The two-pot retirement system may feel like another rulebook for your money, but early evidence suggests it could be the quiet revolution that stops South Africans from retiring broke – and even doubles or quadruples what savers take into old age.

Since the launch of the two-pot retirement system in September last year, headlines have painted a bleak picture – warning of South Africans raiding their savings to stay afloat. But according to Guy Chennells, chief commercial officer of Discovery Corporate & Employee Benefits, the data tells a more encouraging story.

The reform was introduced to address a long-standing problem: under the old rules, resigning meant you could withdraw 100% of your retirement savings. For many in financial distress, this quick fix came at the cost of future security, leaving thousands with nothing at retirement.

The two-pot system changed that by splitting savings into three components:

- Vested pot – all savings before 1 September 2024. You can still withdraw it on resignation, but only once. A new job won’t create another vested pot.

- Savings pot – seeded with 10% of vested savings (capped at R30 000) and topped up with a third of future contributions. Members can withdraw from it once a year, with a minimum of R2 000.

- Retirement pot – two-thirds of all future contributions, locked away until actual retirement.

For younger workers entering the system now, there is no vested pot. Their savings go straight into the savings and retirement pots, removing the risk of cashing out everything in one go.

Examining some of the observed behaviour of members around two-pot savings – and what that means for the retirement fund industry in the long term – at the Institute of Retirement Funds Africa’s conference this week, Chennells says that while Discovery looks at the same data, they have a very different outlook to other industry doomsayers.

Member behaviour so far

As expected, first-time claims spiked in September 2024 when the system launched, then stabilised at a consistent monthly level, showing only a slight downward trend.

There was a smaller jump in March 2025 when the new tax year opened, driven mainly by repeat claimants – members who had already accessed their savings five or six months earlier.

On amounts, the difference was notable:

- First-time withdrawals averaged about R13 000.

- Repeat withdrawals dropped sharply to about R4 600, a 60% decline, as the first-time withdrawals had already reduced the balance, which now needs time to rebuild.

Chennells suggests this reduced payout may influence future member behaviour, because the “second-time hit” is far less compelling than the first.

Who’s raiding their pots?

At Discovery, tracking member behaviour under the two-pot retirement system has revealed some fascinating patterns – and a few assumptions about how things might play out.

At present, about 90% of members have become eligible to access their two-pot savings. To qualify, you must have opted in (for those over 55 under the T-day rules) and have at least R2 000 in your savings component. Those who don’t meet these criteria are automatically excluded from withdrawals.

Of eligible members, 61% have chosen to leave their money untouched since the system kicked in, while 39% have withdrawn funds.

Interestingly, among those withdrawing, 93% take the full balance, rather than partial amounts, Discovery’s data shows.

Whereas the media often gravitates toward doom-and-gloom headlines, he sees a different picture. If Chennells had to choose, his first “good news” headline would read: “Drowning in debt and facing soaring living costs, yet six in 10 eligible South Africans still choose to preserve their two-pot savings.”

That, he argues, is remarkable. Despite financial pressures that might easily justify short-term withdrawals, most fund members have resisted the temptation to take what they can, whenever they can. Many have treated the savings pot responsibly, a sign that the industry’s education campaigns are gaining traction.

Still, the picture is not without concern. On the other side of the statistic, four in ten eligible South Africans are withdrawing from their two-pot savings – behaviour that could erode their long-term security. Here, Chennells says, trustees and administrators must step in with stronger interventions to help change the trajectory for those at risk.

Why two-pot could change South Africans’ retirement outcomes

In South Africa, financial planners often say a “good” retirement means replacing about 70% to 75% of your salary when you stop working. This measure, called the net replacement ratio, shows how much of your pre-retirement income you’ll still receive through an annuity once your monthly paycheque ends.

For example, if you earned R50 000 a month, you’d want at least R35 000 in retirement to maintain your lifestyle.

