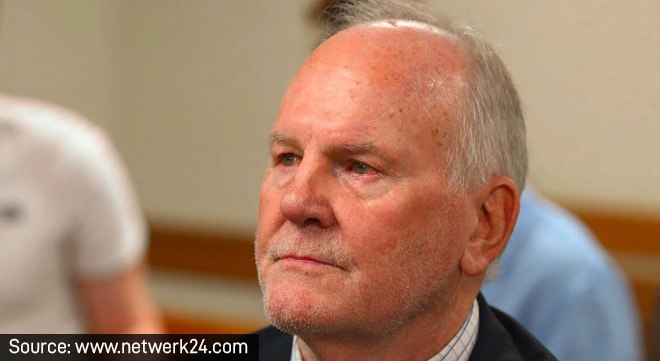

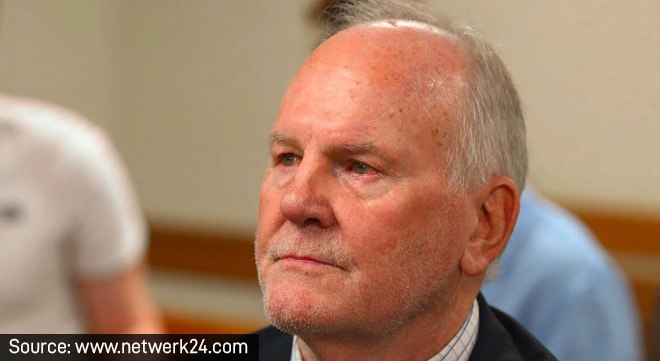

Former Steinhoff executive Stéhan Grobler fined R358.75m

The FSCA says Grobler contravened the Financial Markets Act by publishing false or misleading financial statements between 2014 and 2017.

The FSCA says Grobler contravened the Financial Markets Act by publishing false or misleading financial statements between 2014 and 2017.

The High Court overturns an earlier disallowance of the curator’s costs and reaffirms that former trustees remain personally liable for curatorship and inspection expenses.

Ministerial Directives issued in July 2021 applied only to specified businesses under the Businesses Act, not to FAIS-regulated FSPs.

The report details the Panel’s mandate, membership, and engagement with the regulator since its establishment in 2023.

Regulatory initiatives across payments, digital assets, open finance and embedded finance are expected to progress this year.

But the Authority fines Livestock Wealth and its CEO for displaying a partner FSP licence in a ‘misleading’ way.

South Africans should verify anyone offering financial services or investment opportunities.

The rising number of investigations and inspections underline a shift from registration to active supervision.

It is now easier for brokers and policyholders to place business with Lloyd’s, particularly for personal indemnity, cyber, marine trade, and mining exposures.

The Authority says the penalties reflect the financial benefit gained from unlawful conduct and the harm to clients – handing 30-year debarments to several Banxso executives.

The FSCA imposes a R197m fine on Medbond Insurance Brokers and its principal, whom it debarred for 30 years.

The FSCA’s investigation concluded that South African Relocations and The Relocations Group offered marine insurance without registration.

The Authority found that most investor funds were used to pay ‘returns’ to other investors and cover personal expenses.

New end-dates extend the temporary allocation of certain supervisory duties to the FSCA and PA while regulatory frameworks are finalised.

A2X says it will pay the fine, adding the vast majority of the affected companies have elected to retain their secondary listings.

The FSCA has uploaded recordings of its five-part webinar series aimed at helping CASPs meet their FICA obligations.

The regulators will issue a discussion paper to clarify governance, disclosure, and consumer-protection expectations.