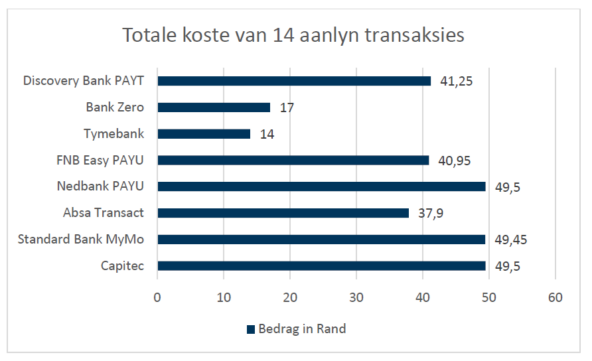

The Bank Charges Report, published annually by the Solidarity Research Institute (SRI), this year included a new category for purely online banking services.

The comparison of banking costs assumes that no cash transactions are conducted; only 14 digital transactions, as well as the monthly administration fees. It also assumes that all debit orders and internet bank payments are external, to put these banks on an equal footing with the “traditional banks”, SRI said.

It said the major factor that determined the cheapest bank was the number of free transactions.

TymeBank emerged as the cheapest bank, slightly ahead of Bank Zero. In the case of both banks, the only transaction on SRI’s list with a fee is sending cash to a cellphone number.

As in previous years, the five banks that made up the “core” of the 2023 survey were Absa, Capitec, First National Bank (FNB), Nedbank, and Standard Bank.

Four transaction profiles

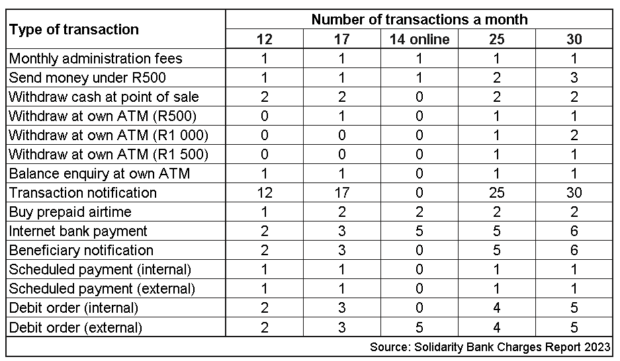

Solidarity’s banking fee comparison is based on four different transaction profiles, split across four different groups:

- Accounts marketed to people with a low income and fairly basic banking needs (profiles with 12 and 17 transactions a month).

- Accounts used for online transactions only (14 cash-free and contact-free transactions).

- Accounts marketed to people with a middle-class income and sophisticated banking needs (25 transactions a month).

- Accounts marketed to people with a higher-middle-class income and sophisticated banking needs (30 transactions a month).

Although some banks have prescribed income levels for different accounts, SRI said the user profiles are not compiled according to income level but according to the number of transactions for every profile.

“The number of transactions that every user conducts in a month should correspond with income levels – lower-cost bank accounts therefore are used for low transaction profiles and higher-cost accounts for higher profiles. Although it is estimated to be the most cost-effective account for the suggested category, every user’s needs are unique and there may be exceptions to this guideline,” SRI said. (See below for more information about the transaction profiles.)

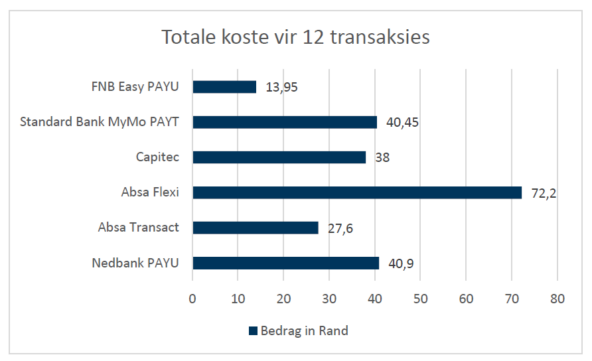

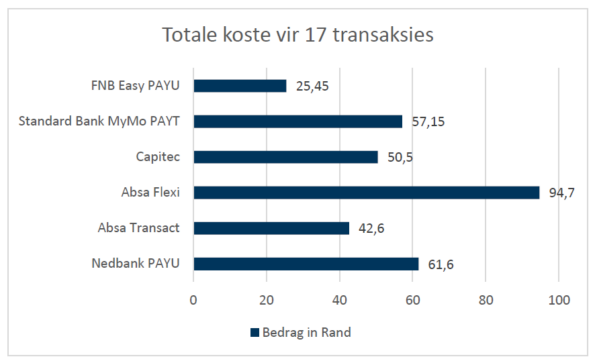

Low income and fairly basic banking needs

The large number of free transactions offered by FNB put the bank in first place in both lists of transactions in this category. The Absa Transact account, last year’s winner, is the second place, SRI said.

Although Capitec is still the only bank in this category that offers interest on its transaction account, the cost for such an account where a balance of R5 000 is maintained would be R10 more than for an FNB Easy PAYU account for the same 17 transactions, according to Solidarity.

