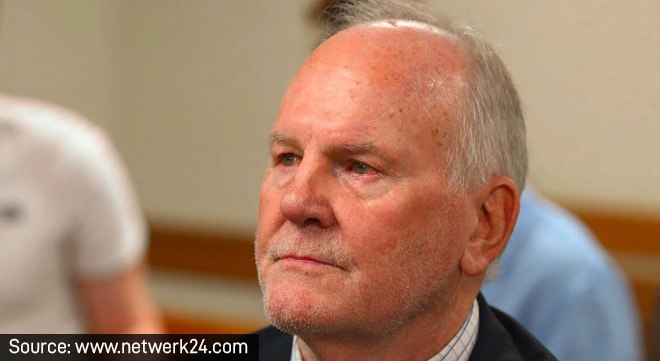

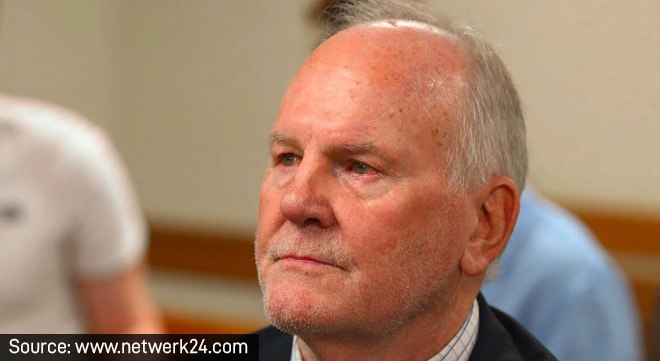

Former Steinhoff executive Stéhan Grobler fined R358.75m

The FSCA says Grobler contravened the Financial Markets Act by publishing false or misleading financial statements between 2014 and 2017.

The FSCA says Grobler contravened the Financial Markets Act by publishing false or misleading financial statements between 2014 and 2017.

The draft ARP Manual introduces licensing, capital, and AML/CFT obligations for informal remittance providers.

The central bank’s consultation paper outlines a structured transition to policy-rate-based lending, with fallback protections for legacy contracts.

The case focuses attention on how the exchange control framework applies to crypto platforms that facilitate offshore trading through loans.

Regulatory initiatives across payments, digital assets, open finance and embedded finance are expected to progress this year.

The shift from prime to a repo-plus model won’t cut your debt overnight, but it promises more transparent lending.

The Reserve Bank has partially reversed its exchange control changes, removing tax-clearance requirements for some non-resident income flows. However, restrictions on rental income and directors’ fees remain in place.

The National Planning Commission recommends revising Regulation 28 to redirect at least 20% of retirement fund assets towards infrastructure and productive fixed assets.

South Africa’s financial markets brace for the end of Jibar as SARB signals a major shift toward the more transparent, transaction-based ZARONIA benchmark.

Top domestic Bitcoin wallets moved nearly R63bn offshore since 2019, spurring the SARB and Treasury to develop a cross-border crypto transaction framework.

The MPC’s first rate cut in months underscores the SARB’s view that a lower target can support a gradual easing cycle.

Godongwana announces a shift from the 3%-to-6% range to a 3% target with a 1-percentage-point tolerance band, to be implemented over two years.

The judgment dismissed parts of Sasfin’s exceptions and left SARS’s statutory claim under the Financial Sector Regulation Act to proceed.

The Institute for International Tax and Finance says the latest exchange control changes could discourage foreign investors and add red tape for non-residents.

The South African Reserve Bank cites deficiencies in Access Forex’s RMCP, customer verification, and staff training.

The South African Reserve Bank declares five vehicles, jewellery, and art from the estate forfeit under the Exchange Control Regulations.

Governor Kganyago signals target reform ‘as soon as is practical’ while policymakers pause cuts.