulfil insatiable investor demand.

My analysis indicates that major forces other than normal supply and demand are at play.

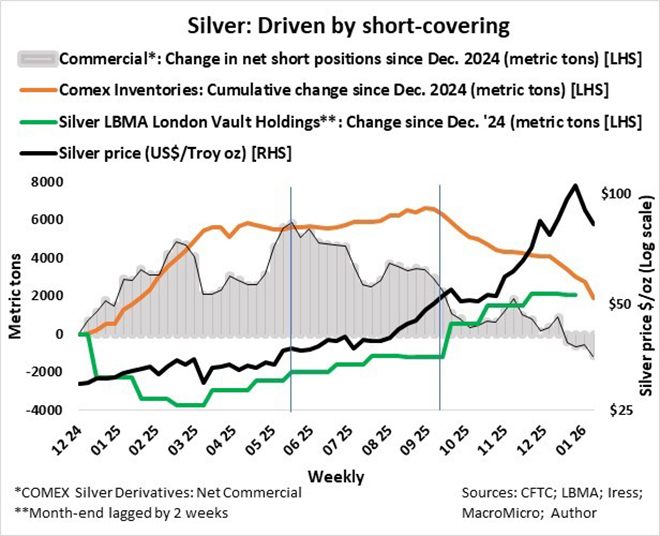

Due to concerns that precious metals may be included in the Trump administration’s broad tariffs (Bloomberg), massive amounts of precious metals and specifically silver moved to Comex from other commodity exchanges and vaults outside the United States in the first quarter of last year, resulting in the near doubling of Comex inventories. It seems that developments in the silver market are leading other precious metal prices. The accompanying graph in a nutshell effectively encapsulates all the driving forces in the silver market.

From London Bullion Market Association (LBMA) statistics, it appears that most of the increase in Comex inventories are accounted for by a significant reduction in the silver held in London vaults.

It is also apparent that most (about 83%) of the increase in Comex silver inventories in the first quarter of last year were immediately hedged by commercial entities such as miners, refiners, jewellers, and other end-users (referred to as commercial in CFTC Commitments of Traders Reports). During the sell-off of silver in April, commercial entities nearly halved their new net short positions taken on in the first quarter, most probably because of the expiration of silver derivative contracts, while London vaults started to increase their silver holdings. Comex silver inventories remained stable during that time, meaning most of the close-out settlements were cash-settled. Normal hedging resumed until June, when the net short position of commercial interests approximated the massive increase in Comex silver inventories in the first quarter last year.

From June to the end of September last year, LBMA London silver vault holdings increased steadily, while commercial entities steadily reduced their net short position in silver derivatives on Comex. That pushed silver to $43/oz from about $30/oz in April. Quite normal behaviour for precious metals.

Since September, the silver market changed abruptly. Retail demand in India due to Diwali could not be satisfied because of an apparent shortage of silver metal in London.

The silver market was cornered.

The massive short squeeze started in October, when the net short position in commercial interest was slashed by more than 3 500 tons, while silver held in London vaults jumped by approximately the same quantity and Comex silver inventories fell by more than 2 000 tons, resulting in a surge in the silver price above $55/oz. It appears that some elements of the short squeeze are continuing as commercial net short positions continue to fall and Comex inventories are still contracting.

A major concerning reversal in silver could be unfolding.

It seems the short squeeze in the silver market is on its last legs. Silver in London vaults are already 2 000 tons higher than at the end on 2024, the net short position of commercials are more than 1 000 tons less than at the end of 2024, and Comex silver inventories are 4 600 tons from its peak in October. Most concerning is the lack of follow-though on the silver price. Unless there is a severe supply shock in the silver market, the price is such that it will attract an avalanche of silver scrap returning to the market. The silver price is juicy enough for commercial players to aggressively hedge against a slump in silver. Yes, the silver market is normalizing.

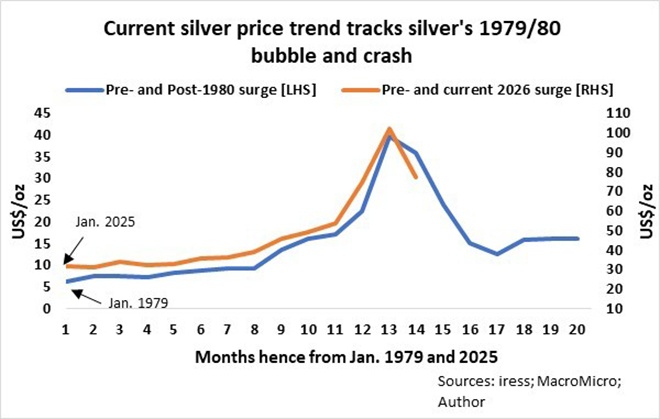

The behaviour of the silver market since January last year is strikingly like the boom, bust period in 1979/81 when the Hunt brothers cornered the silver market.

We saw the hysteria in silver. Will panic follow?

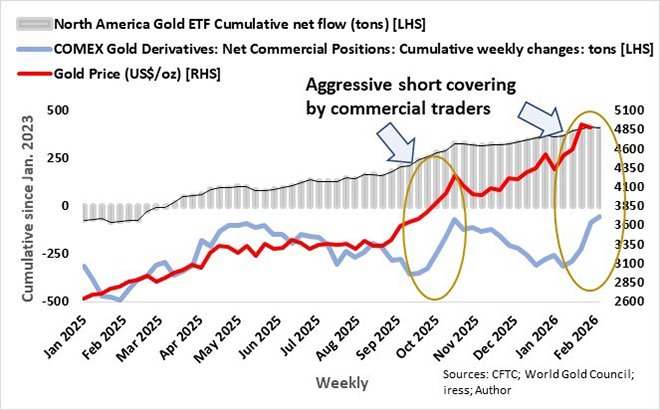

Other precious metals piggybacked on silver on the way up, specifically since November last year. Despite major short covering in gold over the past three weeks, it seems that gold, while not immune, is best placed to survive a silver collapse as ETF demand and central banks are likely to lend solid support.

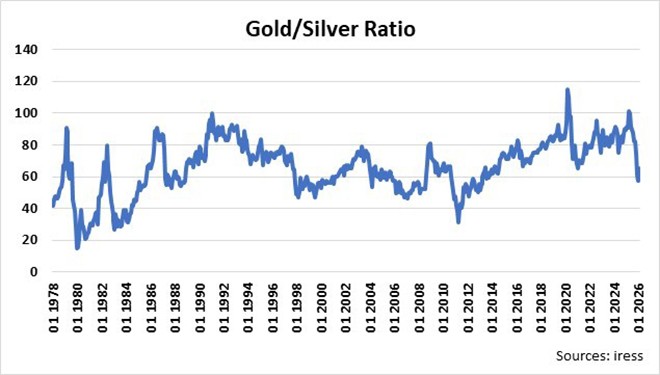

The gold/silver ratio could increase significantly from 65 currently.

That is why I steer clear of silver.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.