The future of healthcare financing: why brokers must stay agile

In a landscape defined by rising costs and digital disruption, brokers who embrace technology and tailor gap cover to individual life stages will lead the way.

In a landscape defined by rising costs and digital disruption, brokers who embrace technology and tailor gap cover to individual life stages will lead the way.

Industry experts say that small, unclaimed pots left behind by members pose a growing challenge that must be managed to protect long-term retirement outcomes.

Advisers can highlight their human edge by spotting common gaps in AI-generated DIY plans, from overconfidence in returns to blind spots in risk protection.

South Africa ranks 4th worst in the world for road safety, with rising accident claims underscoring the need for appropriate protection.

The first edition of our new series unpacks the types of medical plan, who they suit, and why the cheapest option isn’t always the smartest choice.

DTAs shape the taxation of lump sums and annuities. This is what financial advisers can do to preserve clients’ retirement benefits.

For smaller employers facing rising compliance and governance costs, umbrella funds usually deliver better cost-efficiency and reduced fiduciary risk.

Without careful liquidity planning, families risk financial strain for years while estates remain tied up in red tape, highlighting the need for wills, offshore planning, and open financial conversations.

With its structured, flexible training, Moonstone Business School of Excellence transforms the daunting RE 5 into an achievable milestone – equipping learners with regulatory fluency.

International comparisons suggest there’s scope for local advisers to lift fees above 0.5% of AUM, says Mark Polson of UK consultancy The Lang Cat.

As rental demand surges, advisers can help clients navigate the insurance complexities of furnished, semi-furnished, and short-term lets.

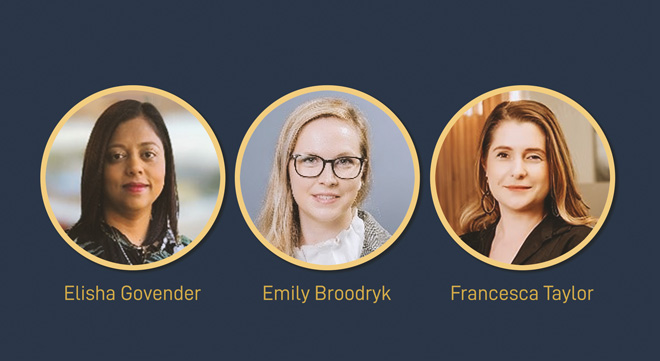

Emily Broodryk, Elisha Govender, and Francesca Taylor recommend the qualification to financial advisers who want to deepen their expertise.

FNB survey also finds that most under-60s expect to work beyond their retirement age, with only 10% planning a full stop.

Whether clients are long-term holders of crypto or occasional traders, transparency now is better than an audit later.

Compliance expert Anton Swanepoel says financial services providers must adopt a winning mindset, strategy, and tech-driven approach.

Alexforbes has launched Alexforbes One, its third umbrella fund and first designed for both internal consultants and IFAs, marking a major step in its strategy to strengthen ties with advisers.

MBSE has launched a fresh range of online courses – covering topics such as CODI, banking conduct, FICA for banks, and impactful feedback – to help you sharpen your skills.