Middle-class income and sophisticated banking needs

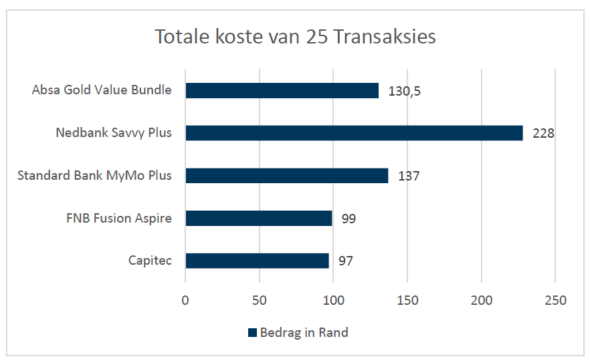

The profile with 25 transactions a month was used for this comparison.

“This category contains the banks’ flagship accounts – the accounts they market to the core customer base. With the exception of Capitec, the accounts in this category all qualify for the banks’ respective loyalty programmes. This also includes other forms of added value, such as linked credit cards, insurance at a discount, access to airport lounges, and other packages that differ widely from one bank to another. Although Capitec does not offer such an extensive loyalty programme, this bank has been included because it has a considerable number of clients in this consumer group,” SRI said.

It said Capitec would have been the winner in this category if it were judged purely on costs.

However, taking into account the larger offering of the various accounts, FNB’s Fusion Aspire account “towers above the others”, with a monthly fee of R99 that includes all other transactions. Therefore, if more transactions, apart from most cash transactions, are conducted, the cost will still be R99, SRI said.

It said other relatively competitive accounts in this category are Absa’s Gold Value Bundle, with a cost of R130.50, and Standard Bank’s MyMo Plus account, at a total cost of R137. Nedbank’s total cost amounts to R228.

Higher-middle-class income and sophisticated banking needs

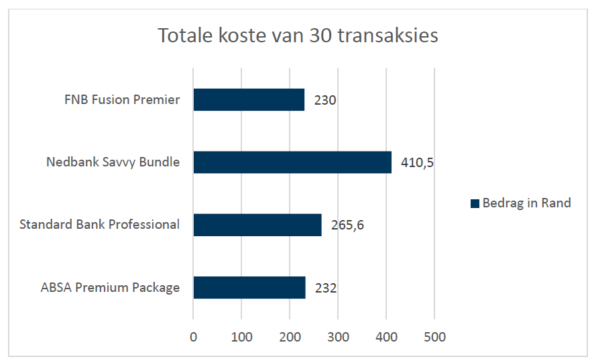

The user profile with 30 transactions a month was used for this comparison.

The accounts in this category are more focused on added value and reward programmes than purely on costs, SRI said.

“The aim of our report, however, is to compare costs, and consumers are encouraged to see if the added value justifies the extra costs. While costs probably are not the main factor for users in this category, it could nevertheless be useful to bear this in mind before considering other factors.”

SRI said the decisive factor, once again, was the number of free transactions. For this reason, FNB was the winner in this category, with a total cost of R230. As with their Fusion Aspire account, the R230 paid for the Fusion Premier account is the monthly administration fee. It includes all other items on our list of transactions.

Almost the same goes for Absa’s Premium package, slightly behind with a cost of R232. If airtime purchases on this account were free, it would have beaten FNB, SRI said.

Transaction profiles reflect changing trends

SRI said the transaction profiles for 2023 were adapted to reflect changing consumer trends. The profiles contain fewer cash transactions and more debit orders than in the past, and transactions that have been replaced completely by banks’ online services and applications, such as balance enquiries, have been removed.

To reflect the cheapest possible transaction options, messages to beneficiaries were adapted to reflect email notifications, where available, instead of SMSs, because the former are usually free. Furthermore, SMS notifications were switched to transaction notifications because several banks are offering the option to receive notifications free of charge through the bank’s cellphone application.

As in the past, the transaction accounts have been compiled based on guidelines that correspond with the hints for saving given by banks. These guidelines include:

- Few cash withdrawals, no cash deposits and no cheques;

- Little or no cash at ATMs, preferably at shop counters;

- No visits to branches – use internet banking services;

- Where purchases are made, such as buying airtime, it is done via online platforms; and

- Using cellphone application notifications instead of SMS notifications, as well as email instead of SMS notifications when these are sent to beneficiaries.

Methodology: points to note

SRI’s annual bank charges report provides an analysis of ordinary transaction profiles – accounts that are available to any member of the public. This means that accounts for the youth, students, the aged, and specific faith groups, as well as private bank accounts are, not covered.

The report also does not include accounts specifying a minimum or maximum monthly income, unless it is the only one in the category offered by a specific bank. Some accounts that do not cover full banking services – for example, not allowing debit orders – have been excluded.

The cost of credit facilities – in the form of credit cards, overdraft facilities, vehicle financing, home loans and personal loans – are also not covered. In the case of some of the bundled accounts aimed at higher-income groups, such services, or discounts on them, are included in the package.

A new trend among several bundled accounts is to include life insurance or access to low-cost cellphone data. Such added value is not discussed in the report. Therefore, consumers should ensure that they know what they are paying for and should try to get as much value from their packages as possible, SRI said.