Discovery Life’s claims report: ancillary benefits dominate payouts

Life insurance payouts rose in 2023, while Covid-19 claims fell sharply, indicating the virus’s shift from pandemic to endemic status.

Life insurance payouts rose in 2023, while Covid-19 claims fell sharply, indicating the virus’s shift from pandemic to endemic status.

Lusizo Henna laundered the R3.1m refund within 14 days of SARS paying the money into his business account.

A tribute to a great friend of the industry and a champion of the work that compliance officers do.

The trading platform denies any involvement in the deepfake advertisements that circulated on social media.

Investment Solutions by Alexforbes provides IFAs with access to previously inaccessible asset classes.

In 2022, the industry saw a net income of R2.57 billion – down from R12.18bn in 2021 – and faced an operating deficit of R6.155bn, the largest in 23 years.

The final dividend was 14% higher than last year, while headline earnings rose by 11% to R1.033bn.

The bank also says it closed the accounts of some 190 clients in 2023 following ‘reviews of client activity and related reputational risks’.

Paul Hutchinson, sales manager at Ninety One, recommends growth-focused investments to protect against long-term economic changes – and inflation.

The move aims to stem the tide of delistings, which has halved the size of Africa’s largest stock exchange since 2001.

The group is shifting from ‘bank-build mode’ to a testing phase with select banking partners.

DA MP takes Old Mutual to task for comments suggesting the 1 September implementation date ‘may slip’.

The decision addresses the recovery of VAT on payments made under loan cover provided free of charge.

The chairperson of the RAF board and the fund’s chief executive recently faced legal action for failing to accept delivery of documents pertaining to a claim for compensation.

A property seller loses an appeal to retain a R1m deposit – the purchaser had not validly waived his rights to a suspensive condition.

Lesedi Kelatwang alleges his advocacy of BEE and transformation played a role in his dismissal.

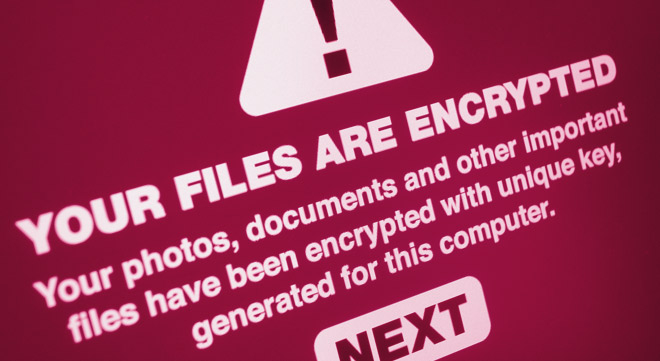

The International Trade Administration Commission explains why it delayed notifying the public of the attack for almost four months.