Sygnia launched its Life Bitcoin Plus Fund last month, providing living annuity holders and retail investors who take out a five-year sinking fund with access to the world’s largest Bitcoin exchange traded fund (ETF).

The Life Bitcoin Plus Fund is Sygnia’s most recent addition to its Life Plus range, which consists of three funds that use a “portable alpha” investment strategy to generate small, consistent returns (alpha) beyond the performance of an underlying asset, in this case, Bitcoin (beta).

The fund invests in BlackRock’s iShares Bitcoin Trust ETF (IBIT), to provide exposure to Bitcoin within a regulated framework. The fund is aimed at investors who want exposure to crypto without the complexities of direct ownership, such as managing digital wallets or exchange accounts.

During a presentation this month, Kyle Hulett, Sygnia’s head of investments, said the fund has returned 12% since its launch on 1 June, as Bitcoin reached highs of about $120 000, driven by concerns over inflation and the depreciation of the dollar, as well as global geopolitical uncertainty.

Hulett said “Crypto Week” – 14 to 18 July – in the United States boosted the performance of cryptocurrencies. Three significant regulatory developments occurred during Crypto Week:

- On 18 July, President Donald Trump signed the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act) into law. The Act establishes a framework for regulating stablecoins and ensures that stablecoins issued by exchanges are fully backed by dollar reserves.

- On 17 July, the House of Representatives passed the CLARITY Act (Digital Asset Market Clarity Act). The Act seeks to create a clear regulatory framework for digital assets by defining which federal agencies oversee different types of cryptocurrencies.

- The Anti-CBDC Surveillance State Act cleared the House of Representatives. The Act aims to block the Federal Reserve from issuing retail central bank digital currencies (CBDCs), reflecting industry concerns about privacy and competition from government-issued digital currencies.

These regulatory moves were largely positive for the crypto ecosystem, enhancing investor confidence by promoting transparency, security, and clearer legal frameworks. Although the immediate impact favoured stablecoins, the ripple effect supported Bitcoin’s strong performance, because Bitcoin often serves as an entry point into the crypto market before investors diversify into other tokens or stablecoins.

What is the portable alpha strategy?

Hulett explained the portable alpha strategy and why Sygnia has incorporated the strategy into its Plus range of funds.

He said the strategy is designed to address the challenge of low expected returns across most asset classes, where traditional alpha generation has become increasingly difficult and even negative for many active managers.

Global markets are forecast to deliver much lower returns over the coming decade because of structural headwinds such as deglobalization, demographic shifts, rising debt levels, inflationary pressures, and climate-related risks. For example, expected returns on US equities are projected to drop from roughly 12% historically to about 3% to 4%, making even modest alpha gains meaningful.

Portable alpha enhances low-cost passive investing by adding a stable, incremental return element derived from credit markets, thus helping investors to squeeze out every possible basis point in a low-return world.

Portable alpha separates the alpha component from the beta exposure of an investment. In Sygnia’s implementation, investors gain full exposure to a target index via futures contracts or total return swaps, while the leftover cash (not tied up in margin for futures) is invested in higher-yielding money market instruments. Because futures are priced under the no-arbitrage principle, the return on a futures-based portfolio replicates the index return, assuming a risk-free rate on cash. However, by investing the cash portion into money market funds that outperform the overnight bank rate slightly, Sygnia effectively “ports” small amounts of consistent credit alpha onto the passive beta exposure without materially increasing risk.

The strategy also leverages the liquidity, efficiency, and cost-effectiveness of futures markets, avoiding typical brokerage and custody fees associated with direct stock or bond holdings.

Additionally, the structure benefits from favourable tax treatments within the insurance policy framework.

Investors should be aware that portable alpha – like all investment strategies – is not without potential downsides and risks.

Portable alpha’s reliance on futures and derivatives introduces counterparty and liquidity risks, and the small alpha generated depends on stable credit markets and money market returns outperforming risk-free rates.

There is also the inherent operational complexity in managing futures margins and maintaining the strategy, which could affect the tracking error if not managed efficiently.

Portable alpha’s incremental gains, while meaningful in a low-return environment, are relatively modest (about 0.5% per annum), and investors should be aware that they do not eliminate market risk or volatility associated with the underlying index exposure.

Why the fund invests in IBIT

The Life Bitcoin Plus Fund invests in IBIT primarily for reasons related to regulatory security, liquidity, operational convenience, and risk mitigation.

Hulett said investors cannot currently invest in Bitcoin via a JSE-listed fund primarily because the Johannesburg Stock Exchange lacks finalised listing requirements and clear regulatory frameworks for crypto-based ETFs. Sygnia was poised to introduce a Bitcoin ETF as early as 2018, but the initiative was halted days before the launch because of regulatory uncertainty.

Moreover, the South African Reserve Bank has not classified cryptocurrencies definitively as either onshore or offshore assets. This ambiguity complicates regulatory compliance and investment capacity for local investors, who face restrictions on how much offshore discretionary capital they can deploy towards crypto. Consequently, direct crypto investments are typically treated as offshore transactions, subject to foreign exchange controls, rather than domestic investments.

