The FAIS Ombud has praised large financial services providers for increasingly settling complaints directly with consumers without the need for them to be reported to the Ombud’s Office.

The Ombud, Advocate John Simpson (pictured), highlighted the decrease in cases opened against FSPs in 2022/25 when he released his Office’s annual report this week.

He said the Office made “excellence progress” on various fronts over the past financial year.

“We’re making ongoing good progress in resolving disputes between consumers and financial services providers,” Simpson said. “Over the past few years, the Office has been implementing various case management processes and systems, as well as the premature complaints process. They are now producing very consistent, excellent results. And I’m very happy with the progress that we’ve made now and that those systems are working properly.”

The new Rules for the Office took effect on 1 July 2024. The most significant changes were the increased claim jurisdiction from R800 000 to R3.5 million and the Office no longer accepting complaints against unregistered providers.

He said that raising the claim jurisdiction limit did not result in a significant increase in cases.

Accepting complaints against unregistered providers served no purpose, because entities that offer services unlawfully simply ignored the Office’s requests to respond to a complaint, Simpson said. The rule change also encourages consumers to transact only with registered providers and not to respond to investment scams and false information on social media.

Consumers more aware of the Office

In 2024/25, the Office received 15 404 new complaints – including enquiries, premature complaints, and formal complaints – an increase of 45.68% compared with the 10 574 complaints received in 2023/24.

Simpson said the significant increase in new complaints was a positive development because it shows there is greater consumer awareness of the Office – “people appear to know about us far more than before, and they’re contacting us”.

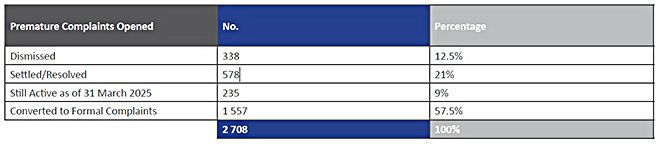

A premature complaint is one where there is no indication that the complainant attempted to resolve the problem with the FSP before lodging a complaint with the Ombud. The Office sends such complaints to the FSP, which is given six weeks to resolve the complaint.

The Office opened 2 708 premature complaints, of which 1 557 remained unresolved after six weeks and were moved to the formal investigation phase.

Enquiries are complaints that do not fall within the FAIS Ombud’s jurisdiction or do not relate to a financial service. Non-FAIS complaints are referred to the appropriate forum, where possible.

Of the 15 404 complaints, 12 022 were classified as enquiries, an increase of 98% from the 6 073 enquiries in 2023/24. Most of the enquiries (10 177) were referred to other ombud schemes – for example, 59.15% were sent to the National Financial Ombud Scheme.

Most complaints (38.5%) originated from Gauteng, followed by the Western Cape (14%), and KwaZulu-Natal (13%).

The Office saw a slight increase in the number of cases that originated from the more rural areas, which led to a corresponding slight decrease in complaints from Gauteng and the Western Cape. Simpson said this indicated that the Office’s work to make rural communities aware the Office’s existence is bearing fruit.

Decrease in cases opened against providers

The Office opened 3 382 complaints (including formal and premature complaints) in 2024/25, a decrease of 24.86% compared with the 4 501 complaints opened in the previous year.

Simpson said the Office evaluated the number of complaints (formal complaints, including premature complaints) opened for the 10 largest FSPs – mainly insurance companies – for the past three financial years, beginning in 2022. The Office found there was an average annual reduction of 31.5% in the number of complaints opened against them. This contributed to a decrease in the number of cases that the Office had to deal with.

“Again, we see this as a very positive development,” Simpson said. “We contacted the providers in all these instances to make sure they’re settling these matters, and that they’re telling complainants about us if the matter is not settled. They provide us with that confirmation. So, we are quite satisfied that public do know about us, the insurers are settling the matters, and the simpler matters most certainly get settled, and this has led to a decrease in the number of cases we need to actually look at and investigate,” Simpson said.

The annual report said the decrease in complaints indicated that, with the Office’s guidance, FSPs are becoming increasingly effective in resolving complaints directly with complainants, without the need to be escalated to this Office. “We are very encouraged by this significant progress and commend the providers in this regard.”

The annual report said the Office has an “open door” policy that invites FSPs to contact the Office at any stage for guidance in resolving complaints. This could involve general guidance on a principle or specific guidance on a reasonable settlement offer.

