Since the beginning of 2022, gold had a stellar performance as measured against virtually all investable asset classes. Furthermore, it boosted the finances of gold-producing countries and even led to massive windfalls in tax revenues.

But gold is in trouble.

Gold has decoupled from the capital markets.

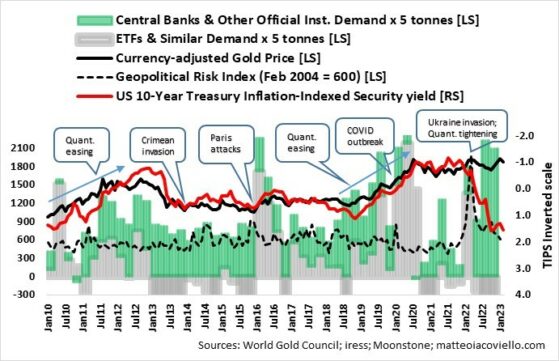

During the 16 years leading up to Russia’s military assault against Ukraine, launched in February 2022, gold was nothing else than a 10-year US Treasury Inflation-linked Security or bond, also known as TIPS. TIPS are government bonds whose face value rises with inflation. The gold price in US dollar terms was highly correlated to the US 10-year TIPS yield (R squared = 0.86).

The gold price in US dollar terms is inversely correlated to the external value of the US dollar – a stronger US dollar leads to a fall in the gold price in US dollar terms, and conversely, a weaker US dollar leads to a rise in the US dollar price of gold.

To counter cross currency movements and obtain a currency-adjusted gold price, I assumed a make-up of 50% US dollar and 50% non-US dollar by applying the official US dollar index, a measure of the dollar’s relative value compared to a basket of foreign currencies that includes only six currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

During times of quantitative easing, longer-dated interest rates fall, and investment and speculative demand as measured by gold-backed exchange traded funds (ETFs) and similar demand increases – as does demand from central banks and other official institutions. The opposite happens when quantitative tightening is of the order of the day.

Geopolitical events normally lead to a spike in investment and speculative demand, but demand tends to fade on a higher gold price and turn into profit-taking/sales. The Geopolitical Risk Index (GPR) developed by Dario Caldara and Matteo Iacoviello at the Federal Reserve Board reflects “automated text-search results of the electronic archives of 10 newspapers to calculate the index by counting the number of articles related to adverse geopolitical events in each newspaper for each month (as a share of the total number of news articles)”.

Although the Russian invasion and annexation of the Crimean Peninsula in February 2014 saw the GPR nearly doubling over the ensuing six months, gold-backed ETFs and similar funds experienced outflows, with the currency-adjusted gold price marking time. The Paris attacks in December 2015 also nearly doubled the GPR and led to a surge in inflows in gold-backed ETFs and related funds, while central banks and other official institutions followed suit as the gold price surged by 21% over the ensuing nine months.

Double whammy

At the beginning of 2022, the Federal Reserve ended its quantitative easing policy, which involved purchases of US government bonds and mortgage securities to provide liquidity to capital markets. It was replaced by quantitative tightening where the Fed began selling those assets, combined with interest rate hikes to keep inflation in check through slowing economic growth. Russia’s Ukraine invasion led to ongoing global energy and food crises, which forced the Fed’s hand even further.

The double whammy of quantitative tightening and Russian aggression hit the capital markets hard. The US 10-year TIPS yield increased 250 basis points (2.5%) to 1.5% from a negative 1% at the end of 2021. An investment in the iShares TIPS Bond ETF, which seeks to track the investment results of an index composed of inflation-protected US Treasury bonds, has returned minus 11.6%, income reinvested, since the end of 2021.

Russia’s invasion of Ukraine was such a major event that it nearly tripled the GPR in March 2022. Gold-backed ETFs and others experienced significant inflows in the first quarter of last year, while official sector purchases pushed the currency-adjusted gold price nearly 8% higher at the end of the first quarter compared to the end of December 2021.

The outflows experienced by ETFs and others in the ensuing quarters were to be expected, as inflation-linked and other government bonds offered superior value to gold. The currency-weighted gold price fell by more than 9% from March to October.

The fall, however, compares very favourably to a fall of more than 40% projected by gold’s historical relationship with TIPS yields. Since then, gold has virtually recovered all its lost ground. It is also worthwhile to note that during normal quantitative tightening cycles, gold would have severely underperformed global equities as measured by the MSCI World index in US dollar terms. This time around, gold has performed roughly in line with equities. Yes, gold carries a significant premium relative to other assets.

The Russia factor

Is gold a geopolitical hedge or something more sinister?

Based on the World Gold Council’s statistics, it is evident that buying by central banks and other official agencies during the last two quarters of 2022 is buoying the gold price.

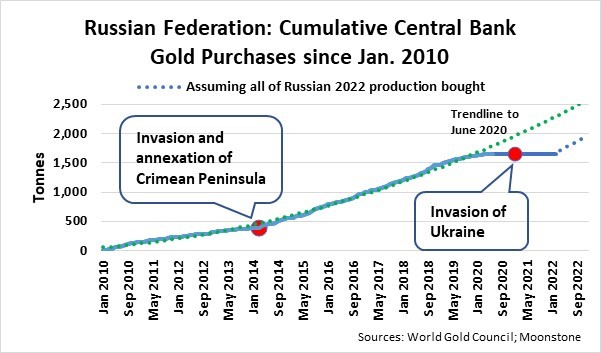

The Russian Federation had been a steady buyer of gold until Russia invaded and annexed the Crimean Peninsula in the first quarter of 2014. Thereafter, Russia upped the rate until June 2020, but based on official numbers, the country from thereon was apparently relatively inactive until January 2022. No data is available since the Ukraine invasion began, though.

According to the World Gold Council, Russia produced about 332 tonnes of gold in 2022, and with all the sanctions slapped on the country, it is likely that the gold ended up in its reserves somewhere or other. Yes, similar to Russia’s first invasion of the Crimean Peninsula, where a significant portion of the country’s production was hoarded by the central bank in the first nine months after the aggression started. I will also not be surprised if Russia understated its reserves from June 2020. It is possible that the trend from 2014 could in fact be extended, meaning that reserves could currently be about 1 000 tonnes higher than they were at the end of January 2022.

However, the real picture will emerge much later. Russia’s impact on the gold market looms large. Continued and increased aggression and central bank buying are needed to buoy the gold price. Yes, to bolster gold miners and therefore maintain the windfalls for gold-producing countries. When the guns of Moscow fall silent, gold may find itself in a vacuum because some of the central bank holdings may find their way back into the market.

As such, in my books, gold is the least attractive and perhaps the riskiest asset among virtually all asset classes. I ask: Is gold an accident waiting to happen or is Russian aggression the new normal?

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.

I think you have it wrong. Have you factored in that China, Russia, India and Saudi Arabia has already decoupled from using the dollar as the reserve currency and not paying for oil purchases in dollar but currently in Renminbi at working at establishing a currency based on a basket of precious metals of which gold will form a large part. These countries make up roughly 80% of the world population and if other countries follow suit and dump the dollar, USA will hit record inflation for which they are not ready.

What an absolute load of rubbish. Have you noted gold’s performance today after the SVB event? Yet another banking debacle in your world of paper money.

10 years ago Krugerrands were R14000

Today they are approaching R40000 – if you can find any.

No other asset has performed like this, and the game is only beginning.

yeah JPM is a Fortress, Putin Bad, precious metals a waste of time