In addition, Regulation 28, which governs retirement funds such as pension, preservation, and retirement annuities (RAs), explicitly prohibits these funds from investing in cryptocurrencies. Similarly, unit trusts under the Collective Investment Schemes Control Act are barred from crypto investments.

Since direct investment into Bitcoin or a Bitcoin ETF is not currently feasible on South African exchanges, the Life Bitcoin Plus Fund uses IBIT as an accessible proxy to gain Bitcoin exposure.

Hulett said Sygnia chose IBIT for the following reasons:

- IBIT is a highly liquid and well-established vehicle. It was launched in 2024 by Blackrock, the world’s largest asset manager and largest provider of ETFs.

- IBIT is the largest Bitcoin ETF globally, holding a market share of 58%, with assets of more than $86 billion, representing almost 4% of Bitcoin in circulation. This scale ensures tight bid-ask spreads and ease of trading, which is crucial for minimising costs and maintaining portfolio efficiency.

- IBIT provides strong custodial security by using Coinbase, the world’s largest institutional digital asset custodian. This includes ring-fenced custody protecting investors’ assets from exchange bankruptcy, a backup custodian to ensure continuity, and 100% offline “cold storage” for Bitcoin holdings. These features significantly reduce counterparty and cybersecurity risks, which are critical concerns when dealing with crypto assets.

Notwithstanding the above, Hulett said investors should note that investing in IBIT is not risk-free:

- Large-scale sales by major investors could impact the ETF’s price and market stability.

- Theft or the compromise of private keys could lead to the irreversible loss of assets.

- Negative sentiment among speculators can cause extreme price volatility, which is inherent in Bitcoin and cryptocurrencies in general.

- Competition from CBDCs poses a regulatory and market risk to Bitcoin’s demand.

Hulett emphasised that Bitcoin and crypto assets are far more volatile and riskier compared with traditional asset classes such as equities, bonds, and cash.

Who is the fund for?

The Bitcoin Plus Fund is available to both living annuity investors and sinking fund investors (also known as endowment policyholders), but it is not available to RA investors because of the Regulation 28 restrictions.

The fund is designed for investors who may not fully understand the complexities of crypto trading but want regulated access to Bitcoin through an underlying investment (IBIT) rather than directly holding cryptocurrencies.

Investors should ideally allocate no more than 5% of their overall portfolio to the fund, reflecting the high volatility and risk associated with Bitcoin and crypto assets generally.

It is suitable for investors who have a moderate to high risk tolerance and an investment horizon of at least five years.

Hulett said financial advisers do not require a crypto licence to advise clients on the Bitcoin Plus Fund. They must hold a long-term insurance licence, because the fund is structured as an insurance policy under the Long-term Insurance Act.

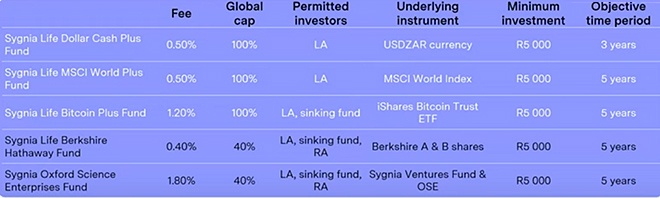

The graphic below sets out the main features of the Bitcoin Plus Fund compared with the two other Life Plus funds and the five Life global funds.

Tax implications

The tax advantages and disadvantages of the Life Plus funds, including the Bitcoin Plus Fund, are linked to their structure and the use of portable alpha.

One advantage is that when investing via a sinking fund (a five-year endowment), investors benefit from tax-efficient rates: income is taxed at about 30% (about two-thirds of the marginal rate), and capital gains are taxed at 12%, which is generally lower than standard marginal tax rates. This offers a significant tax benefit compared to direct investments that might be taxed at higher rates, Hulett said.

However, there is a notable tax implication arising from the portable alpha strategy. Since the fund employs a combination of cash (or money market instruments) plus futures to replicate index exposure and generate additional returns, part of the returns is classified as interest income (from the cash component), while the rest is capital gains (from the futures). This effectively converts some capital gains into interest income, which is typically taxed at a higher rate. This shift can change the overall tax profile of the investment, potentially increasing the tax payable on returns compared with a purely capital gains-based fund.

Disclaimer: The information in this article is neither a recommendation nor an endorsement. It does not constitute financial or investment advice. Investors should conduct their own research and consult qualified financial advisers before making investment decisions.

Sygnia’s Life Bitcoin Plus Fund is a bold step forward in merging traditional finance with digital assets. Offering Bitcoin exposure through a regulated life insurance structure removes barriers for conservative investors while maintaining upside potential. Coupled with recent U.S. regulatory clarity, this move signals growing global confidence in crypto as a legitimate asset class.