Chennells says member behaviour under the two-pot system already shows a divide: some people will always dip into their savings whenever they can, while others will treat it as an emergency-only fund or leave it untouched until retirement.

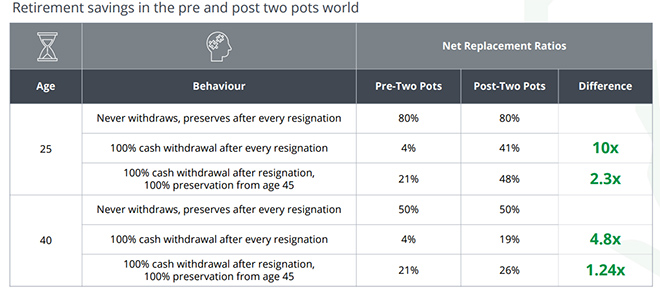

Using these insights, he modelled how retirement outcomes would look in the old system versus under two-pot.

The 25-year-old saver

Consider a 25-year-old earning R240 000 a year, contributing 12% to retirement, and planning to retire at 65.

If they never cashed out and preserved all their savings after each job change, they would retire with an 80% replacement ratio – both in the old system and the new system.

But under the old rules, if they cashed out every time they resigned – and assuming they change jobs every five years – their replacement ratio would collapse to just 4%.

If they “got serious” at age 45 and preserved from then on, they’d end up with 21% in the pre-two-pot world.

Now compare that with the same person in the post-two-pot world. If they withdrew from their savings pot every year until age 45, then buckled down, they would still achieve a 48% replacement ratio – more than 2.3 times higher than before.

“A complete paradigm shift of what their retirement years are going to look like without changing their behaviour at all, not educating them one bit,” Chennells explains. “In fact, if because of the two-pot system being so ‘tempting’, they worsened their behaviour, and they take two-pot savings every single year till the day that they retire, they still get to retirement with double what they would have. That is a phenomenal outcome.”

The 40-year-old late starter

Discovery also modelled outcomes for a 40-year-old starting with nothing saved, earning R240 000 a year, contributing 12% to retirement, and planning to retire at 65.

- If they preserved everything from then on, they would reach a 50% replacement ratio on retirement – whether in the old or new system.

- Under the old rules, if they cashed out every time they changed jobs, they’d be left with just 4% at retirement.

- In the two-pot world, even if they withdrew their savings pot at every opportunity, they’d still end up with 19% – 4.8 times better.

- For those who cashed out until 45 but then preserved, the old system would deliver 21%, while two-pot would lift that to 26% – 1.24 times better.

In short: whether people save diligently, dip in occasionally, or even raid their pots regularly, every group ends up better off under the new rules.

In Discovery speak: “every cohort is better off under the two-pot regime”.

Chennells argues that the two-pot system is not something “we need to fight”. Rather, he says, it creates a platform for better outcomes – particularly if members adjust their behaviour. The system’s built-in restrictions provide a strong tailwind for improving retirement outcomes, but the challenge, in his view, is particularly acute for those in mid-career.

Although the two-pot framework offers a basic level of protection, it is up to the industry to help members change their habits so they can build on this foundation and achieve “an even better result”.

Long-term impact of the two-pot system on retirement savings

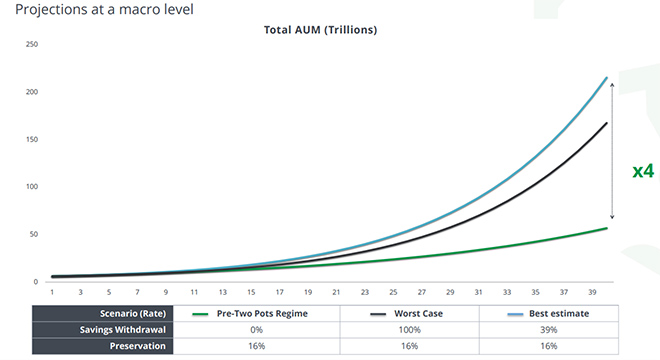

Chennells then zoomed out to the industry level. He admits the modelling involved “fairly heroic assumptions”, but ones consistent with growth trends from 2015 to 2025.

