The number of recurring-premium risk policies grew modestly during the first six months of this year, whereas the number of monthly savings policies declined, according to statistics released yesterday by the Association for Savings and Investment South Africa (ASISA).

According to the half-year statistics, ASISA members managed 45.6 million risk and savings policies on behalf of individual policyholders at the end of June, a marginal increase from the 44.4 million policies in force at the end of December 2024. In addition to these individual policies, ASISA members managed about 85 000 group schemes on behalf of employers and other organisations.

At the end of June, South African life insurers held 36.8 million risk policies for policyholders paying monthly premiums. Close to 17 million were funeral policies, just over 7 million were credit life policies, and 12.8 million were life, disability, severe illness, and income protection policies.

The ASISA statistics show a growth of 1.6% in recurring-premium risk policies in the first six months of this year.

In the first half of 2025, close to 4.5 million recurring-premium risk policies lapsed (the policyholder stopped paying premiums for a policy with no accumulated fund value).

Gareth Friedlander, a member of the ASISA Life and Risk Board Committee, said although some of the lapses may reflect policyholders switching to alternative providers, many occur when financially stretched consumers stop paying premiums altogether.

Losing risk cover can have serious consequences. Those who lapse their policies may no longer qualify for new cover on the same terms or could experience a life-changing event while uninsured, leaving their families financially exposed, Friedlander said.

The number of individual recurring-premium savings policies (endowments and retirement annuities) dropped from 5 million at the end of 2024 to 4.9 million over the six months to the end of June because of maturities and surrenders.

Policyholders surrendered just over 233 000 recurring-premium savings policies during the six months. A surrender occurs when the policyholder stops paying premiums and withdraws the fund value before maturity.

The balance of the 45.6 million in-force policies at the end of June were single-premium policies (3.3 million) and universal life policies.

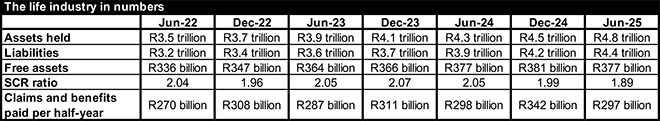

Life insurers paid claims and benefits worth R297 billion in the first six months of 2025. These payments included claims against life, disability, critical illness, and income protection policies, as well as underwritten pension fund benefits, annuity payments to pensioners, and endowment policy benefits.

“Our industry exists predominantly to provide people with the option to insure against the financial impact of a life-changing event or to provide for a time when they are no longer able to earn an income. Last year, ASISA members settled 95.6% of death claims received, paying beneficiaries of life and funeral policies R39.5bn in benefits,” Friedlander said.

Life insurers ended the first half of 2025 with assets under management of R4.8 trillion, up from R4.5 trillion at the end of December 2024.

Life insurers also reported a healthy solvency buffer, which at a ratio of 1.89 is almost double the Prudential Authority’s solvency capital requirement (SCR).

Friedlander said policyholders and beneficiaries must be able to trust that life insurers will be able to pay valid claims when the need arises, even in times of extreme market turmoil and unusually high claims, as was the case during the Covid-19 pandemic.

“The key indicator of the industry’s health is the average solvency buffer, which has consistently been around double the Prudential Authority’s requirement. Strong capital buffers ensure that life insurers are in a position to pay claims and policy benefits, even during difficult times, which is when policyholders and beneficiaries also need financial support the most.”