Draft amendments aim to remedy gaps in AML framework

The Bill largely clarifies and strengthens existing AML/CFT expectations rather than introducing a new regulatory philosophy.

The initial payout returns roughly 6 cents on the rand to creditors, with legal costs taking a large slice – but further recoveries may change the final dividend.

The Bill largely clarifies and strengthens existing AML/CFT expectations rather than introducing a new regulatory philosophy.

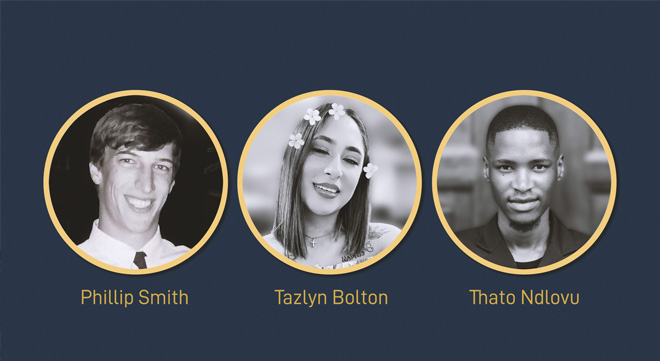

Top achievers share how MBSE’s Higher Certificate in Wealth Management translates knowledge into real-world confidence.

The Minister of Employment and Labour removes a 2003 exemption that shielded employers from labour-inspector oversight.

FNB has disbursed over R1 billion to Ithala customers and is sending about 5 000 SMS notifications per day to schedule branch visits.

The National Debt Counselling Association is pushing for a regulated mechanism to remove consumers from incomplete debt counselling caused by life-changing events.

RAs and living annuities usually fall outside the deceased estate, which means the proceeds will not be tied up while the estate is finalised.

South Africans should verify anyone offering financial services or investment opportunities.

The Bill proposes that arrangements yielding outcomes similar to traditional financial products be treated as financial services.

The comment comes amid a growing standoff between organised labour and GEMS after the scheme announced a 9.8% contribution increase for 2026.

The Office of the Tax Ombud is seeing the same delays, verification snags, and procedural irregularities highlighted by a tax practitioner.

Historical trends suggest it could take up to three years for some sectors’ price-to-book ratios to normalise, says Ryk de Klerk.

Iwan Schelbert admitted to his role in generating a fraudulent invoice that helped to inflate Steinhoff at Work’s accounts.

The National Consumer Tribunal rules the dealer breached the Act by leaving serious defects unrepaired – rejecting its disclaimers and partial fixes.

Taxpayers challenging assessments in transfer pricing disputes face hidden risks, including the rare possibility that the Tax Court could consider increasing an assessment.

In Circular 48, the CMS signals tougher enforcement against exempted insurers, warning that non-compliant branding and failure to notify regulators will attract decisive action.

South Africa’s removal from the EU’s high-risk list eases regulatory friction, but economists caution that rebuilding investor confidence will be gradual.

MBSE top achievers share how the HCSTI turns ambition and experience into long-term growth in short-term insurance.