The normalised earnings of OUTsurance Holdings Limited, the 89.7%-held subsidiary of OUTsurance Group Limited, increased by 36.3% to R1.502 billion in the six months to the end of December 2022, as Australian subsidiary Youi quadrupled its normalised earnings to R646 million compared to the six months to the end of December 2021.

Youi’s earnings benefited from relatively benign weather-related claims and rapidly rising interest rates, which bolstered investment income. By contrast, the first half of the previous financial year was characterised by significant weather events and the low point of the interest rate cycle, the group said.

OUTsurance’s Australian operations, which are 10 years younger than its short-term business in South Africa, now generate 56% of the group’s gross written premiums and 39% of its normalised earnings.

On the other hand, the group’s South African short-term insurance operation, OUTsurance, reported normalised earnings growth of 1.5%, to R951m.

“Against a difficult economic backdrop, the effects of a wetter summer season and load shedding, OUTsurance delivered an acceptable operational and financial performance for the six months under review, with operating profit increasing by 13.1%. The growth differential between operating profit and normalised earnings is explained by lower investment income, where the positive impact of higher interest rates in the reporting period was offset by comparatively lower returns on equity investments,” the group said.

OUTsurance Personal, the largest contributor to the group’s profitability, saw its operating profit edge up by 0.8% to R1.078bn.

Gross written premium growth of 6.6% (R4.311bn) was positively impacted by premium increases, while net earned premiums rose 6.2% (R4.202bn).

OUTsurance Personal’s claims ratio increased from 51.6% to 52.4%, which the group attributed to:

- Increasing theft rates on high-value vehicles with “vulnerable” remote control security systems;

- An increase in property-related claims because of extensive load shedding;

- The normalisation of motor vehicle claims since the end of the lockdown;

- Wetter weather conditions; and

- Higher vehicle repair cost inflation.

Operating loss decreases at OUTsurance Business

The other business segment of OUTsurance is OUTsurance Business, which has a direct and a tied agent channel, called OUTsurance Brokers.

Over the past four years, the group has been expanding its distribution capabilities, and this has included a “major” investment in OUTsurance Brokers.

The investment seems to be paying off, with OUTsurance Brokers delivering gross written premiums of R617m, which was 42.3% higher than in the prior year.

OUTsurance Brokers’ operating loss decreased from R199m to R100m, and the group expects the channel to break even during the next six months.

This improvement, plus the direct channel’s operating profit increasing by 7% (R228m), saw OUTsurance Business’s operating profit leap by more than 800%, from R14m to R128m.

OUTsurance Business, which is a quarter of the size of the personal lines business, grew gross written premiums by 17.2% (R1.194bn), while net earned premiums were up 18.5% (R1.159bn).

The segment’s claims ratio improved from 63.1% to 56.9%, which the group attributed to lower new business strain in the OUTsurance Broker channel, coupled with pricing and underwriting actions to improve margins and counter the drivers of claims inflation.

Life business disappoints

The group has also been investing in expanding OUTsurance Life’s distribution capabilities. It entered the life business in 2010.

OUTsurance Life delivered gross written premium growth of 20.5% (R465m), with the funeral segment’s gross written premium growing by 60%, due to the expansion of the distribution partnership with Shoprite, which has included deploying OUTsurance agents at some Shoprite stores.

Despite this, OUTsurance Life’s operating loss increased from R51m to R100m, which the group attributed to more volatile yields.

The funeral business experienced a turnaround, from an operating loss of R26m to an operating profit of R2m, but the loss on underwritten policies widened from R25m to R102m.

OUTsurance has struggled to penetrate the underwritten life insurance market. The group hoped its direct-selling model would work as well as it did in its short-term insurance business. The group has since built a tied-agency force of about 600 financial advisers and is starting to receive more support from independent brokers.

The segment recorded a headline loss of R69m, up from R21m in the comparative six months.

Group earnings up 77%

In December last year, OUTsurance Group Limited (OGL) listed on the JSE after completing its transition and rebrand from Rand Merchant Investment Holdings.

Read: Short-term insurer OUTsurance lists on the JSE

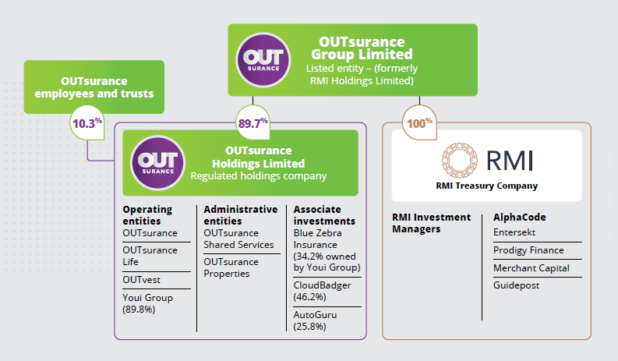

That some of its entities are also called OUTsurance can make it difficult to understanding the group’s structure. The organogram below may help:

The group said its earnings base changed significantly after the sale of its 30% interest in British insurer Hastings in December 2021 and the unbundling of its stake in Discovery and Momentum Metropolitan in April 2022.

OGL’s normalised earnings from continuing operations increased by 77.7% to R1.317bn for the six months under review.

In addition, its normalised earnings per share from continuing operations were 86 cents, also an increase of 77.7%.

The ordinary dividend per share was 56.8c per share, an increase of more than 141% from the 23.5c compared to the six months to the end of December 2021.

OUTsurance Holdings’ operating profit rose 65.8% to R1.894bn, with new business premiums up 8.6% to R3.673bn.

It recorded gross written premium growth of 17.4% to R13.618bn, while net earned premiums increased by 18.2% to R11.733bn.

More expansion ahead

OUTsurance announced that has applied for a short-term insurance licence in Ireland and plans to enter that market, of 5.1 million people, in the first quarter of 2024.

The insurer won’t launch life or investment products in Ireland. It will focus solely on short-term insurance as it has done in Australia.

“Ireland’s motor and home insurance market is a strong strategic fit for OUTsurance,” chief executive Marthinus Visser told Reuters, adding the move was in line with the company’s long-term strategy for growth and diversification.