Simpson said the Office wants to continue providing guidance to consumers and the financial services industry on avoiding disputes and resolving them quickly. “The increased awareness of the office and the reduction in the complaints against the largest providers definitely points to this working and definitely points to an improvement in this regard.”

Most complaints about funeral policies

Of the 3 382 complaints opened, 52.84% related to advice on long-term insurance products, and most of these concerned funeral policies – 1 358 of the 1 787 complaints relating to long-term insurance.

Complaints related to advice on short-term insurance products made up 12.36% of opened complaints, with advice related to motor vehicle insurance making up 105 of the 418 complaints.

This was followed by complaints related to investment advice (399 complaints, or 11.8%), most of them concerning collective investment schemes (167 complaints); retirement (270 complaints, or 7.98%), most of them about living annuities (88 complaints); and forex (259 complaints, or 7.66%).

R31.7m awarded to consumers

The Office resolves complaints by alternative dispute resolution methods, such as mediation, conciliation, recommendation, and, as a last resort, by issuing determinations, which have the status of a civil court judgment.

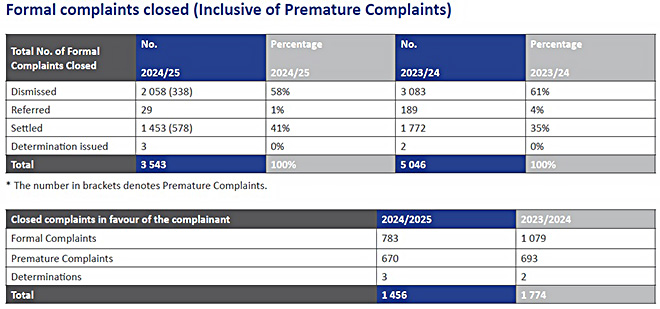

A total of 3 543 complaints (including cases carried over from the previous year and premature complaints) were closed, a decrease of 29.78% compared with the 5 046 cases closed in 2023/24.

The decrease was primarily because of the closure of very old cases (mainly relating to property syndication matters), and caseloads have now stabilised.

The percentage of complaints settled in favour of the consumer, or where an award was made, was 41%, compared with 35% in the previous year. In other words, most complaints are settled in favour of the FSP. The 41% comprises 24.7% of formal complaints and 63.1% of premature complaints where a finding was made in favour of the complainant.

The total amount settled or awarded to consumers was R31 748 435 compared with R39 525 923 in 2023/24.

It took an average of 59.28 working days to finalise the 3 543 formal complaints (including premature complaints), compared with 63.33 working days in 2023/24.

Most complaints were settled via conciliation and recommendation, with the Office issuing only three determinations.

Two of the determinations related to funeral service providers and one to advice about motor vehicle insurance. Moonstone has written about these determinations:

- FAIS Ombud orders funeral home to pay R20 000 claim after failed cover

- Burial society ordered to pay after failing to inform policyholder of premium hike

- FAIS Ombud finds broker negligent for failing to update client’s contact details

Tribunal upholds most decisions

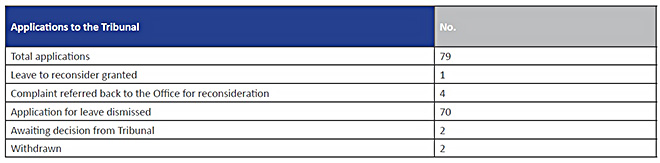

A party to a complaint who is aggrieved by the Office’s final decision may apply to the Financial Services Tribunal for a reconsideration of the decision.

The Tribunal received 79 applications for reconsideration, compared with 76 in 2023/24. Of the 79 applications filed with the Tribunal, as of 31 March 2025, 70 (94.59%) were dismissed, and four complaints were remitted to the Office for further investigation.

Publication of case summaries

Simpson said the Office will be announcing a new initiative to publish case summaries on a dedicated section of its website. These summaries will include details of various cases the Office has handled – such as settlements and dismissals – but without disclosing the names of the parties involved to maintain confidentiality.

The main objectives of publishing these case summaries are:

- To provide transparency about the Ombud’s decision-making process.

- To serve as a resource for both FSPs and members of the public, helping them to understand how similar disputes have been resolved.

- To guide FSPs and complainants on the Ombud’s approach to different cases, what the likely settlement amounts might be, and what factors influence decisions.

- To help the financial services industry and consumers resolve future disputes more efficiently and fairly, using real examples as references.

Currently, case summaries are published the Office’s annual reports and newsletters, but the new website section will allow for easier and ongoing public access to these examples.