OUTsurance expects its full-year profits to surge by up to 45% on the back of increased earnings in its Australian operations Youi.

The group attributed this to strong premium growth, a material decrease in natural perils claims, and higher investment income as interest rates rise.

The JSE-listed financial services group expects normalised earnings to climb by between 35% and 45% for the year to the end of June 2023, from R2.316 billion in 2022, the company said in a voluntary trading update on Wednesday.

Earnings from its short-term insurance operations in South Africa could rise by as much as 10%, from R1.743bn, while Youi’s earnings could surge by between 220% and 250%, from R413 million.

OUTsurance Life was expected to see earnings growth of 5% to 15%, from R100m.

OUTsurance, valued at almost R60bn on the JSE, generated 56% of its gross written premiums and 39% of its normalised earnings from Youi in 2022.

Youi, which is 10 years younger than OUTsurance’s short-term business in South Africa, provides car, home, business, and third-party insurance.

In the 2021 calendar year, the company’s claims were pushed up by flood and hail events, while in September, the state of Victoria was hit by a magnitude-5.9 earthquake.

The group is weighing its options on what to do with its investment unit, OUTvest, the trading update said.

Following a strategic review of OUTvest, which remains a sub-scale business, the group has decided to consider a restructuring of OUTvest, which includes the possibility of a disposal. Client investments will not be affected by this decision. All client obligations will continue to be honoured without operational disruption,” the company said.

OUTvest, which was launched six years ago, offers financial advice and investments via a website and an app, combining technology and financial advisers based in a call centre.

Shift in earnings base

OUTsurance Group Limited (OGL) listed on the JSE in December 2021 after completing its transition and rebrand from Rand Merchant Investment Holdings.

OGL’s disposal of British insurer Hastings Group and the settlement of preference share debt in December 2021, and the unbundling of its interest in Discovery Limited and Momentum Metropolitan Holdings Limited in April 2022 have significantly changed the group’s earnings base, the group said.

The group’s earnings base is primarily impacted by the performance of OUTsurance Holdings Limited (OHL), the group’s 90% held subsidiary and owner of OUTsurance and Youi.

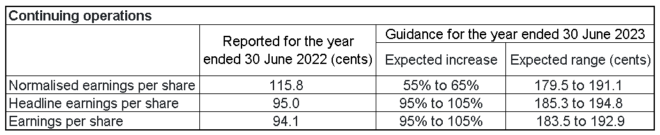

When looking only at continuing operations, the group’s earnings per share and headline earnings per share are expected to grow by between 95% and 105%.

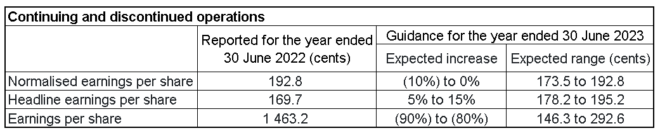

But when factoring in discontinued operations, headline earnings per share are expected to grow by 5% and 15%, while earnings per share are expected to decline by 80% to 90%.

OUTsurance has applied for a short-term insurance licence in Ireland and plans to enter that market in the second half of the 2024 financial year.

OGL’s financial results for 2023 are expected to be released on 15 September.