MBSE top achievers shine: how these financial pros thrived with online learning

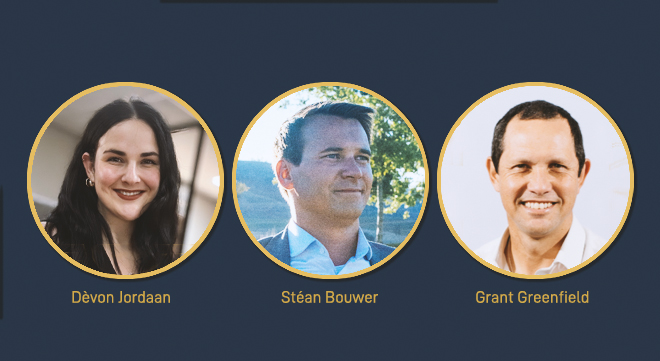

Dèvon Jordaan, Stéan Bouwer and Grant Greenfield, top achievers at Moonstone Business School of Excellence, share their stories on the power of preparation and perseverance.