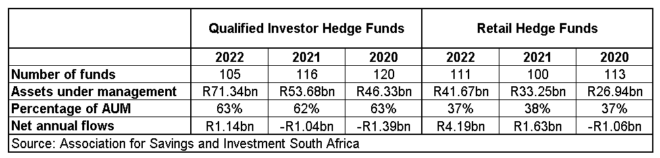

The South African hedge fund industry grew its assets by 30% in 2022, ending the year with R113.01 billion under management. The industry’s assets under management (AUM) were R86.93bn at the end of 2021, according to statistics released by the Association for Savings and Investment South Africa (Asisa).

The industry attracted net inflows of R5.33bn in 2022. In 2021, hedge funds attracted muted net inflows of R0.59bn, and in 2020 the industry saw net outflows of R2.45bn.

Hayden Reinders, the convenor of Asisa’s Hedge Funds Standing Committee, said the industry experienced several lean years following the implementation of crucial reform initiatives, which resulted in comprehensive regulation and the consolidation and closure of funds. The number of hedge funds has stabilised at 216 for the past two years.

In 2015, South Africa was the first country to implement comprehensive regulation for hedge fund products. The regulations provide for two categories of hedge funds:

- Qualified Investor Hedge Funds, which require a minimum investment of R1 million and are open to investors with a solid understanding of the investment strategies deployed by hedge funds and the associated risks.

- Retail Hedge Funds are strictly regulated in terms of the investments and the risks that they are allowed to take and are open to all investors who can afford the average minimum lump sum investment of R50 000.

Hedge funds fall under the Collective Investment Schemes Control Act and are deemed regulated collective investment schemes, just like unit trust portfolios.

“Seeing strong growth numbers for the industry is a welcome development and hopefully indicates that hedge funds in South Africa are increasingly being accepted as an important investment tool in mitigating market volatility,” Reinders said.

Reinders hopes that the industry will achieve even better growth in 2023 on the back of the amendments to regulation 28 of the Pension Funds Act that came into effect at the beginning of this year. The amendments separate hedge funds and private equity investments, allowing retirement funds to invest 10% of assets into hedge funds and 15% into private equity investments.

“The amendments enable hedge funds to operate on a more level playing field, which should result in stronger inflows,” Reinders said. “Most pension funds are nowhere near the 10% maximum, which means there is plenty of room for growth.”

That said, the industry is still awaiting changes to Board Notice 90 of 2014, which prevents long-only unit trust portfolios from investing directly in hedge funds. This restriction is widely regarded as the biggest obstacle to investors’ money flowing into hedge funds.

Retail Hedge Funds drive flows

According to Reinders, 37% of AUM was held by Retail Hedge Funds at the end of December 2022, while Qualified Investor Hedge Funds held 63% of assets.

Yet, the net inflows in 2022 were driven predominantly by Retail Hedge Funds, which attracted net inflows of R4.19bn. Qualified Investor Hedge Funds, on the other hand, recorded net inflows of R1.14bn.

Reinders said that linked investment service providers have become more willing to offer retail hedge funds, making them more accessible to investors. In addition, he said, some of the bigger hedge fund managers are investing in distribution and business development teams to grow their market share.

Popular hedge fund strategies

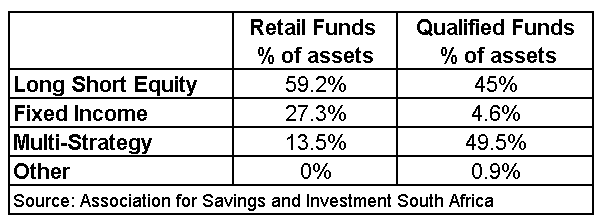

Hedge funds in South Africa are classified according to their investment strategies. The most popular hedge fund strategy is Long Short Equity. At the end of 2022, 59.2% of retail money was invested in Long Short Equity Hedge Funds and 45% of qualified investor money.

Long Short Equity funds predominantly generate their returns from positions in the equity market regardless of the specific strategy employed, such as “long bias” and “market neutral”.

Fixed Income funds invest in instruments and derivatives sensitive to movements in the interest rate market.

Multi-Strategy funds are portfolios that, over time, do not rely on a single asset class to generate investment opportunities but blend a variety of different strategies and asset classes, with no single asset class dominating over time.

Other Hedge Funds apply strategies that do not fit into the other classification groupings.