Sahil Mahtani, the head of macro research at Ninety One, says the consequences of “the future that has already happened” are likely to be profound for investors.

Throughout history, it’s been almost impossible to plan for the future, as we experienced recently, when the world was thrown into turmoil during the pandemic. Markets are still recovering and experiencing the aftershocks. What will 2030 hold?

Although human affairs cannot be modelled, we believe it makes sense to prepare, in the words of Peter Drucker, “for the future that has already happened”.

This means generally that the outcomes of events and trends that have already taken place will unfold over time. The conflicts of recent years, both in Ukraine and in Palestine, are likely to have three consequences that are likely to resonate well into the coming decade.

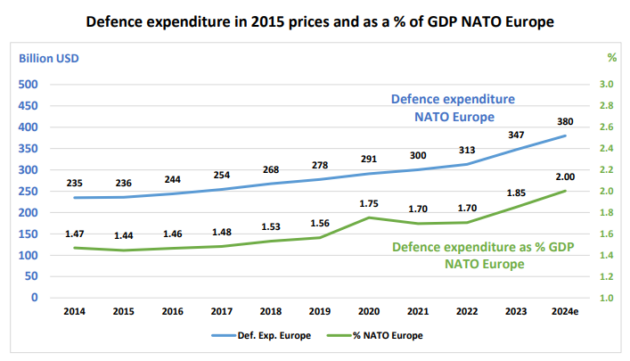

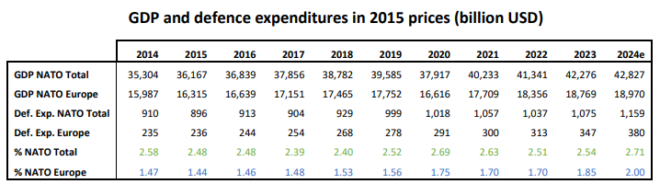

First, military spending is on track for its most substantial increase since the end of the Cold War in 1991.

NATO’s secretary general, Jens Stoltenberg, released NATO’s latest defence spending figures in February, which show an unprecedented increase across European Allies and Canada.

Euro area countries are ramping up production and spending to meet the dual objectives of supplying arms to Ukraine while addressing their own defence needs. By 2028, European defence spending is expected to exceed pre-invasion levels by €100 billion.

Projections also suggest that defence spending outside Europe could rise by an additional $200bn over the next five years compared to pre-invasion estimates.

Of course, the true cost could be higher than current estimates. For example, 2024 marks the first year that European NATO allies will spend a targeted 2% of their combined GDP on defence expenditure, a six-fold increase since 2014.

If the leaders among them were to increase their spending by just 0.5% of GDP, annual global defence expenditures would balloon by $700bn. This equates to a potential increase of 1.2% to 2.8% of global capital expenditures, which is significant considering that global GDP is about 3%.

Second, geopolitical events in recent years have created a global divide. This has spurred the emergence of the “Global South”, a growing coalition of largely developing countries, which notably includes India and China. This group, with deep-rooted values and histories, is increasingly assertive on the global scene.

In addition, the growing tension between the US and China, as well as the acceleration towards a multipolar world, has shifted trade routes and repositioned traditional economic structures. As a result, new investment opportunities are emerging, particularly in developing nations, including frontier markets.

Finally, recent conflicts have accelerated investments in climate solutions and dual-use technologies. Skyrocketing energy prices, initiated by the war, have ignited Europe’s green transition, potentially shaving five to ten years off the timeline.

Households and governments are rapidly shifting towards electric vehicles, heat pumps, greater efficiency, and renewable power.

Meanwhile, the war’s reliance on long-range weaponry and electronic warfare underscores the timeless link between conflict and technological innovation.

We believe several promising themes can lead to returns as long as investors are careful about valuations. However, investors should brace for challenges that could reshape the macro-economic landscape, increasing the likelihood of unpredictable growth and inflation patterns over time.

Historically, this kind of economic climate usually leads to less diversification potential and lower stock values. The consequences of “the future that has already happened” are likely to be profound for investors.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning tax advice that is appropriate to every individual’s needs and circumstances.