South African investors are slightly more optimistic than their global counterparts that they will earn higher returns in the next 12 months, the 2023 Schroders Global Investor Study has found.

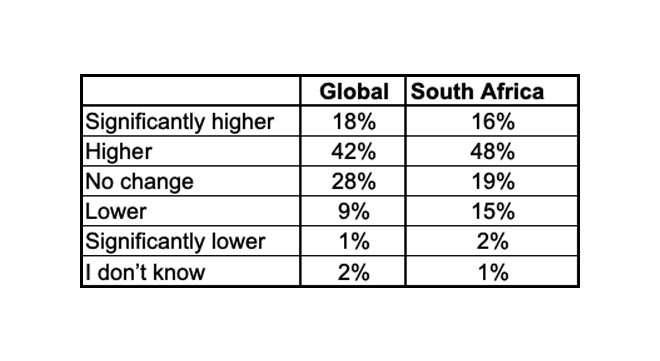

According to the survey, 64% of South African investors think their returns will be “higher” or “significantly” higher in the next 12 months, compared with 60% of investors globally.

How people think their returns over the next 12 months will compare with the previous 12 months:

Most investors globally expect annual returns of 11.5%, similar to last year’s results. South African investors were the most optimistic, having identified a 16.8% return. This is substantially higher than the 9.46% annualised return of the MSCI World Index between 1987 and September 2023.

Between 26 May and 31 July 2023, Schroders commissioned an independent online survey of more than 23 000 “wealth investors” who invest from 33 locations around the world, including 400 South Africans. “Wealth investors” are defined as those who will invest at least €10 000 (or the equivalent) in the next 12 months.

The study found that 78% of investors believe we have entered a new era of policy and market behaviour as a result of higher inflation and interest rates. Only 4% disagreed, while 18% neither agreed nor disagreed.

This is in stark contrast to last year’s study, when some respondents believed the market challenges were a blip and predicted a quick return to the more benign, low-inflation, low-rates environment.

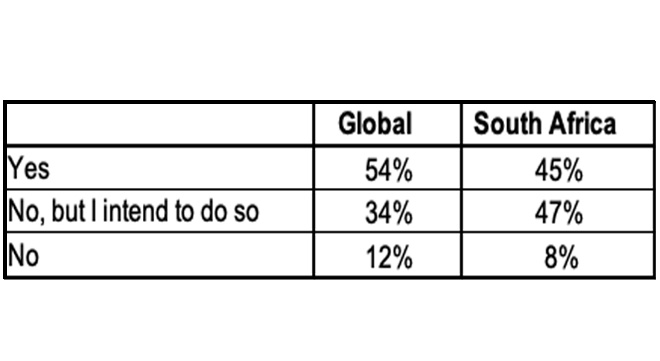

As a result, more than half of global respondents have already adjusted their investment strategies, and a third intend to do so. South African wealth investors, while a bit slower to do so, also plan to adjust their strategies.

Are you adapting your investment strategy for this new era?

The research shows that South African respondents who rated their investment knowledge as “expert” were the quickest to react, with 60% having already adapted their strategy.

Johanna Kyrklund, Schroders’ group chief investment officer and co-head of investment, said: “In an investment landscape being increasingly shaped by the three D’s of deglobalisation, decarbonisation and demographics, investors are still getting used to the fact that higher inflation and higher interest rates are here to stay. Every asset has had to reprice to compete with a yield on cash in the bank. Valuation matters once again.

“Compared to the last 15 years, you may now need to be more flexible and active in the way you invest. The results of the study show that some investors are adjusting quicker than others.”

Perceptions of the best investments

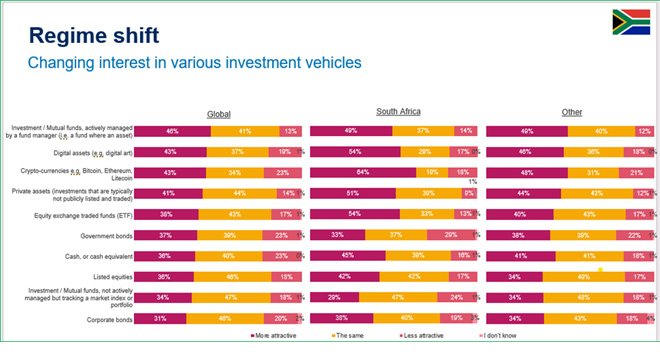

The study highlights the importance of active fund management for many investors globally, while private assets were recognised as an essential diversifying tool.

South Africa investors showed a heightened interest in digital assets and cryptocurrency compared to global respondents.

