Suretyships mean what they say: advisers learn hard lessons after broker house collapse

A Northern Cape High Court ruling shows how easily advisers can be left personally exposed.

The government finally cuts payers of personal income tax some slack – and increases the medical scheme tax credits.

A Northern Cape High Court ruling shows how easily advisers can be left personally exposed.

The High Court confirms that evidence from confidential arbitration can be disclosed in related South African litigation, forcing insurers and other parties to rethink how they manage arbitration materials.

Many employees know how much they are contributing but not whether it will deliver a sustainable income.

Balancing ‘Black Tax’ with your own financial security is possible through clear boundaries, strategic planning, and professional guidance.

Discovery Health is engaging affected members individually after a processing error led to some pharmacy claims being paid beyond Above Threshold Benefit limits during 2025.

Despite a decisive High Court loss, the Information Regulator is pushing on with an application for leave to appeal as the DBE confirms matric results will again be published in newspapers.

From a shipbuilding director to a career-changer at 40 and a junior adviser navigating cross-border portfolios, MBSE’s Advanced Certificate in Financial Planning equips diverse professionals with confidence.

Consumers can now claim directly against banks for faulty vehicles, while a major used-car dealer faces fines and refunds, signaling tougher enforcement of consumer rights.

Accountable institutions will have to provide comprehensive information on the location of their operations when registering with the Financial Intelligence Centre.

OUTsurance will join South Africa’s alternative exchange from January, giving shareholders an additional platform to trade its shares with lower fees and extra liquidity, says A2X CEO Kevin Brady.

Consumers must understand product terms and ensure documentation accurately reflects agreed guarantees and beneficiaries.

Momentum Insure’s chief actuary, Rudolf Britz, urges advisers to guide clients through an annual insurance review in January – a simple yet powerful step to protect goals, reduce worry, and enable financial growth.

The rising number of investigations and inspections underline a shift from registration to active supervision.

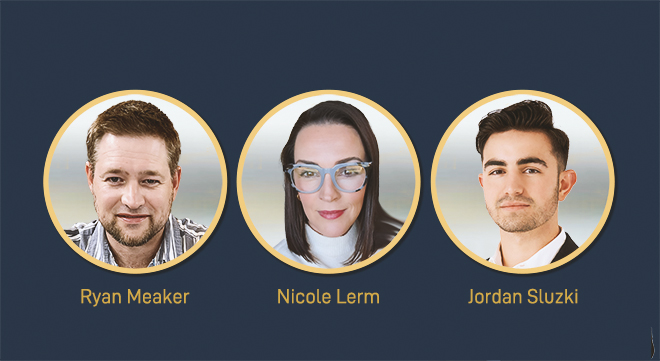

Top achievers from Moonstone’s Postgraduate Diploma in Financial Planning show how the programme builds professional judgement, technical depth, and career clarity.

The Reserve Bank has partially reversed its exchange control changes, removing tax-clearance requirements for some non-resident income flows. However, restrictions on rental income and directors’ fees remain in place.

A drone listed on a policy wasn’t insured for its main purpose. This case is a reminder that exclusions can cancel out the protection you think you’ve bought.

Clients can pay upfront for three, six, or twelve months of cover, offering an alternative to monthly debit-order policies.