Collectively, small, medium and micro enterprises (SMMEs) are the largest employment sector in South Africa and the biggest creator of new jobs, yet most employers in this sector don’t offer employee benefits.

“Only seven million employed people are contributing to a pension fund, so more than half of South Africa’s 16 million employed are not. Taking our nation’s unemployment rate into account, we need to ensure that those who are employed are being well taken care of,” says Nzwa Shoniwa, the managing executive of Sanlam Umbrella Solutions.

As Shoniwa points out, providing benefits is not only good for staff; it also enables employers to attract and retain talent.

To this end, Sanlam Corporate recently launched the Sanlam Easy Retirement Plan (SERP), an umbrella fund specifically for employers and employees in the SMME sector.

It is also available to employers of home-based employees, such as domestic workers and gardeners. In other words, the fund accepts employers who have only one employee. Participating employers are limited to up to 50 employees.

SERP is for employees aged 16 to 65. Members can sign up for retirement, lump-sum disability, funeral, and death benefits.

The plan does not offer a dread disease/critical illness benefit. And there is no temporary disability benefit; disability must be “total” and “permanent”.

There are 10 fixed-contribution plans from which to choose, with contributions ranging from R280 to R3 094 a month, which depend on whether the member chooses a retirement benefit only (plan 1) or retirement and insured benefits (plans 2 to 10).

The monthly amount for each plan is the minimum contribution required. Employers or employees can make additional voluntary contributions.

The normal retirement age is 65, and all risk benefits cease at 65.

The contribution split between the employer and the employee is dependent on the employer. All contributions are deemed to be employer contributions.

Click here to see SERP’s contributions, insured benefit cover, and costs.

Where the contributions are invested

The fund’s underlying investment portfolio is the Simeka Wealth Preservation Portfolio. Members do not, at this stage, have a choice of portfolios.

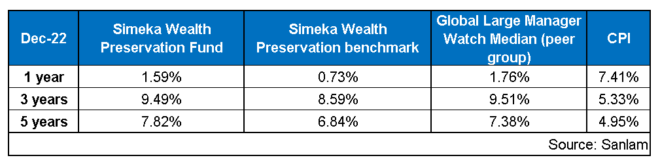

The table below shows the fund’s net returns compared to its benchmark, the peer group Global Large Manager Watch Median and the Consumer Price Index in December 2022.

What are the costs?

The following costs are payable on contributions to the retirement fund:

- An administration fee of R15.18 (including VAT) a month.

- An asset-based administration fee of 0.75% (incl. VAT) a year (about 0.063% of the member’s share per month).

- An intermediary fee based on 5.75% of contributions (incl. VAT) a month, capped at R44.27. This fee is not payable on additional voluntary contributions.

- A contingency reserve account levy of 0.7% (incl. VAT) a year (about 0.058% of the member’s share per month).

Options when withdrawing or retiring

Members who withdraw from the fund when they resign, are dismissed or are retrenched can choose from the standard pre-retirement options:

- Transfer their benefit to another employer’s pension or provident fund, a retirement annuity fund, or a preservation fund;

- Withdraw the benefit amount as a cash lump sum (which will be taxed according to the pre-retirement lump-sum withdrawal table); or

- Leave the benefit in the fund as a paid-up benefit until they retire.

At retirement, the member’s entire investment will be paid as a retirement benefit, and they have the following choices:

- Use the retirement benefit to buy an annuity from Sanlam or another provider; or

- Take a portion of their retirement benefit in cash and use the rest to buy an annuity from Sanlam or another provider.

The fund currently does not have a default annuity strategy. Sanlam says the retirement benefits of most of the members who retire from the fund are below the de minimis amount (R247 500), as well as the minimum amounts to purchase annuities. “We are looking at reviewing the product offering in its entirety as part of the next phase of development.”

The fund does offer retirement benefits counselling to members.

Sanlam says SERP is “fully digital and automated”, and it takes “only a few minutes” to sign up online.

More info asking for my SME clients and how is the referral system or commission work for us as Advisors