Without two-pot, he explains, retirement fund assets would likely rise from about R4 trillion today to R50 trillion in 40 years, assuming minimal withdrawals and preservation rates of just 16%.

With two-pot, however, the picture changes dramatically. Even if every member withdrew annually, assets could reach more than R150 trillion – three times higher than without reform. And if behaviour continues as Discovery has observed – with six in ten preserving and four in ten withdrawing – the figure could climb past R200 trillion.

If current behavioural trends continue, Chennells said: “South Africans as a collective will have four times as much in retirement as they would have had without the two-pot system. Certainly, in the next 40 years, this industry and the people that it serves will be four times wealthier than they otherwise would have been.”

I just wnt to knw since Sars tax this money am l be able to gt a tax return for the amount they deducted

Don’t take that savings you’ll end up owing SARS that’s how they work don’t know how do they get to that but that’s what happened with people who withdraw from their savings they ended up owing SARS

It is text at a higher rate than what you would normally pay in your tax bracket.

If I deduct from my savings at the age of 61,is this not going g to affect my pension payout?

Yes, it will, which is why you should preserve all your savings until retirement.

Assuming on retirement you were going to take your savings as a lumpsum, your annuity should still be the same ( calculated on the vested pot + the retirement pot), also assuming you are not going to take any lumpsum from your vested pot on retirement…

Hi, I wanted to know I’m 51 yrs old I have been with my company for the past 12 years, this ís the 2nd yr that I will be taking a portion using the Two Pot system, will I still have enough by the time I retire at the age of 60 yrs.Also what will happen if I retire at a early age of 55 years.

Please reply to my questions so I can have clarity.

.

It is not possible to answer this question without having a lot of information about your financial situation, including your total retirement savings, any any discretionary savings, current income, debt obligations, monthly expenses, state of health, financial dependants. You need to consult a financial adviser who can assess your overall financial position and advise you accordingly.

Tell me in simple terms so as to be able to understand, Is it wise to withdraw from 2 pots please answer in simple terms.

The disadvantages of withdrawing are:

1. You are taxed on the withdrawal at your marginal tax rate (personal income tax bracket). At retirement, you are taxed at the lower retirement lump sum withdrawal rate, and the first R500 000 you withdraw is tax-free.

2. If you withdraw before retirement, you will have less to withdraw as cash when you retire. All the money in your retirement pot must be used to buy pension, so your only cash at retirement is in your savings pot and one-third of what is your vested pot (if you have vested savings – those before 1 September 2024). Many people need cash at retirement for things such as settling debt.

3. At retirement, you don’t have to take all the money in your savings pot as cash. You can use some or all of it for a pension. The less money in your savings pot at retirement, the less you have to use – together with your the money in the retirement pot – for a pension.

There may good reasons to withdraw from your savings pot before retirement, such as settling debt. You need to consult with a financial adviser who can look at the impact of a withdrawal on your entire financial position, including the impact on your retirement income (pension).

I withdrew R77 000 last month. After tax I got R42 000.

And then I still paid another R18 000 tax again on my salary. Scam. Double tax in one month.

Tell me sir if I don’t take money from my savings pot until retirement at 65,used that to purchase my pension, at 65 I’m I going to receive my whole pension fund

Yes, you will receive the entire amount in the savings pot at retirement, and you can use it to buy a pension.

Yes it’s true now I own Sars.But I received 2 pot last year and when I call them, they explained exactly that.

I am bit lost when I read some of the comments when someone said he can buy his pension when retire, second question one my colleague is retiring next month and he was told that he is going to get one third of his pension and that is the law and we all didn’t know that, Joseph Sefiti from DHL , Old mutual pension fund

It’s a load of bollocks… short term relief for a load of regret in the long term! Patience is a virtue; impulse brings about regret. Stick with your long term plans!