What investments have become more attractive over the past six months?

70% of South African respondents cited costs and expenses as the largest perceived barrier to investing in private assets; with transparency (63%) and experience with/knowledge of the asset class (61%) as runners-up. Global investors were most concerned with transparency (65%), followed by experience with/knowledge of the asset class (64%) and then illiquidity (63%). The findings indicate greater education is required to support the continued growth of these investments.

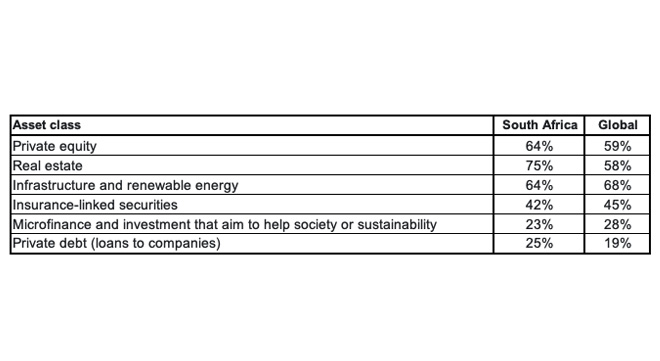

Nevertheless, almost 48% of South African respondents said they would consider allocating 6% to 20% of their portfolios to these assets. On average globally, investors said they would consider allocating 16.4% of their funds into private assets. For more “expert” investors, this rose to 23.1%.

Specifically, South African wealth investors are most attracted to real estate (75%) followed by both private equity and infrastructure and renewable energy (both 64%). Global respondents were almost 20% less likely to invest in real estate than South African respondents.

People’s top choice of private asset if they could invest:

Overall, respondents see private assets as an important way to boost portfolio performance, with global and South African respondents indicating this as the most attractive quality of investing in this asset class.

Global respondents saw diversification as the second most attractive quality of private asset investment at 51%, while 47% South African respondents cited the diversification aspect – favouring sustainability and/or impact investing considerations instead at 55%. Meanwhile, 40% of global respondents are attracted by the perceived sustainability credentials of private assets.

Why investors are attracted to sustainable investing

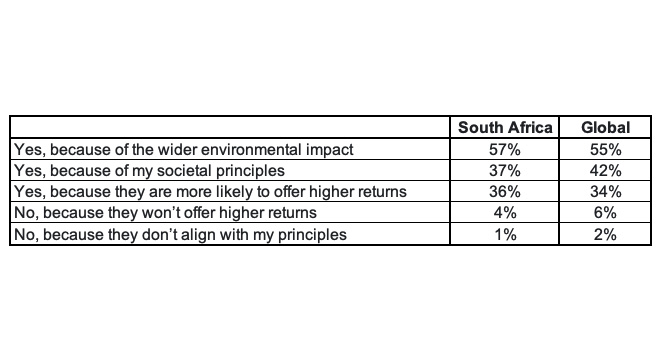

Investors are attracted to investing sustainably because of the potential to generate positive environmental impact and align investments to their societal principles.

Are people attracted to sustainable funds, and if they are, why?

More than a third of South African investors (36%) said sustainable funds are likely to offer higher returns. On average, the proportion of all investors shunning sustainable investing because of performance concerns has fallen by half compared with last year’s survey.

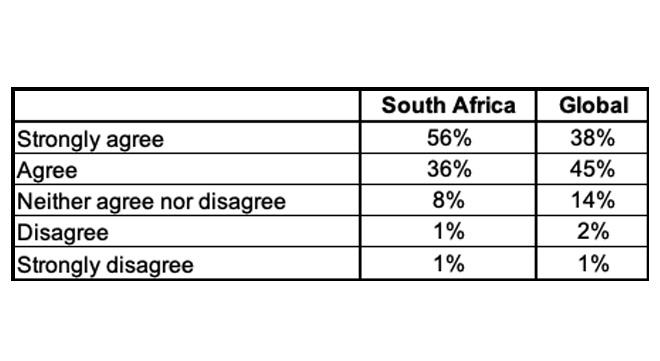

A key element of sustainable investing is active ownership – engaging with companies directly to improve business outcomes with the aim of supporting investment returns. Most South African respondents (79%) have heard of the concept of active ownership. South African investors are more confident in the long-term value creation of sustainable funds, than their global counterparts.

Does encouraging companies to act sustainably help them to generate long-term value?

Specifically, the key active engagement topics for global investors are climate (33%), natural capital (26%), and the treatment of workers (20%). For local investors, the focus is slightly different, with the treatment of workers coming out as the biggest priority (32%), followed by climate (24%) and natural capital (19%).