Santam authorised to establish IFSC reinsurance office in India

The licence allows the insurer to operate as an International Insurance Office within India’s financial hub.

The licence allows the insurer to operate as an International Insurance Office within India’s financial hub.

MBSE visits automotive dealerships to equip F&I professionals with CPD, FICA, and POPIA training tailored for their workplace needs.

The 2025 CE Index places short-term insurers mid-table within financial services, with clear differences emerging between brands and channels.

Interconnected hazards are altering claims patterns and capital pressures for insurers – shifting priorities for brokers and corporate risk teams, says PSG Insure.

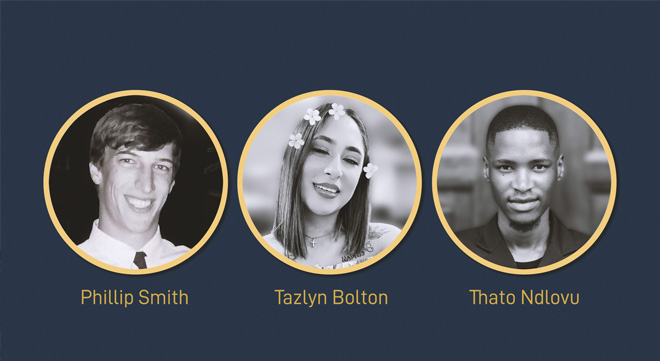

MBSE top achievers share how the HCSTI turns ambition and experience into long-term growth in short-term insurance.

A drone listed on a policy wasn’t insured for its main purpose. This case is a reminder that exclusions can cancel out the protection you think you’ve bought.

DataEQ’s 2025 Index shows that insurers’ positive brand campaigns are undermined by operational weaknesses in claims, billing, and responsiveness.

Don’t wait for New Year’s resolutions – build or refresh your competence in financial services with MBSE’s nine COB modules.

MBSE’s free Virtual Open Days from 11 to 13 November offer aspiring and established finance professionals a chance to explore accredited qualifications, engage with lecturers, and map out their next academic step.

MBSE’s free Virtual Open Days from 11 to 13 November offer aspiring and established finance professionals a chance to explore accredited qualifications, engage with lecturers, and map out their next academic step.

Across three days in November, aspiring and current financial services professionals can explore MBSE’s suite of accredited qualifications.

Disciplined underwriting, improved claims experience, and robust investment income helped non-life insurers to navigate structural headwinds.

While insurers can decline claims involving unroadworthy vehicles, repudiations must be linked to the cause of the loss.

Kickstart your career with MBSE’s accredited online qualifications – from certificates to its new future-ready BCom degree.

Standard Insurance’s five-year analysis discloses the main perils affecting businesses and households, and when and why policyholders are most likely to claim.

Santam’s Thabiso Rulashe on how insurers are adapting to stay resilient – and profitable – in an era of rising risks.

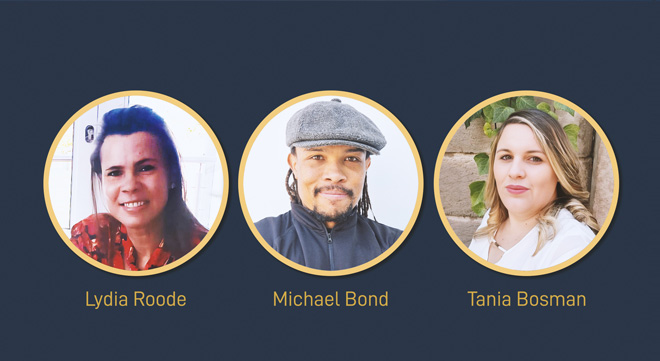

How MBSE graduates like Lydia Roode and Michael Bond leveraged the Higher Certificate in Short-term Insurance to excel in real-world scenarios.