Class action litigation in SA could spike with ‘non-attack’ data breach claims

Improper data handling could lead to expensive claims, and stronger enforcement of POPIA is critical to preventing future litigation, say legal experts.

The Road Accident Fund has withdrawn its challenge to the Auditor-General and accepted adverse findings.

Improper data handling could lead to expensive claims, and stronger enforcement of POPIA is critical to preventing future litigation, say legal experts.

Kabelo Gwamanda is accused of conning Soweto residents through his company, Ithemba Lama Afrika, leaving policyholders stranded when the business vanished in 2012.

Having reached the target of 4.5% with ‘little or no cost’, Lesetja Kganyago argues that South Africa can achieve permanently lower inflation and interest rates.

Mika Adsetts, global chief investment officer of Momentum Multi-management, says that while PPPs are crucial for advancing infrastructure goals, an array of investments is key to scaling these projects.

Average inflation is expected to be 5.1% in 2024 and 4.8% in 2025 and 2026, according to the Bureau for Economic Research’s latest inflation expectation survey.

The NFO decided that failing to follow customary mourning rituals did not prevent the recognition of a customary marriage, awarding the claim based on fairness.

The FSCA also reiterates its warning against Donafin, which continues to charge fees for unauthorised financial services.

How to show your clients that gap cover can be the missing piece in their overall healthcare and financial protection strategy.

Financial planner Lara Warburton says clients believe trustee-endorsed annuities don’t offer enough flexibility or returns to sustain them through long retirement periods.

In investing, one key factor is often overlooked: the payback period. Understanding duration can reshape your portfolio strategy and help you manage risk more effectively.

The planner acted in the client’s best interest, highlighting the importance of clear communication and thorough record-keeping in financial advice.

With SARS tightening crypto enforcement, taxpayers should review their past filings, ensure accurate reporting of crypto profits, and consider the Voluntary Disclosure Programme to avoid severe penalties and interest.

Key proposed amendments include imposing fines for non-compliance, enhancing the Information Regulator’s authority to issue directives, and introducing search-and-seizure powers.

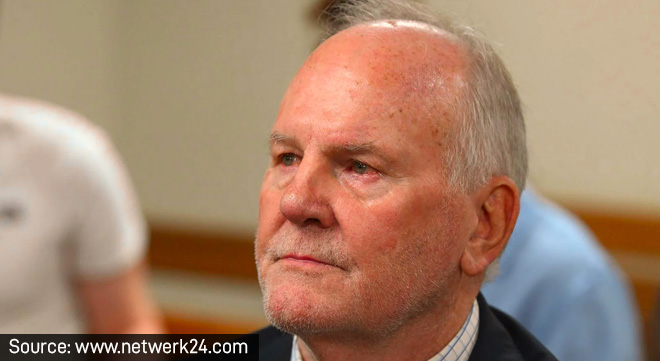

Stephanus Grobler, who is facing multiple charges including racketeering and fraud, is due to appear in court in February next year.

Financial stress frequently appears in the workplace as anxiety, which can develop into depression, increased absenteeism, and substance abuse.

Associate Professor Tasleem Ras’s analysis of a patient’s case highlights critical pitfalls in cancer care.

FSCA warns about Miway Express Credit Solutions, as well as entities and individuals who are impersonating legitimate FSPs.